New York Employees Will Soon Receive Pay for Breast Milk Expression Time.

Continue reading State Mandates ‘Breast Milk Expression Time’

New York Employees Will Soon Receive Pay for Breast Milk Expression Time.

Continue reading State Mandates ‘Breast Milk Expression Time’

| Plan Update April 29, 2024 Texas Schools Health Benefits Program (TSHBP) Dear TSHBP Member Districts; We hope this message finds you well. We are writing to share an update with you for the Texas School Health Benefits Program (TSHBP). The TSHBP Board of Directors passed a resolution on April 24, 2024, to amend the time frame within which each member district must provide the appropriate notice of withdrawal from the TSHBP Program from 90 days (June 1st) to 75 days (June 15th). Districts that elect to participate in the options presented by the TSHBP, must notify the Program no later than June 15th of their election. Districts who wish not to participate in any of the options presented by the TSHBP must notify the Program no later than June 15th of their withdrawal. It’s worth noting that in the event a member district decides to withdraw from the TSHBP Program, there is an obligation to continue honoring any payment commitments as outlined in Section XVII (Withdrawal) of the TSHBP Bylaws. This includes fulfilling the current additional contribution of $150 per employee per month, which remains applicable after September 1, 2024. As mentioned in previous communications, the TSHBP will propose additional plan options for districts to review when they receive their renewal packet. We will begin delivery of these options on or before May 15th. The TSHBP will also schedule webinars after the options are delivered so that our member districts can attend and learn about each of the plan offerings before the decision date of June 15th. Please do not hesitate to reach out to us if you have any questions or need further clarification. We are here to assist you in any way we can. TSHBP Bylaws |

| Thank you for your dedication to our shared goals. Warm regards, The TSHBP Team |

| Texas School Health Benefits Program 2175 North Glenville Drive Richardson, TX 75082 www.tshbp.org |

At their May 2, 2024, meeting trustees of the Texas government health plan for Texas educators will consider renewal rates and benefits for the 2024-2025 school year.

Continue reading Texas Government Health Plan Renewal To Be Released

By Paul Miller

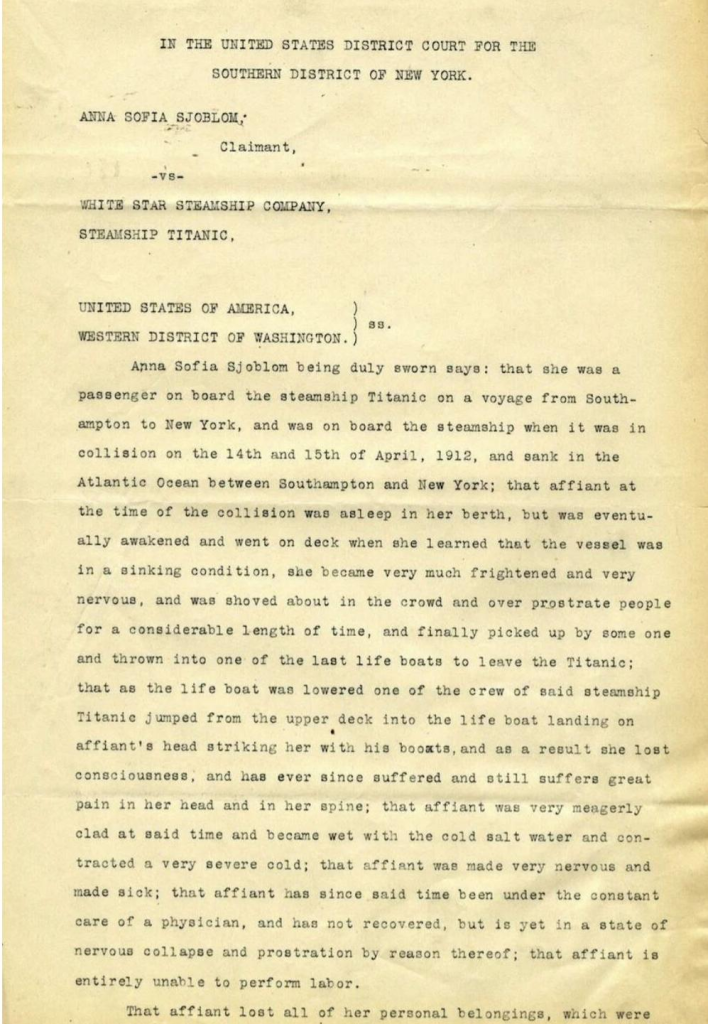

Here is a section from a rather harrowing insurance claim; made by Anna Sofia Sjöblom, a passenger aboard the RMS Titanic.

Continue reading More Lloyds of London History By Miller

“Aetna, which is set to win a multibillion Texas Medicaid contract, got a peek at sensitive information submitted by 17 rival health plans during the bidding process….”

Continue reading State’s Premature Release Of Bid Proposal Info Pisses Off 17 Vendors

The explosive growth in self-funded insurance plans means that quality excess protection is more important than ever to your self-funded clients. FAIRCO has brought in-house and also partnered with trusted industry veterans to create a Medical Stop Loss solution that will meet your customer’s specific needs by offering a wide variety of options, contract periods and deductibles.

Continue reading FAIRCO

Direct Primary Care (DPC) is a cutting-edge solution to the rising cost of health care. Allied National can help small employers find a DPC provider and setup a major medical plan to “wrap” the DPC coverage.

Continue reading Allied National’s Direct Primary Care National Directory

With the announcement to districts by the Texas Schools Health Benefits Program ( TSHBP) that member districts must pay an additional monies per employee per month (PEPM) that are enrolled in the program, many member districts are rethinking their membership in the program. Unfortunately, they may be up against an imminent deadline. TSHBP requires districts to tell them by May 1 if they wish to opt out of the program.

Continue reading Texas Health Insurer Makes “Cash Call” to Districts with May 1 Renewal Deadline

This photograph shows waiters at the entrance of the 1928 Lloyd’s building in 1932.

By Paul Miller

It was a year in which an unusual action regarding a wealthy man’s insurance policy went before the King’s Bench Division. Before starting on a proposed trip around the world, Charles Weyerhaeuser, aged 63, took out an insurance policy with underwriters at Lloyd’s for £82,000.

Continue reading More Lloyds of London History By Miller

Same person, different pictures. She started running and never gave up. She must feel pretty good these days.

Continue reading Ozempic vs Olympics

“Insurance companies are usually upended by poor underwriting practices…….. improper pricing and poor selection of reinsurance.” – Robert Rheim

Continue reading A Walk Through Memory Lane – Insurer For Texas School District Goes Bankrupt

Marpai Bolsters Sales Team with World-Class Executives, Richard Brewer and Ben Utz

Source: Marpai, Inc. (Nasdaq: MRAI), 4/24/2024

TAMPA, FL — Marpai, Inc., an independent national Third-Party Administration (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans with affordable, intelligent, healthcare, today announced the strategic hiring of two industry-renowned salespeople, significantly strengthening its sales force with a focus on accelerating its growth trajectory. These appointments underscore Marpai’s commitment to accelerating growth and expanding its market reach.

Will commercially insured school districts be “pardoned” and allowed to rejoin the Texas government health plan?

The TRS ActiveCare Board of Trustees are set to meet May 2. It is about this time of year TRS officials announce the upcoming September 1 renewal for the Texas government health plan for Texas educators.

Continue reading TRS ActiveCare Board of Trustees To Meet Next Week

Dragging claims happens when reserves are depleted, claims are spiking, and funding is insufficient to cover incurred claims coming through the pipeline.

Continue reading It’s a Drag

What is an employer to do? What is a managed care vendor to do?

Continue reading Non-Compete Agreements & Gag Clauses

By Sergei Polevikov, ABD, MBA, MS, MA 🇮🇱🇺🇦

Telehealth is collapsing, but you already knew that.

Continue reading Optum’s Telehealth Shutdown Is Just the Tip of the Iceberg

Five minute patient visits starting at 8:00. Hour and a half for lunch starting anywhere from 12:30 to 2:00. Keyboard entries 20-40 times a day – must be accurate and no mistakes, life can depend on it.

Continue reading A Day In The Life Of A Fee-For-Service Primary Care Physician

“In anticipation of the expected funding deficit for the 2023-2024 plan year, each TSHBP member school district will be required to make an additional contribution of $150 per month per participating employee starting May 1, 2024.”

Continue reading TSHBP Makes Cash Call

“If a risk pool is profitable, the members get the advantage of reduced rates. But if the pool is unprofitable, the MEMBER DISTRICTS may be faced with assessments (additional contributions) regardless of what they tell you.“

Continue reading Texas Risk Pools

‘It’s just not fair,’ Krynicki, who is also a board member of the advocacy group Obesity Action Coalition told the Journal.

Continue reading Employers Force Fat Employees To Spend Retirement Funds Before Retirement

Reference Based Pricing (RBP) vendors should rejoice. They’ve been vindicated. But alas, one of the largest health care unions in the country does them one better. They support RBP pricing at 100% of Medicare, not 120, 140 or even 180% of Medicare.

Continue reading Healthcare Worker’s Union Supports Medicare Pricing

By Ge Bai – Contributor – I am a professor of accounting and health policy at Johns Hopkins.

Why Are Cash Prices Lower Than Health Insurance Negotiated Prices?

Apr 21, 2024

Growing evidence demonstrates a counterintuitive phenomenon in healthcare: the cash price is often cheaper than insurance prices for the same service or product. Cash prices are unilaterally determined by a provider, while insurance prices are bilaterally negotiated between a provider and an insurance company. Don’t insurance companies presumably possess more bargaining power than individual patients?

Continue reading Why Are Cash Prices Lower Than Health Insurance Negotiated Prices?

The moment the employer signs such contracts, they are most likely already in violation of ERISA.

Continue reading What Are the Fiduciary Risks of Self-Funded Health Plans?

With nervous anticipation and mounting excitement TSHBP member school districts wait patiently for their 2024-2025 renewal.

Continue reading 2024-2025 TSHBP Rates Anxiously Anticipated

Back in the 70’s Blue Cross of Texas sales reps were captive agents. Or were they?

Continue reading When Did Blue Cross of Texas Begin Brokerage?

How to get free, near free or almost free health insurance? How’s that possible?

The Affordable Care Act, a government promulgated misnomer, gifts more people access to health insurance by lowering premium costs. How? By taxing middle class Americans and printing more money.

Continue reading How To Get Free, Near Free or Almost Free Health Insurance

TSHBP member school districts exiting the TSHBP health insurance program for Texas school districts must provide written notice of termination no later than 120 days before each renewal date.

Continue reading Are TSHBP Member Districts Between A Rock & A Hard Place?

FOR IMMEDIATE RELEASE

Willacy County Employee Health & Welfare Plan Adopts Wellness Initiative

Raymondville, TX – April 15, 2024 – Willacy County is pleased to announce the launch of its latest initiative aimed at enhancing the health and wellness of its employees. The new program is designed to promote healthier lifestyles and improve overall well-being among county employees.

Continue reading Willacy County Employee Health & Welfare Plan Adopts Wellness Initiative

CMS Invites Hospitals To Raise Prices And Buy Physician Practices

By Ge Bai – Contributor

Mounting hospital bills, crushing medical debt, ballooning insurance premiums… While we are wrestling with these widespread healthcare affordability problems, it’s helpful to keep in mind that they are often caused by public policies. The most recent example is the financing scheme of Medicaid expansion in North Carolina.

Continue reading Government Encourages Hospitals To Raise Prices & Buy Physician Practices

By Paul Miller

Bollywood stars Sunny Deol and Amitabh Bachchan have both taken out insurance on their voices.

Continue reading More Lloyds of London History by Miller

Joe Sixpack, a young man, has bleeding gums. He has no dental coverage and can’t afford to see a dentist. Besides, who on God’s earth wants to see a dentist anyway? So Joe ignores his symptoms.

Continue reading The Importance of Dental Care Coverage Is Often Overlooked By Health Plans

Insurance Agents, Lawyers, Real Estate Agents and more. Admitted and non-admitted. Instant quotes

Continue reading Need Professional Liability Cover?

“We have the best discounts!” says the BUCA owned TPA rep. “Just ask any of our providers and you’ll see its true!”

Continue reading BUCA Owned TPA Tacitly Admits Not All PPO Providers Enjoy The Same Managed Care ContractResearch shows that diets high in added sugar increase heart disease risk factors such as high triglycerides, elevated blood sugar and blood pressure, obesity, and atherosclerosis—the narrowing of arteries caused by fatty deposits accumulating along artery walls.

Continue reading Give Me Some Sugar!Cynthia helps Jonathan through the complicated maze of the American airline system.

Continue reading If Air Travel Worked Like Healthcare

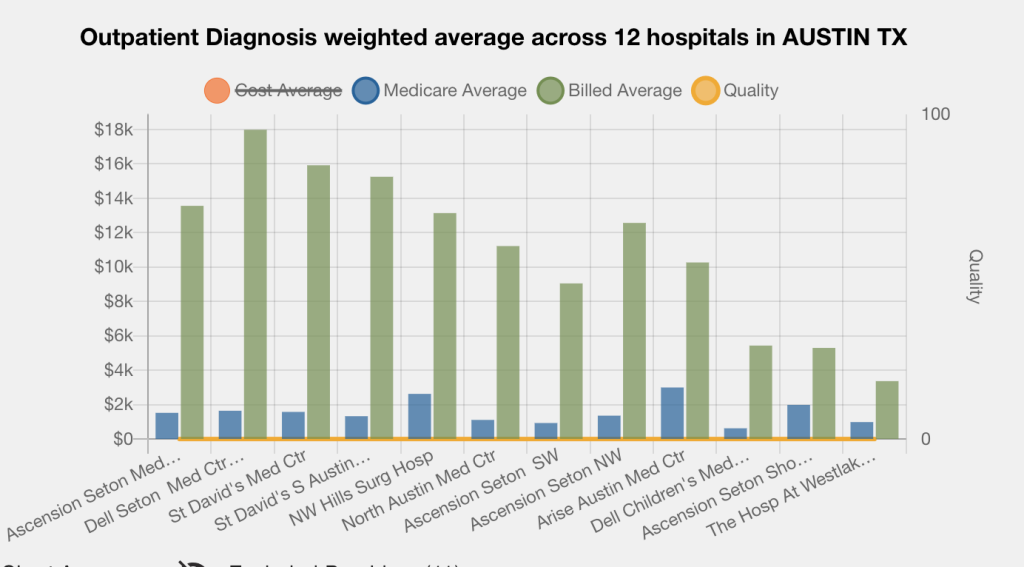

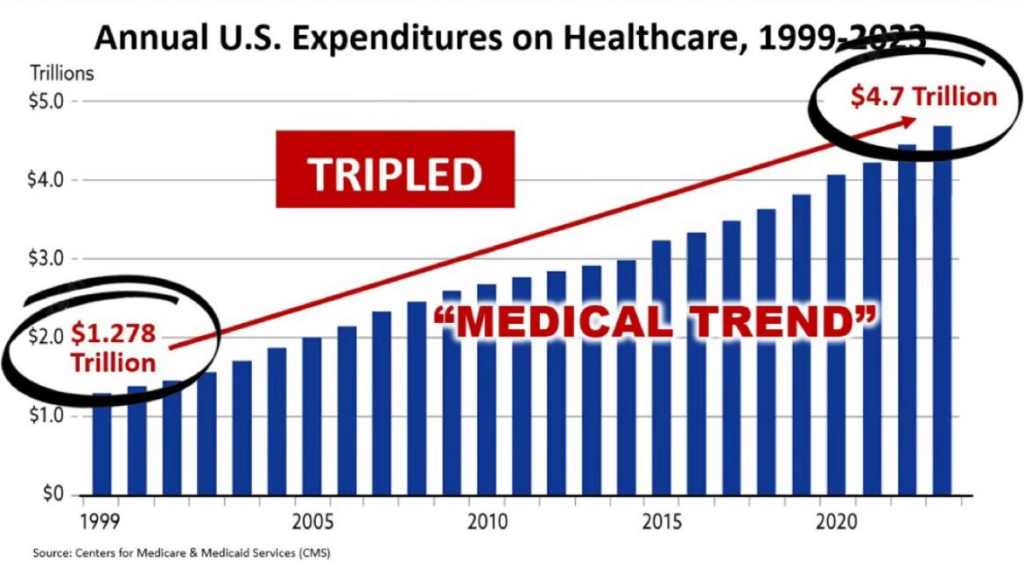

We received an email today from 6 Degrees. The graph above caught our attention.

Continue reading We Won’t Accept 120% of Medicare, But We’ll Accept 89%!

The Texas 88th Legislature passed a slurry of bills affecting group insurance plans. Below are a few of them:

Continue reading TEXAS Limits Ground Ambulance to 325% of Medicare & Promulgates Other Neat Things

“Direct primary care is too expensive!, It’s two, three, four times more expensive than fee-for-service primary care!” cries the insurance consultant waiving his calculator. “The true cost should be something south of a $20 membership, not $70, $80 or more!”

Continue reading Direct Primary Care Is Too Expensive!

By Sims Tillrson

I fired my doctor last week after seeing him for over 5 years. He didn’t do anything wrong – the system did.

Continue reading I Fired My Doctor Last Week

“Your honor, the facility has already been paid TWICE- perhaps even more than its billed charges.”

Continue reading Aldeen’s Sunday Morning Bathroom ReadMyHealthGuide Source: Denniston Data Inc, The Healthcare Transparency Company, 4/10/2024

The U.S. healthcare marketplace needs a transparent standard that is fair to patients, providers, and self-insured employers offering health benefits to their employees.

AUSTIN, TX — In its Healthcare Pricing Guide (HPG) solution, Denniston Data Inc. (DDI) offers standardized benchmark rates by procedure code inclusive of all in-network negotiated rates for every medical service performed by every provider, from every health insurance company. These agreed-on negotiated marketplace rates can be used as the basis for fair compensation for out-of-network providers.

WellRithms Publishes White Paper Exposing Flaws in Reference-Based Pricing and Introduces Superior Alternative

“While RBP allows employers more than one way to pay a medical bill without having to establish a provider network, thereby opening the marketplace, it has still failed to provide a methodology that is transparent and understandable. RBP’s pure Medicare multiple is arbitrary and does not meet the definition of UCR pricing.”

Continue reading RBP Pure Medicare Methodology Is Flawed

How do you know if your stop loss carrier has bells on their balls? And what’s the implication if they do or don’t? Glad you asked………..

We just learned of a stop loss carrier that guarantees, for a premium load of 6%, a 30% premium refund if spec. claims are below 50%.

Participating stop loss contracts are not new although few brokers and plan sponsors are aware they exist.

Continue reading Stop Loss Carrier With Bells On Their Balls Offers Participating Contract

“Don’t bother doing something unless you’re radically different from the competition” – Richard Branson

By Bill Rusteberg

Mike Keogh was an extraordinary man. A former Blue Cross salesman in the 1950’s, he later built an independent brokerage in San Antonio with great success. I met Mike in the early 80’s and did quite a bit of business with him.

Continue reading Mike Keogh

She rushed to the hospital when her water suddenly broke, but returned home as she was unable to pay what the hospital charged for the operation. In the end, the baby died during delivery at home, and the mother became critically ill.

Continue reading Newborn Dies After Local Hospital Refuses Care

“We had to issue this new ruling because Americans can’t read!” explained the high ranking government official during Happy Hour at the Off The Record watering hole.

“But if that’s true, how do you expect them to read the new rule?” replied the bartender.

Continue reading Another Government Health Insurance Ruling Issued Because You’re Stupid & Can’t Read

“The Butler didn’t do it! But maybe he can fix it. Call him in NOW!” Sherlock Holmes says to Watson. “You mean Josh? Josh Butler?” replies Watson

Continue reading We’re Ok Because Everyone Else Is Not OK Too (There’s Plan C Just In Case)

This is your plan. Your costs increase every year. Ours don’t. That’s curious isn’t it?

Continue reading Your Plan Compared To Our PlanBy Paul Miller

The picture above shows one of four Lloyd’s Medal types bestowed by Lloyd’s of London.

In 1939, Lloyd’s set up a committee to find means of honouring seafarers who performed acts of exceptional courage at sea. This resulted in the announcement on 27 December 1940 of the “Lloyd’s War Medal for Bravery at Sea”.

Continue reading More Lloyds of London History By MillerProper rate setting must be based on one’s own risk not based on someone else’s. That’s simple common sense. To do otherwise is a recipe for disaster.

Continue reading SHADOW PRICING: Marketing’s Preferred Approach To Underwriting

More Risks, More Opportunities for Employers in Healthcare

Heightened legal risks are forcing many employers to reconsider their hands-off approach to purchasing healthcare — delegating the management of plan assets to insurers or third-party administrators owned by insurers.

Continue reading Plan Sponsors Face Punishment If They Screw Up Their Health Plan

He’s now at the hospital waiting to be seen……………

Continue reading Patient Accidentally Drinks A Bottle of Invisible Ink…

By Paul Miller

This picture shows Audrey Hepburn receiving treatment after injuring four vertebrae. It was an injury that cost her insurer Fireman’s Fund $240,000.

Continue reading More Lloyds of London History by MillerMany Americans look to government for help since a free market in American health care doesn’t exist when it could. When plan sponsors grow balls and take action against the Medical Industrial Complex good things happen. But like anything else in life, leadership only succeeds when followers heed the siren.

Continue reading When Free Market Leadership Fails, Government Steps In

The short answer is “Not too good.” Some districts are learning the grass is not always greener on the other side.

Continue reading How Are Texas School Districts Outside TRS ActiveCare Faring These Days?

William Lee “Bill” Ebaugh

It’s been six years since Bill’s forced retired at 88 years of age. We wonder what he’s been up to these days…………….

Continue reading Bill EbaughHealth insurance has become a highly regulated government utility complete with punishing government sanctions for those who err. All make mistakes, for to err is human and pervasive. No one is perfect. An attorney’s dream.

A post on Linkedin yesterday reminded all of us how complex compliance issues are plaguing government enslaved employers these days.

Below are 15 reasons why ICHRAs make sense to more and more employers fed up with all the rules and regulations, ready to escape the threat of punishing government sanctions, contingency based lawsuits and time lost to productivity when dealing with the non-sensical and crazy world of American health insurance.

Continue reading The Great Escape

Last year it was reported the TSHBP renewal offer included a provision for a cash call to member districts should funding prove insufficient to pay claims and expenses at any time during the 2023-2024 plan year.

Continue reading Is The TSHBP Making a Cash Call To Member Districts?

Ozempic production costs less than $5 a month: Study

Continue reading Ozempic’s 18,600% Price Markup

Weight Loss Drug Coverage Ends for North Carolina State Employees

“State officials are continuing to negotiate with makers of weight-loss drugs in an effort to reach a better financial deal that would allow coverage of the drugs through the State Health Plan …

Continue reading State Employee Health Plan Ends Weight Loss Drug Coverage

Who is behind a Stealth Startup company sniffing around the market sensing Cash Pay Health Plans present investment quality opportunities?

Continue reading Stealth Startup Eyes Cash Pay Health Plan Opportunities?

Elevance Health is the largest for-profit managed health care company in the Blue Cross Blue Shield Association. As of 2022, the company had 46.8 million members within its affiliated companies’ health plans.

Continue reading Six Employees Take Home $64,000,000 Of Your Health Insurance Premiums

More employers are realizing cash paid medical claims reduce plan costs 50% and more over “discounted” managed care pricing. More TPAs like Kempton are joining the Cash Pay Health Plan movement with good success.

Continue reading Kempton Cash Price Agreement

Don Hankey owns Knight Insurance Group and is chairman of Knight Specialty Insurance Company, the company that issued the $175 million bond Donald Trump posted in April 2024 to appeal the verdict in a civil fraud case.

Continue reading Insurance Broker Bails Out Trump

Regional Meetings Cancelled

After promising free food and gift cards to Texas school district officials the TSHB has rescinded the offer.

Continue reading TSHBP Cancels Free Food & Gift Card Event – Giftless School Officials Go HungryWords are the most powerful tool humans have ever had. Mastering language by reading and writing, starting at a young age, will prepare children for success no matter what they end up doing for a living.

Continue reading The Power of Words

WASHINGTON – April 1, 2024

With a stroke of his magical pen President Biden’s Executive Order expands Medicare coverage to every living American whether they pay taxes or not.

Continue reading President Biden Expands Medicare For All

SOURCE: The Cured Has Longer Shelf Life

We don’t cure our patients because it’s not necessary. It’s a choice we made to remain faithful to ourselves and you.

Continue reading The Uncured Have A Shorter Shelf Life

“He Who Controls Referrals Wins” – Molly Mulebriar

“Around 61% of employed physicians said they have moderate or no autonomy to make referrals outside of their practice or ownership system…………..Many physicians say they are losing their ability to influence how patient care is delivered — 60% of physicians said non-physician ownership of practices results in a lower quality of patient care, according to the NORC survey.”

Continue reading The Erosion of Physician Autonomy

“The reimbursement battle rages on, a healthcare tug-of-war with patients caught in the middle.”

Continue reading The Reimbursement Conundrum

The trustees of the Hidalgo County self-funded health plan providing healthcare benefits for the county’s +4,000 employees administered by Aetna believes there may be a better solution than traditional fee-for-service primary care.

Continue reading 4,000 Pound Gorilla Sees Value In Direct Primary Care