Health insurance has become a highly regulated government utility complete with punishing government sanctions for those who err. All make mistakes, for to err is human and pervasive. No one is perfect. An attorney’s dream.

A post on Linkedin yesterday reminded all of us how complex compliance issues are plaguing government enslaved employers these days.

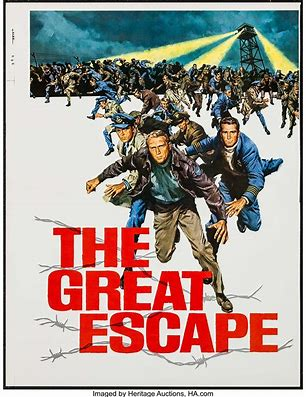

Below are 15 reasons why ICHRAs make sense to more and more employers fed up with all the rules and regulations, ready to escape the threat of punishing government sanctions, contingency based lawsuits and time lost to productivity when dealing with the non-sensical and crazy world of American health insurance.

By Dean Jargo on Linkedin

The Top 10 Questions Being Asked in Health Plan Fiduciary Lawsuits

Johnson & Johnson and Mayo Clinic are currently wrestling with these questions.

If you’re a senior leader, do you know how your company would answer the questions below?

1. Is my health plan advisor free of financial conflicts?

2. Was the selection process for all plan vendors adequate and free from conflicts?

3. Has all vendor compensation been disclosed and reviewed for reasonableness?

4. Were third-party vendors and their services adequately supervised?

5. Have all gag clauses been removed from vendor contracts?

6. Is plan data being accessed and regularly reviewed?

7. Are claims being properly paid (i.e. not being overpaid)?

8. Are there any ERISA prohibited transactions?

9. Are the costs of healthcare services clear and transparent (prior to care)?

10. Are the Explanations of Benefits (after care) clear and transparent?

Here are some more questions that are also important…

1. Do we have a fiduciary committee for our health plan?

2. Do we have a committee charter?

3. Do we have adequate fiduciary liability insurance and are all company fiduciaries named individually in the policy?

4. Does our committee meet regularly and document decisions and processes?

5. Have we hired vendors to fulfill certain fiduciary duties and has this responsibility been clearly documented in a contract?

Don’t wait for the lawsuit; the time to act is now.

RELATED BLOG POSTINGS (WARNING: YOUR BROKER WON’T LIKE YOU READING THIS SO LET’S KEEP IT QUITE BETWEEN YOU AND ME OK?)

StretchDollar’s Free ICHRA Platform

ICHRAs Designed to Minimize Offloading Bad Experience

CMS Publishes ICHRA Premium Look-up Table

Large Employers Turning To ICHRAs

ICHRAs VS “One Size Fits All” GROUP HEALTH INSURANCE

ICHRA Administrator Releases 3rd Annual Report

5 Reasons ICHRAs Could Be An Alternative To Self-funding

Save 43% On Health Benefits Using An ICHRA?

ICHRA’s – An Employer’s Dream Come True?

ICHRA’s Are Looking Better Every Day Thanks To The MHPAEA

How the ICHRA is Changing the Face of Health Benefits

Individual Coverage Health Reimbursement Account (ICHRA)

Texas Senate Bill 120 – A Gift to ICHRA’s?

Legacy Broker Reacts When Asked About an ICHRA