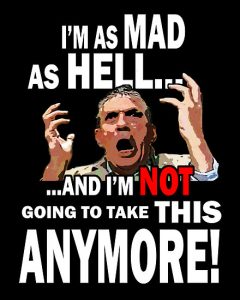

Employers are living a nightmare. The American middle class is too……………

By Bill Rusteberg

Providing employee health insurance benefits is not at all like the good ole days when rates were low and guaranteed for two years, benefits were indemnity based, no underwriting to speak of, employee applications for insurance were the size of an index card, no participation requirements, pregnancy was not considered an illness and not a covered benefit, outpatient prescription drugs were not covered, there was no punishment seeking care from an out-of-network provider because plans back in those days didn’t have networks, employers were not punished for not providing employee health insurance but most did anyway to attract quality employees, life was simple. Life was good. And I was single.

All that has changed of course (including the single part). Only seasoned (old) people like me remember the good ole days giving us a perspective most don’t share these days. Medical insurance has become an entitlement, a heavily regulated government utility relegating many of the freedoms of yesteryear to the history books. And it’s employers who shoulder the burdens of onerous government diktats under threat of punishing government sanctions.

Employers are running out of money and running out of patience. They are at risk and they don’t like it.

There are three solutions to their problem. At least that is how I see it.

- Continue to provide status quo coverage and pay for it by freezing hiring, reduce pay increases, shift cost sharing to employees by making them pay more for less, and keep bidding out the insurance every year hoping for better results. (For Employers with humming-bird balls)

- Move away from status quo plans and incorporate proven strategies that work to solve health care with better benefits and static rates. (For Employers with big brass cojones)

- Set up an ICHRA empowering employees to celebrate rugged individualism by buying their own insurance that fits their individual needs and which they own and control. (For Employers with bigger brass cojones)

Number 1 takes a lot of time and effort on the part of employers. Number 2 takes a lot more time and effort. Number 3 requires almost no work for the employer, freezes his cost to what he can afford to spend, and takes him out of the health insurance business.

Number 1 takes a lot of time and effort on the part of employers. Number 2 takes a lot more time and effort. Number 3 requires almost no work for the employer, freezes his cost to what he can afford to spend, and takes him out of the health insurance business.

Hallelujah! “Free at last, free at last, God Almighty we are free at last! “(Quote stolen from Dr. Martin Luther King – please forgive me!)

ICHRA’s require no underwriting, pre-existing conditions are covered immediately, individual choice of insurance companies, individual choice of benefits, portable with market driven rates.

Individual health insurance competes with group health insurance in both affordability and benefit offering. A large +5,000 life case in Dallas, Texas is an example. This employer contributes less than 80% of the employee only premium. With annual rate increases the employees share has increased each year. As a result the group plan has suffered a 27% loss in plan participants. Where did they go?

What is an individual coverage health reimbursement arrangement (ICHRA)? | healthinsurance.org

RiskManagers.us assists plan sponsors with respect to financial and actuarial analysis and value-added consulting on the design, pricing, and funding of health plans, including Individual Coverage Health Reimbursement Arrangements (ICHRA) plus administration. For an ICHRA analysis contact RiskManager@RiskManagers.us