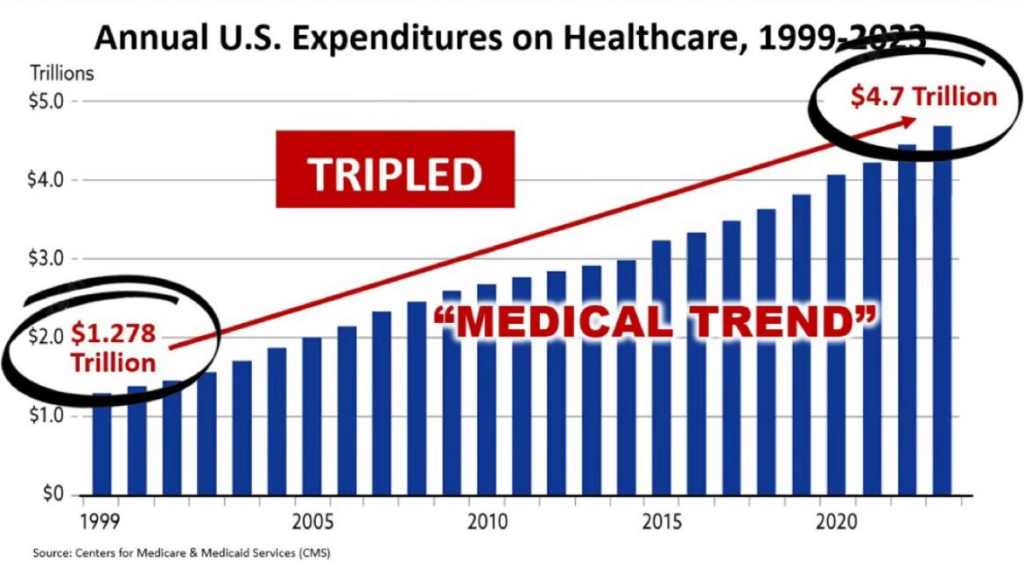

This is your plan. Your costs increase every year. Ours don’t. That’s curious isn’t it?

Why have your costs gone up while ours hasn’t? Blue Cross made a rare admission of the truth some years ago:

“This is part of an overall national trend to move away from PPO plans that come with high costs to consumers and offer little in the way of coordinated care” – Blue Cross & Blue Shield of Illinois

Source: CHICAGO (FOX 32 News) November 2015

Managed care contracts drive costs up, not down. That’s proven and without dispute. We don’t subscribe to PPO networks because that would be dumb.

“Paying protection money for the promise of no balance billing against egregious, arbitrary sticker pricing that has no relationship to costs whatsoever, and agreeing to provider reimbursement levels based upon secretive contracts you cannot see or audit, violates fiduciary duties and is contrary to basic, common American business practices” – Bill Rusteberg

Ben Feldman describes the problem facing most employers these days when it comes to managing their second largest company expense – “You haven’t done anything wrong. You just haven’t done anything, and that’s what’s wrong.“

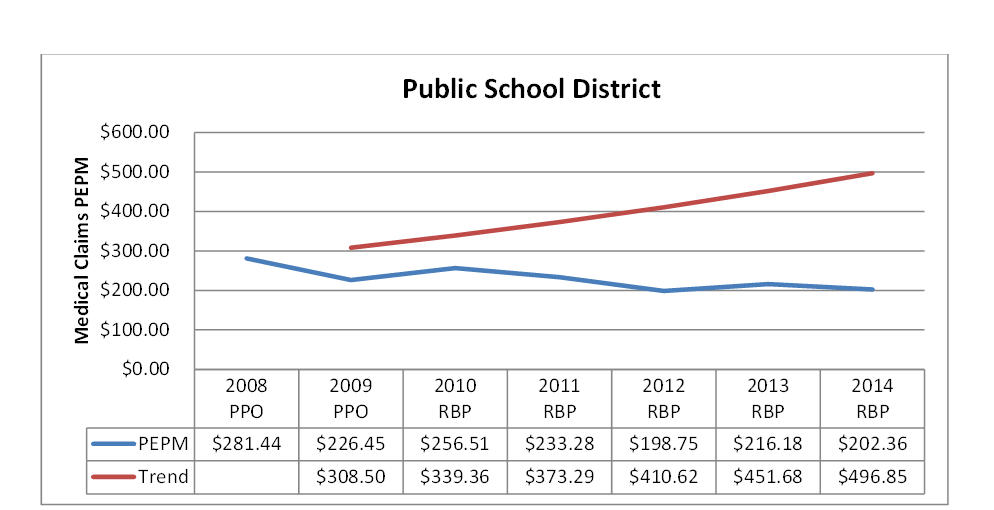

This is our plan. The red line is your plan, the blue line is ours:

This Texas public school district has not had a rate increase in over 15 years and they have improved benefits at the same time. They have beaten medical trend.

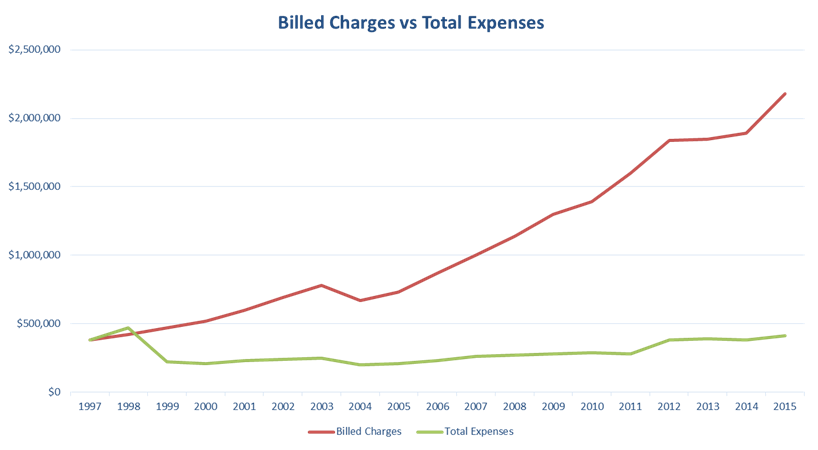

Now let’s turn to the graph below. This tells the true story of what’s driving health care costs. It proves health care costs have remained essentially static for over a decade yet health insurance costs haven’t.

This graph shows the difference between what hospitals bill and their cost of delivering goods and services. Hospitals accepting Medicare patients (almost all of them) must report and attest to their costs by department under penalty of perjury. This is an actual study of one hospital in the Lower Rio Grande Valley:

Notice the red line. It corresponds to your red line. Notice the green line, it matches our plan. Your red line runs parallel to the hospital chargemaster red line because your PPO allowed charges are a discount off the red line. Our green line runs parallel to cost of goods and services because our allowed amounts are a margin placed above the green line (we want hospitals to make money). As the red line goes up, so do your costs. As the green line remains essentially static so do our rates.

The difference between the red line and the green line is called “The Spread.” That’s where third party intermediaries make most of their money but you don’t know or see that.

Want proof? There’s a lot of it out there. Hundreds of lawsuits over the past two or three decades have revealed the truth. Here’s one of them – Weslaco-vs-Aetna described in a Risk Managers blog posting.

This is just a snippet of information you need to understand why your plan sucks and ours doesn’t. It’s all based on facts not hype.

We educate employers on the imploding health care delivery system in this country. We share observations and insight gained over many years by exposing the secrets insurance companies, managed care intermediaries and insurance agents and brokers have kept hidden for years. We walk them through the complicated maze of the American health care delivery system and offer common sense solutions, empowering them to negotiate with health care intermediaries from a position of strength rather than weakness. Once our clients have become self-sufficient, independent and ready to slay the American health care monster with good effect on their own terms, our job is done.

“You’ll have the same problems when I walk out, as you had when I walked in… unless you let me take your problems with me” – Ben Feldman

If you want to learn the truth about American healthcare send us an email: RiskManager@RiskManagers.us.