“A broker can “power up” the bonus to $150,000 per employer group……Commissions of 3 to 6 percent of the total premium……could be about $50,000 a year on the premiums of a company with 100 people, payable for as long as the plan is in place. ……Commissions can be even higher, up to 40 or 50 percent of the premium, on supplemental plans that employers can buy to cover employees’ dental costs, cancer care or long-term hospitalization…………..Bonuses…..as much as $100,000 per group, and “there’s no limit to the number of bonuses you can earn.”

Health Care Service Corporation, which oversees Blue Cross Blue Shield plans serving 15 million members in five states, disclosed in its corporate filings that it spent $816 million on broker bonuses and commissions, about 3 percent of its revenue that year.

Continue reading Employers Pay Brokers BIG BUCKS but Most Don’t Know It

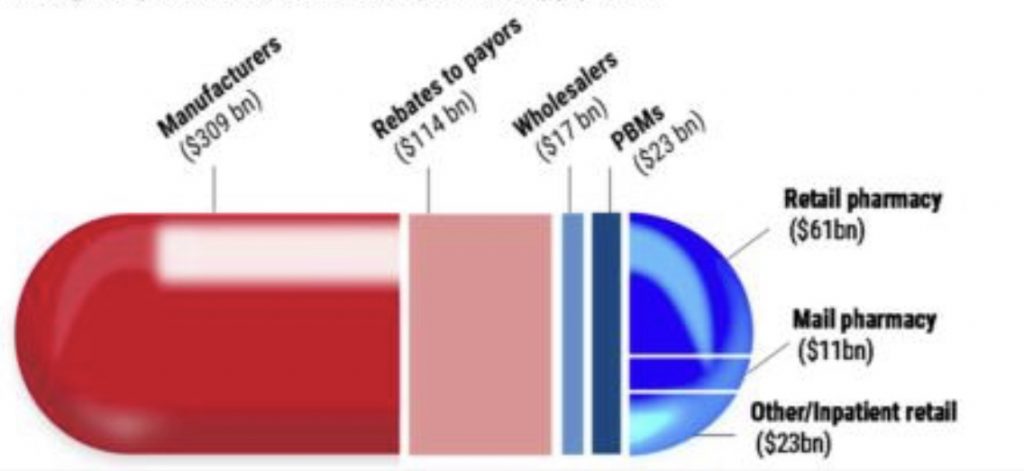

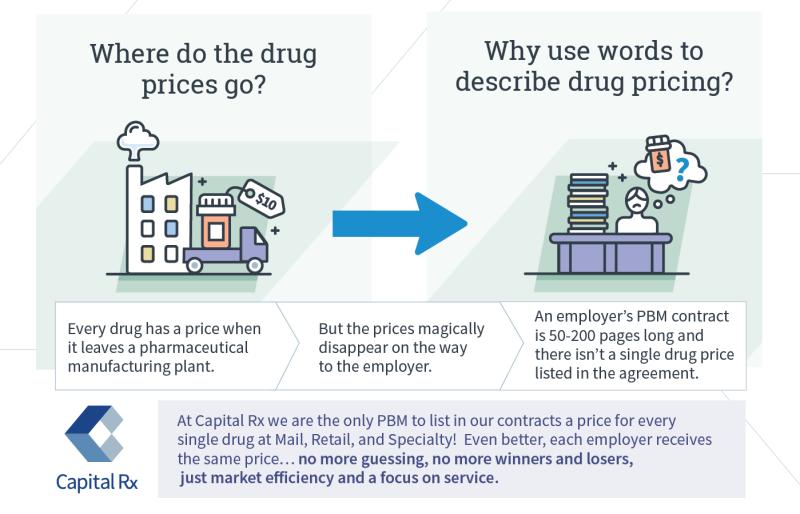

Our Clearinghouse ModelSM simplifies drug pricing and frees up resources to improve patient care. Sometimes a simple change delivers revolutionary results…………..

Our Clearinghouse ModelSM simplifies drug pricing and frees up resources to improve patient care. Sometimes a simple change delivers revolutionary results…………..

“Hi, I’m from Amerman Insurance Services, may I come over to talk to you about insurance this afternoon?”

“Hi, I’m from Amerman Insurance Services, may I come over to talk to you about insurance this afternoon?”

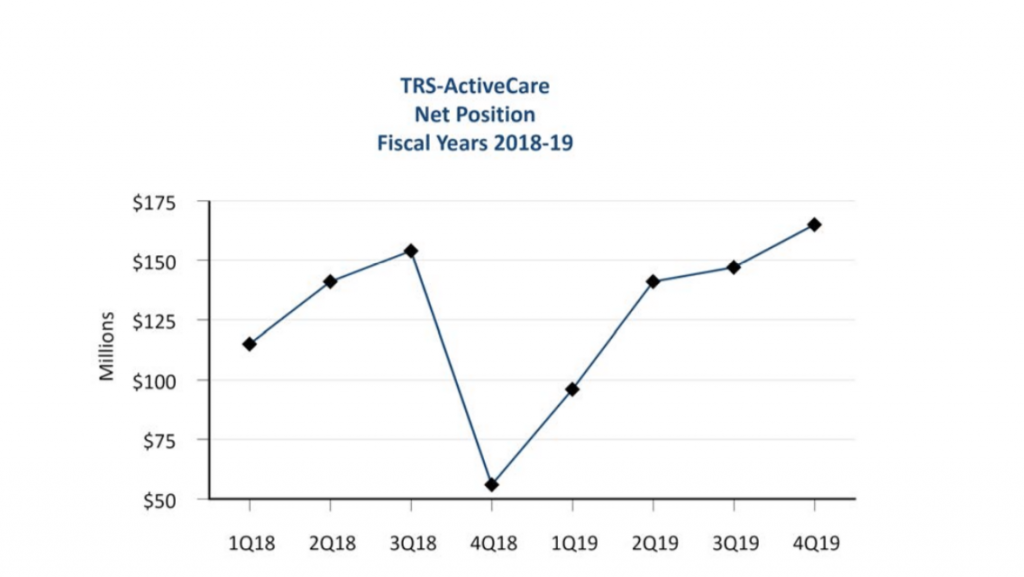

“The CIGNA plans continue to offer better benefits with greater freedom of choice and fewer restrictions than TRS at competitive deductions along with its annual contribution to the Health Savings Account.”

“The CIGNA plans continue to offer better benefits with greater freedom of choice and fewer restrictions than TRS at competitive deductions along with its annual contribution to the Health Savings Account.”