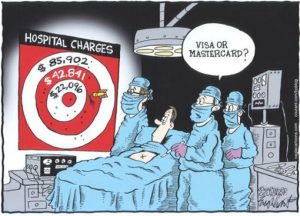

HOSPITAL: Our chargemaster says you owe us $229,112.13!

PATIENT: But you told me I owed only $1,300! What’s a chargemaster?

HOSPITAL: We make up absurd pricing so we can “negotiate” discounts with insurance companies like Blue Cross, United and all the rest. You’re not an insurance company. Besides, what’s a few extra bucks! Pay up!

PATIENT: What’s the 13 cents for?

Story Line: Hospital sues patient for the difference between what her employer’s Reference Based Pricing plan paid (“The sums paid provided Centura with a profit margin of about 5.5 percent”) and billed charges. Patient loses, must pay hospital. Patient appeals to the Colorado Supreme Court and wins. Reference Based Pricing plans across the country rejoice as this set’s precedent.

Excerpts from the appellate court ruling:

Thereafter, and notwithstanding the fact that Centura had told French that her surgeries would cost $57,601.77 and that she would personally be responsible for $1,336.90 of that amount, Centura billed French $229,112.13, reflecting its full chargemaster rates. Centura did so because it determined that it had misread French’s insurance card and that she was, in fact, an out-of-network patient. Centura calculated the amount due after subtracting from the total charges the payment from French’s insurer of $73,597.35 and French’s payment of $1,000.00 (thus, the total amount that Centura charged was over $300,000.00, notwithstanding its pre-procedure estimate that the surgeries would cost $57,601.77).

The case proceeded, and during discovery, French requested that Centura produce the chargemaster that applied on the dates of service for the medical care provided. Centura, however, objected to producing its chargemaster, stating that the chargemaster was “voluminous, proprietary and a trade secret.”

The case proceeded, and during discovery, French requested that Centura produce the chargemaster that applied on the dates of service for the medical care provided. Centura, however, objected to producing its chargemaster, stating that the chargemaster was “voluminous, proprietary and a trade secret.”

In addition, an expert witness for French testified that he had estimated the actual cost of the medical services provided to French to be $70,500.00 and that Centura’s charges for the goods and services at issue greatly exceeded their reasonable value and were thus unreasonable. This witness further opined that the amount that French and her insurer had paid (i.e., approximately $74,000.00) was close to the reasonable value of the services that French had received and that the sums paid provided Centura with a profit margin of about 5.5 percent.

Moreover, as courts and commentators have observed, hospital chargemasters have become increasingly arbitrary and, over time, have lost any direct connection to hospitals’ actual costs, reflecting, instead, inflated rates set to produce a targeted amount of profit for the hospitals after factoring in discounts negotiated with private and governmental insurers.

Moreover, as courts and commentators have observed, hospital chargemasters have become increasingly arbitrary and, over time, have lost any direct connection to hospitals’ actual costs, reflecting, instead, inflated rates set to produce a targeted amount of profit for the hospitals after factoring in discounts negotiated with private and governmental insurers.

Centura has conceded that she would not have been able to understand or interpret the chargemaster’s over 50,000 codes, and thus, access to the chargemaster would not have established mutual assent to any of the rates contained therein. And Centura does not explain how French’s reliance on the foregoing statutes would have altered its position throughout this litigation that its chargemaster was proprietary and a trade secret and would not have been provided to French.

CLASS READING ASSIGNMENT FOR TODAY (not intended to replace or diminish Aldeen’s Sunday Morning Bathroom Read weekly series):

Hospital Chargemaster Insanity: Heeling the Healers

Chargemaster Maintenance Ensures Financial Viability for Hospitals

Hospitals Dismiss Significance Of Chargemaster Prices?

Study: Chargemasters still drive up revenue at US hospitals

Hospitals Dismiss Significance Of Chargemaster Prices?

Hospital Addresses Chargemaster Rates In Response To Time Magazine Story

Ms. French Wins Hospital Lawsuit

OMG! HCA Hospitals Billing At 1,000 – 1,500% of Medicare?

How Nonprofit Hospitals Get Away With The Biggest Rip Off In America

Hospital Price Transparency – Not a Cure for the Disease

Nonprofit Hospitals Are Biggest Rip Off In America

Hospital Transparency? Good Luck

How Hospital Reimbursement Does and Does Not Work

Texas Court Orders Hospital to Disclose Reimbursement Rates

Stricter Chargemaster Regulations Needed To Rein In Healthcare Costs

Hospital Contracts Made Simple – 120% Method

Hospital Must Release Information on Pricing Methodology

8 Memorable Quotes About Hospital Prices

Challenge To ‘Balance Billing’ Hits Hospital

Tough Talk With Hospitals Ends In Missing Person Report

These 10 Hospitals Could Pick Your Pocket Clean

Some Hospitals Charge 1000% Of Medicare Rates? That’s Outrageous!

Data Shows Large Increases In Hospital Charge Master Rates

Hospital Price Gouging Driving Up Healthcare Costs?

Hospital Contracts Made Simple – 120% Method

Cost Plus Insurance To Make Offer To Hospitals?

Ruling: Hospital Bills Should Reflect ‘Reasonable Value’ of Service

Hospital Charges Surge For Common Ailments

1,700 Page Rule Recommends Hospital Pricing Transparency

Sutter Health Hospitals Agree To Pay $46 Million To Avoid Airing Secrets?

Balance Billing, Chargemaster Pricing & Remedies

One Hospital Charges $8,000 – Another $38,000

Ah, but it really is the ChargeMaster…………..

Patients Livid At Hospitals For Rewarding Cash Paying Patients With Steep Discounts

Are Hospital Charge Master Rates Unreasonable?

The Mystery Behind Hospital Charge Masters – Is Pricing Enforceable?

AG Finds Clout of Hospitals Drive Costs

Hospital Official Tells Us Cost-Plus is an Illegal Scheme

Price Discrimination By Hospitals

Hospital Charge Master – Basis for Cost Plus Pricing?

Health Care Costs Have Remained Static But Health Insurance Costs Haven’t – Here’s Why

Renting Medicare’s Provider Network

TPA / RBP Vendor Compares Fees To Competition

Charge Master Rates & Magical Discounts

Renting Medicare’s Provider Network

What Advisers Should Know About The First Reference-Based Pricing Lawsuit

Renting Medicare’s Provider Network

Smoke & Mirrors – Comparing PPO “Discounts”

How Late Will Late Adopters Be Late?

Broker Asks RiskManagers.us Opinion on Direct Contract Offer

Escalator Clauses, Rising Prices, And Why We Should Care

The PPO Claim Re-Pricing Charade

Renting Medicare’s Provider Network

RiskManagers.us Client Tracks Claims To Establish Reserves

Renting Medicare’s Provider Network

Revolution In Health Care Price Transparency May Be Here

World’s Most Ethical Company Seeks Charge Master Specialist

Fellow Health Care Disruptor Shares Personal Experience

Reference Based Pricing Under Fire

Congress Releases Surprise Billing Compromise

It Ain’t Over Until It’s Over………………

How To Make A Killing In American Health Care

Catastrophic Claims on the Rise

The Case of The $153,887 Kidney Stone

Gateway to Health Care: The Clerk In The Cubicle