By Bill Rusteberg

Health care costs have remained essentially static over the past 15-20 years yet health insurance costs have skyrocketed. Here’s why……………

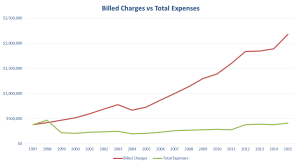

The graph above was developed using public information anyone can get (Thank You Uncle Sam!). Hospitals accepting Medicare patients must report to the government attesting to their cost of providing care. This graph shows one hospital’s cost-to-charge ratio over multiple years and is representative of filings by hospitals in general.

The green line is hospital’s cost as reported to the Uncle Sam. The red line represents the hospital chargemaster rates (Hospitals Dismiss Significance Of Chargemaster Prices?) Payer’s pay somewhere between the red and green line.

Managed care contracts are tied to the red line, so as the red line increases so does the payer’s line. Payer’s line always runs parallel to the red line under managed care contracts.

Medicare and Reference Based Pricing plans tie reimbursement to the green line. Therefore Medicare and Reference Based Pricing costs mirror actual cost plus a margin. Payer’s line always runs parallel to the green line.

The difference between the red line and what the payer actually pays is called The Spread. This is where many third party intermediaries make their money such as percentage of savings, percentage of billed charges, etc. Proof of this can be found in numerous lawsuits filed over the years including Weslaco ISD vs Aetna, HiLex vs BCBS, Anheiser Busch vs Cigna and many more. The Weslaco case for example exposed an intermediary fee of 9.6% of the spread as an additional fee for plan administration.

So why are most plans still clinging to status quo managed care strategies? It’s a combination of things. It’s fear of change, fear of employee push back, reliance upon status quo insurance advisors and HR vs CFO decision making processes. It’s simply a willful avoidance towards understanding health care financing and the truth about what drives health care costs.

So why are most plans still clinging to status quo managed care strategies? It’s a combination of things. It’s fear of change, fear of employee push back, reliance upon status quo insurance advisors and HR vs CFO decision making processes. It’s simply a willful avoidance towards understanding health care financing and the truth about what drives health care costs.

You can’t fix what you don’t see. Yet it’s out in the open for anyone to plainly see if they would only open their eyes for a change instead of taking the ostrich position.

Meanwhile early adopters of Reference Based Pricing are taking plan strategies to new heights, achieving even better results while removing traditional barriers to care found in managed care plans.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.

The shared vision of RiskManagers.us and clients who retain our services is to establish and maintain a comprehensive employee health and welfare plan, identify cost areas that may be improved without cost shifting to any significant degree, and ensure a superior and sustained partnership with a claim administrator responsive to members needs on a level consistent with prudent business practices.

Plan costs, in all areas including fixed expenses and claims are open for review on a continuing basis. Cost effective plan administration and equitable benefit payment to providers are paramount to fulfilling our mutual fiduciary duties. As we proactively monitor and manage an entire benefit program we are open to any suggestions members may make or the dynamic health benefit market may warrant in order to accomplish these goals.

Duty of loyalty to our clients, transparency and accountability are essential to the foundation of our services. To that end, we expect our clients to realize a substantial savings based upon the services that we will deliver.

2020 RiskManagers.us All Rights Reserved