Victor Lustig Would’ve Approved!

“None of us want to underfund a hospital that is providing legitimate services, but this borders on criminal.” – Michael Watson

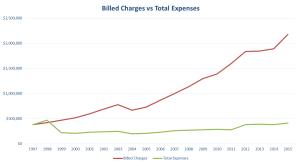

Working The Spread (The difference between the red line and the green line)

Working The Spread (The difference between the red line and the green line)

Hospital chargemasters exist for a reason and have nothing at all to do about the cost of care. Profits are made by third party intermediaries working the spread. Weslaco ISD vs Aetna is one example of many wherein the scheme is exposed. Carriers, brokers, consultants and TPA’s have been known for working the spread including one TPA That Was Caught “Working The Spread”

George A. Nation III argues that “the government needs to step in, not to take over responsibility for providing healthcare, but just the opposite, to eliminate the chargemaster pricing system…………” –Hospital Chargemaster Insanity: Heeling the Healers

What is a hospital chargemaster? “In the United States, the chargemaster, also known as charge master, or charge description master (CDM), is a comprehensive listing of items billable to a hospitalpatient or a patient’s health insurance provider. In practice, it usually contains highly inflated prices at several times that of actual costs to the hospital.[1][2][3] The chargemaster typically serves as the starting point for negotiations with patients and health insurance providers of what amount of money will actually be paid to the hospital. It is described as “the central mechanism of the revenue cycle” of a hospital.” – The Redoubtable Chargemaster

Why do Hospitals Dismiss Significance Of Chargemaster Prices? One hospital’s response is telling: “By law, hospitals are required to maintain a uniform set of charges called the chargemaster. Patients are usually sent a copy of their bill which includes the fees for services rendered from the chargemaster. However, almost all insurance companies, as well as Medicare, pay hospitals on a negotiated pre-determined fee schedule. In fact, less than 4% of services provided at (Redacted) Memorial are paid on the basis of the hospital’s chargemaster. It is true that a hospital’s chargemaster has become increasingly irrelevant and is often a source of misinformation for consumers. With the cooperation of insurance companies, we are working on a plan to revise the chargemaster and align it more closely to the actual fees paid by insurance companies.” – Hospital Addresses Chargemaster Rates In Response To Time Magazine Story

XXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Medical City Dallas and other HCA Facilities Bill 10-15 Times Medicare

MyHealthGuide Source: HPC. 2/18/2022

St. Louis, MO – HPC Notifies Self-Insured Stakeholders that Medical City Dallas and other Hospital Corporation of America (HCA Healthcare) facilities are billing 10-15 times Medicare.

As the top Medical Bill Review company in the nation, Health Payer Consortium (HPC) provides cost containment for self-insured plans across the country.

A recent Axios and John Hopkins University study found that Medical City Dallas marks up its prices more than almost every other large hospital in the country (Axios Hospital Billing). Medical City Dallas is owned by HCA Healthcare. D Magazine out of Dallas reported that “seven of the ten hospitals with the highest mark-ups are owned by Medical City’s parent company, HCA Healthcare” (D Magazine).

“It should come as no surprise, then, that Becker’s Hospital Review published that HCA Healthcare’s CEO made $30,397,771 in his second year as CEO, after factoring incentive compensation, stock awards and pension benefits into his annual salary,” said Patrick Crites, President of HPC (Becker’s Hospital Review). Moreover, HPC is noticing that other HCA Healthcare facilities are adopting this pricing methodology. According to HCA Healthcare’s own Fact Sheet, they own 184 hospitals and 2,000 sites of care located in 21 states and the UK, with the vast majority in the US. So, there is a good chance your groups will incur an egregiously priced claim from one of HCA Healthcare’s facilities (HCA Healthcare Fact Sheet).

“Our Medical Bill Review process identifies billing errors and non-payable items. As result, we protect plans, payers and patients from overpaying for medical care,” says Lindsay Evans, EVP of Sales & Account Management for HPC, “and in speaking with several of my Stop Loss Carrier clients, it seems the problem is weighing heavily on the industry. Several carriers would like to name Medical City Dallas as a non-payable hospital, but this is offset by the fact that HCA Healthcare represents a significant number of hospitals in the US. They are not sure they can be deselected from coverage.”

“None of us want to underfund a hospital that is providing legitimate services, but this borders on criminal,” said Michael Watson, EVP of Claims & Specialty Contracts at HPC.

About HPC

HPC has proven strategies to help combat these egregious billing activities. We have an expert team ready to assist with containing costs on large dollar claims. Contact Patrick Crites at Patrick.Crites@hpcmembers.com. Contact HPC for more information.

Established in 2014 and headquartered in St. Louis, MO., HPC lowers the overall cost of healthcare claims. We are a “client first” company. To us, that means that we view every problem through your eyes, and create solutions that match your process, not ours. HPC has vast experience, and chances are you’ve worked with some of us before. Members of our team have established or managed some of the largest companies in the self-insured space. Visithealthpayerconsortium.com.