The following was written by Joe Paduda, 4-9-09 in Managed Care Matters:

“TPAs and employers and insurance companies send out requests for proposal to each other, to managed care firms, specialty providers, voc companies, IT providers, law firms. All have been on the receiving end of a voluminous, detailed, structured and rigorous RFP – so big that it clogs their virtual and/or physicial mailbox.

The erstwhile vendor is initially happy. Hey, we made the cut, were on the list, we “get” to respond. We have an opportunity.

Then the work starts. Even if the vendor is big, and has staff to help write the responses, and even if it has a ready-made library of canned responses, it is still a lot of work. We arent talking a couple of hours here and there by a junior staff writer – every question has to be reviewed and assigned, then the answer checked for accuracy, grammer, and consistency with other answers. Then someone has to find all the reports and IT flow documents and disaster recovery plans and professional certifications and insurance coverage documents and CVs and make sure they have the right appendix numbers and are in the right format. Then it has to be collated, checked one more time, signed by an executive, and shipped out. All on the prospect’s schedule.

And that’s if it’s a big vendor; if it a small company, the folks who are doing this work are also the folks who are supposed to be doing the “real ” work – handling the tasks that actually deliver value to customers and owners alike.

The point is there is a lot of work involved, and most of the vendors who are doing the work are not going to get anything out of it – at least in terms of revenue. No, they’re going to have to savor the joys of a job well done, even if not done well enough to actually win the business.

I know, the “customer” has also put a lot of work into the process – no argument there. Just understanding what it is you want, what restrictions exist, what the timeline should be and who should be involved in the process from initial specs to final decision means meetings on top of meetings.

But just for a minute think about it from the vendor’s perspective. The erstwhile vendors want to deliver for your company, they think they can do a better job of anyone else, yet they’re forced to only answer what they’re asked, not allowed to demonstrate their abilities and insights and expertise and knowledge. Yes, they may be able to – in response to the “is there anything else we should know, or other ideas you have.” But the responses to these questions don’t fit the scoring methodology. Even if they are creative and innovative and fresh, and look promising, it’s tough for them to see the light of day in the typical RFP process.

Now comes the waiting, and the waiting, and the waiting.”

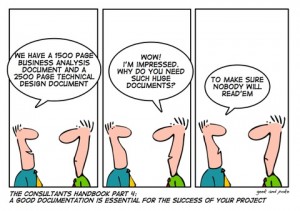

Editor’s Note: We sent this to an insurance consultant in Illinois. His comments: “Exactly…..which is why I rarely respond to public bid inquiries, and as a carrier (his previous employer) I did not either….also, when it comes right down to it….no one reads all the crap……they put you on a spreadsheet and then read later (if at all)…..I quote first with trusted vendors and then do the questions that really matter….when is the last time you had to worry about someone’s disaster recovery plan and whether or not it would work?”

We also rarely respond to RFP’s for the reasons stated by our friend in Illinois. Last year we bid on four jobs, along with the usual crowd of interested consultants. On one case, out of five respondents, our firm was ranked dead last. No interviews or follow up questions to the RFP were asked. Then, on another case, we responded to, we were competing with the same four consultants – the RFP included an interview process of all the respondents – we were ranked number one and obtained the business.