If these firms were in charge of your company’s security, you would have fired them after the first robbery. Instead, there’s a robbery occurring daily within your health plan, but these firms all keep their positions as “trusted advisors”.

By Dean JargoDean Jargo – CEO at Fair Market Health

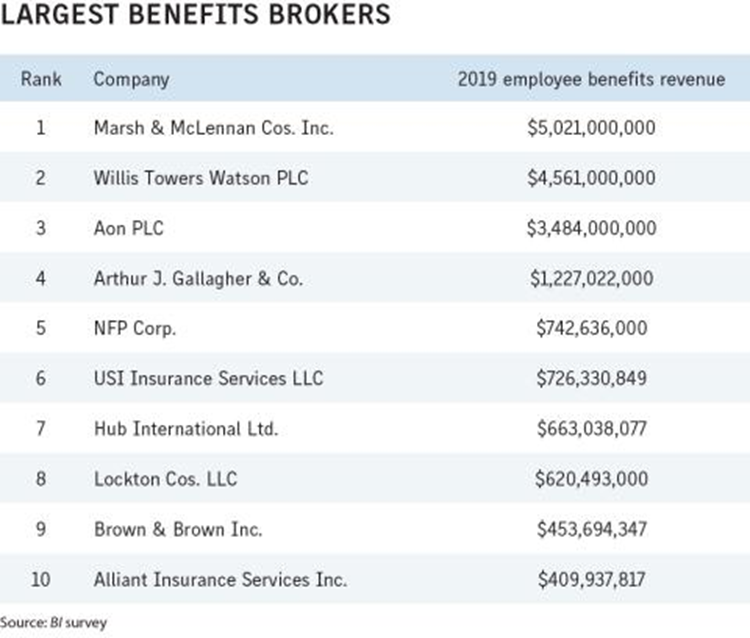

IF we can agree that the brokerages shown above consistently represent themselves as the authoritative “experts” on employee health benefits strategy and design…AND we can acknowledge that the U.S. employee health benefits system is fundamentally flawed (and has been for at least two decades)……Shouldn’t we also question whether these brokerages are a big part of the problem?

Hear me out… I’m not saying that every individual broker working at these companies is incompetent or that they have a conflict of interest.

That’s not a given and NOT what I’m saying. Many are highly capable and consistently working in their clients’ best interest.

I’m talking about these multi-billion $ firms with stellar brands and reputations.

If these firms were in charge of your company’s security, you would have fired them after the first robbery.

Instead, there’s a robbery occurring daily within your health plan, but these firms all keep their positions as “trusted advisors”.

Many like to point fingers at insurance companies, large health systems, PBMs, medical device manufacturers and others for the mess that is U.S. healthcare.

I do it as much as anyone.

My question is… why do the large brokerages get off so easy?