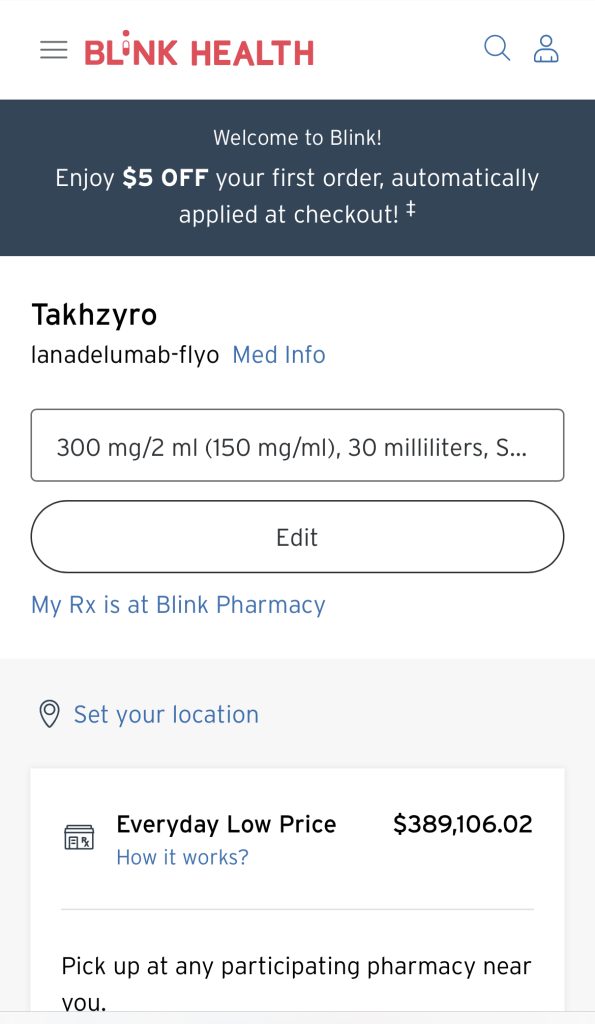

There’s not too many plan sponsors that can afford a plan member’s $389,106.02 drug habit. It only takes a few specialty drugs like this to bankrupt a group medical plan.

Stop loss insurance may help in the plan year in which the drug first surfaces, but on renewal it will surely be lasered which effectively passes the risk back to the plan sponsor.

Plan sponsors faced with the decision whether to continue providing health insurance to their employees or not have three strategies they can employ to keep their group health plan in place:

- Exclude specialty drugs based on Medicare’s definition. Affected members can then apply for financial assistance through various programs such as manufacturer assistance, government grants or foundation monies. There are sources of help to assist these members, most of which charge for their services anywhere from 30% of savings (ouch) to 10% of savings. Others like NiceRx charges patients $49 per month to apply and receive manufacturer assistance. On the other end Texas A&M has a free Rx patient assistance program. Or, consumers in partnership with their physician can apply for assistance. The process is simple, and it’s free. We like “free.”

- ICHRA – Employer can drop his traditional group plan, give each employee a defined contribution to buy an individual policy. This removes the employer from all risk.

- Incorporate the Compassionate Care Plan™ risk transfer method.

This medication is used to help prevent severe swelling attacks due to a certain inherited immune disease (hereditary angioedema-HAE). Lanadelumab-flyo works by binding to a natural substance made by the body (kallikrein) and blocking its effect. This blocking effect lowers the amount of another natural substance (bradykinin) that causes symptoms during an attack of HAE. Lanadelumab-flyo may help decrease symptoms such as abdominal pain/cramps, diarrhea, vomiting, or rapid swelling and pain of the hands, feet, limbs, face, tongue, or throat.