Transparency in health care pricing doesn’t make a whole lot of sense when it’s other people’s money paying for all of this. Who cares what the cost is when all you have to pay is a small co-pay, or some sort of deductible. Then, when you enter that Magical Kingdom called Maximum-Out-Of-Pocket Limit you tend to go crazy in getting more health care to (1) milk it for all it’s worth and (2) revenge against the evil insurance carrier that makes you pay so much in co-pays and deductibles while charging you an arm and a leg in insurance premiums.

Transparency in health care pricing doesn’t make a whole lot of sense when it’s other people’s money paying for all of this. Who cares what the cost is when all you have to pay is a small co-pay, or some sort of deductible. Then, when you enter that Magical Kingdom called Maximum-Out-Of-Pocket Limit you tend to go crazy in getting more health care to (1) milk it for all it’s worth and (2) revenge against the evil insurance carrier that makes you pay so much in co-pays and deductibles while charging you an arm and a leg in insurance premiums.

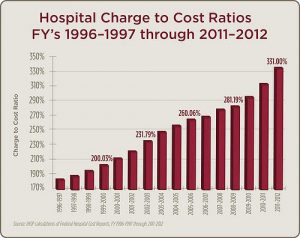

Health care pricing transparency does makes sense when Reference Based Pricing strategies are employed. “My plan will pay you $500 for that procedure, so how much will you charge me? Oh, never mind, I think I can find someone else that will do it for $500………………………

Continue reading Trump Ready To Force Transparency In Healthcare Pricing With An Executive Order

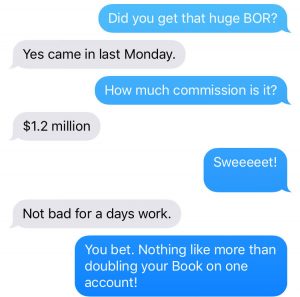

Tired of waiting for the Texas legislature to act in addressing crippling health care costs affecting hundreds of thousands of Texas educators, the Raymondville Independent School District in deep South Texas has decided to act.

Tired of waiting for the Texas legislature to act in addressing crippling health care costs affecting hundreds of thousands of Texas educators, the Raymondville Independent School District in deep South Texas has decided to act.