By William Rusteberg

The most powerful selling tool is fear. It motivates buyers to act quickly and decisively without basis of reasoned consideration. Depending on the level of fear a seasoned salesman can gin up during his close, fees to be charged and eagerly paid by the victim are directly and proportionally related. Higher fear levels bring higher fees.

As Sherlock Holms famously opined many years ago, “It is a capital mistake to theorize before one has data.” Such is the case with Cost Plus Insurance.

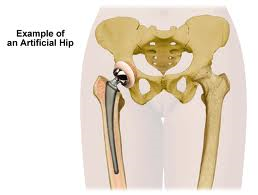

Moving away from managed care contracts by paying medical providers directly involves the risk of balance billing. For example, if a hospital bills $100,000 based on their charge master rates and Cost Plus Insurance reimburses only $15,000, it is expected that the hospital would balance bill the patient (not the plan) for the difference, or $85,000. Excellent fodder for a nice lawsuit, right?

Not so. There are many consumer protections in the case of balance billing that if employed carefully, lawfully and properly, mitigates to a very large degree any chance of a lawsuit or dinged credit. ERISA, Assignment of Benefits, Fair Credit & Reporting Act and Plan Document language are just a few tools to be employed to afford consumer protection in the case of balance billing by medical providers.

Most Cost Plus Insurance plans these days do not provide legal liability protection since many believe it is not needed. One TPA in Ohio doesn’t feel the need for legal liability protection and has not had a lawsuit in over 15 years in managing Cost Plus Insurance for his clients. Another nationally known TPA in Kansas markets their Cost Plus Insurance plan nationally without legal liability indemnity cover and guarantees no balance billing. A Texas based TPA is marketing a similar plan with the same results.

Yet some TPA’s are selling Cost Plus Insurance based on the fear of lawsuits and charging outrageous fees to provide “protection.” An example are fees tied to a percentage of billed charges which can run as high as 12% or more. Since 40-45% of a group’s medical spend are facility charges, applying a 12% fee to inflated billed charges can equate to hundreds of thousands of dollars per year for a 350 life case. These fees are shared by several parties involved in the administration of the plan, including the broker / consultant.

What is the potential liability for Joe Sixpack’s $100,000 hospital bill? In the example above, the hospital believes Joe owes the balance between what Cost Plus Insurance paid and what the hospital charged, or $85,000. So the liability to Joe is $85,000. There is no liability to the plan. Since no one ever pays 100% of billed charges, and since case law may apply, it is highly likely that the hospital will accept significantly less than $85,000 to settle Joe’s bill. In fact much less than paying enormous fees for balance bill protection. Hospitals don’t like lawsuits for a variety of reasons, including perceived poor publicity and public disclosure of pricing practices.

To an employer committed to self-funding his employee benefit plan, it makes perfect economic sense to self-fund balance billing risk too. The claim dollar savings of Cost Plus Insurance provide the funds to handle balance billing issues, whether a plan sponsor shares those savings in advance in the form of fees paid to a third party intermediary for indemnification or sets those monies aside for future loss.

If an employer is hell-bent on having legal liability indemnity coverage, a quick check for surplus lines cover will indicate very low premium levels. Such coverage is much like aggregate stop loss insurance – low risk equals low cost. Many plan sponsors do not purchase aggregate stop loss insurance.

More employers are treating their employees like adults these days. This stance will grow under ACA as Americans are required to seek health insurance or face punishment. Health insurance has now become an individual responsibility and not so much the employer’s moral responsibility. Under a Reference Based Pricing Model, which is where Cost Plus Insurance is heading in the marketplace, plan sponsors will view balance billing as the sole responsibility of the insured.

See http://blog.riskmanagers.us/?p=11943 . Visit www.referencebasedpricing.us for Cost Plus Insurance information and articles