Beers family members built a “conglomerate” by selling a Christian alternative to traditional health insurance. They’re now scrambling for cash, even though they received millions in PPP loans that were later forgiven.

by J. David McSwane and Ryan GabrielsonMay 15, 5 a.m. EDT

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

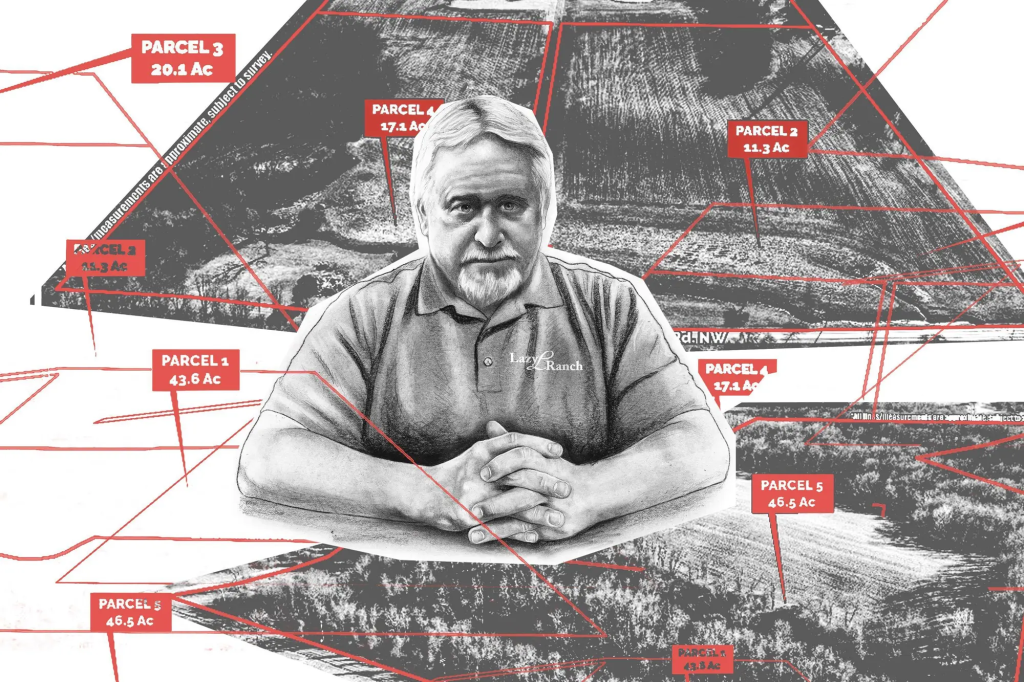

In just a handful of years, members of a Canton, Ohio, family built a financial empire that included a boutique airline, a bank in the Missouri Ozarks, a chain of carpet stores, a marijuana farm in Oregon, and more than $20 million in real estate. The “conglomerate,” as the Beers family calls it, was made possible by hundreds of millions of dollars collected from Americans who thought they had found an affordable alternative to medical insurance. Instead, many were saddled with debt.

The conglomerate, however, is showing signs of strain as the family downsizes its workforce and sells off some of its holdings. These moves will free up cash, said an attorney who represents several family members, and allow them to pay off a court settlement related to its alleged fraud. Now, another big debt has come their way: Several family members face liens placed against their properties for millions in back taxes.

Family That Controlled Liberty HealthShare Shows Financial Strain — ProPublica