“Medical trend” means medical inflation. It’s not driven by free market economics. Rather it’s journey to your health insurance renewal is spawned through managed care contracts you can’t see nor audit.

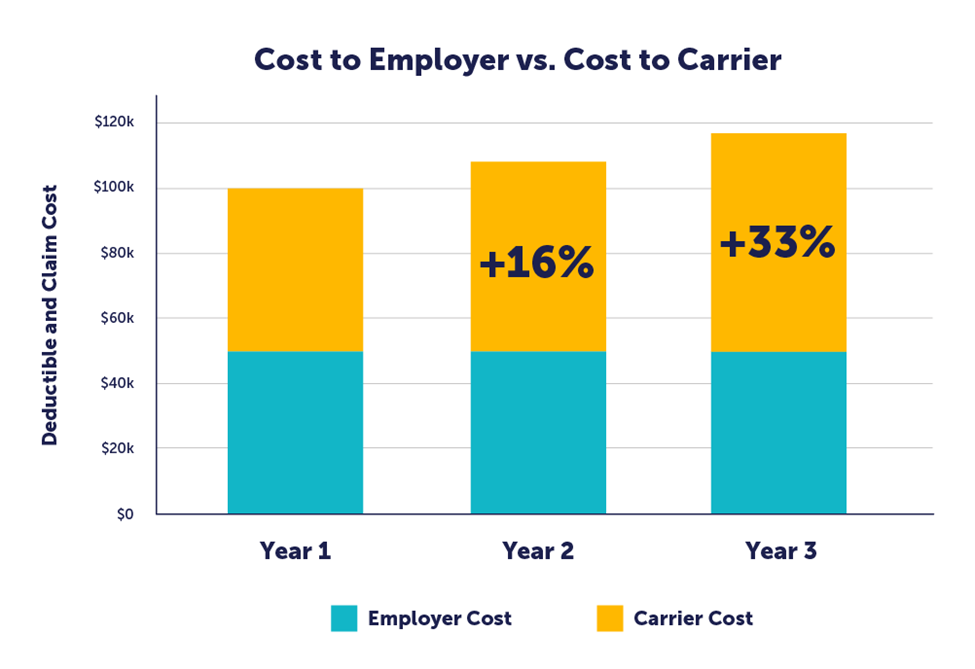

Medical trend, in part, drives your renewal rates. In the example above its assumed medical trend is 8%. In other words, what costs $100 this year will cost $108 next year. In this case does your insurance company view 8% differently?

Of course they do. Here’s why:

All group policies, whether self-funded or fully insured, have internal risk transfer protection. In fully insurance contracts its called a pooling point. Claims in excess of the pooling point are pooled over their entire block of business. In self-funded groups pooling points are called stop loss insurance. Like fully insured groups, any claims over the stop loss threshold are pooled to the carrier’s block of business.

Back to the example shown above – an 8% medical trend on a $50,000 pooling point or stop loss threshold on a $100,000 claim creates a $50,000 liability to the insurance company in the first year but that goes up to $58,000 the second year, or a 16% exposure increase to the insurance company. It gets even worse in the third year when a first year claim of $100,000 becomes a third year claim of $116,640. The insurance company’s risk has increased 33% over year one. This is called leveraged trend.

Leveraged trend applies to traditional status quo managed care plans, i.e. PPO plans but, for the most part, does it apply to non-traditional plans that are growing in the market. These plans have beaten medical trend either by totally eliminating it or reducing it to negative territory.

That’s one reason why Reference Based Pricing plans enjoy static multi-year renewals. Since 2007 when Reference Based Pricing plans were introduced in Texas many of these groups have not had a rate increase for 5, 10 and 15 years.

Once a plan solves medical trend more money is available for wage increases and better benefits. Yet it continues to amaze us that 95% of plan sponsors don’t see the value of proven alternatives that reduce costs and improve benefits at the same time.

Business is about solving other people’s problems. Solving the high cost of healthcare giving employers a competitive advantage is ours.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.