By Marshall Allen

‘That’s an incredible victory! But like many of these wins, it’s bittersweet, because it exposes an outrage. Neither the hospital nor the insurer had been complying with the Illinois law.”

It was 3 o’clock in the morning, and baby Jacob couldn’t breathe.

His panicked parents rushed the 3-month-old to the emergency room closest to their house, near Chicago.

The ER doctor determined that baby Jacob needed intensive care, so he got transferred to Advocate Lutheran General Hospital.

Unfortunately, Advocate Lutheran was out-of-network with the family’s Blue Cross Blue Shield of Illinois insurance plan.

The parents would later find this out the hard way. In the moment, they only cared about their son. Baby Jacob got intubated during that hospital stay in September and spent two weeks in the pediatric intensive care unit. The clinicians saved his life, and he made a full recovery.

Then came the bills. Blue Cross rejected most of the charges from Advocate Lutheran because the hospital was out-of-network.

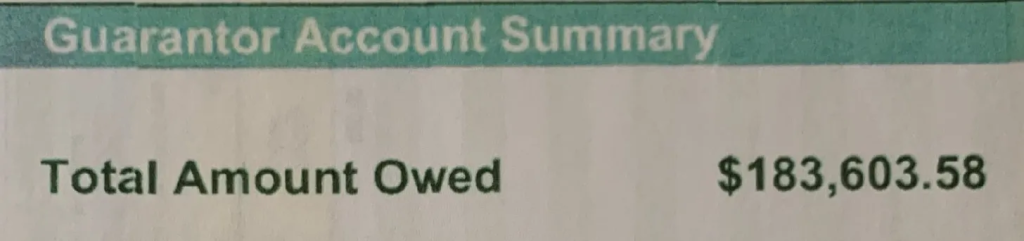

That left Baby Jacob’s parents on the hook for a staggering sum. The bill came to $183,603.58.

Kate, Jacob’s mom, nearly had a heart attack when she saw the bill. She begged for reconsideration, but the hospital and insurance company would not budge. The hospital simply told her that she and her husband could afford it, she said.

Kate does accounting and her husband is a contractor. Like most of us, they don’t have an extra $183k sitting around. The amount is about three times the median family income in Chicago! When the hospital threatened to send them to collections, the couple dutifully started a payment plan – doling out a hefty $500 a month. At that rate, baby Jacob would be a 30-year-old man before the bill was paid!

Kate and her husband considered hiring an attorney. But thankfully they were referred to Gayle Byck, a patient advocate in the Chicago area. In my book, “Never Pay the First Bill: And Other Ways to Fight the Health Care System and Win,” I suggest consulting a paid patient advocate when you are incapacitated, or your situation is too complicated to handle on your own. Not everyone can afford it. But their knowledge and experience navigating the health care system could rescue you.

Byck is a former health services researcher who earned a Ph.D. in public health before opening In Tune Health Advocates several years ago. She knew right away how to handle the case. Illinois is among the states that have passed a law that protects patients who receive out-of-network treatment during emergencies. It’s called the Illinois Network Adequacy and Transparency Act. The law requires that claims in such cases be covered by the insurer at in-network rates. The federal No Surprises Act, which went into effect at the beginning of this year, says something similar. The patients should not be responsible for more out-of-pocket than they would pay for in-network services.

Byck sent a letter to the insurance company, citing the Network Adequacy law. Then she and the couple waited. And waited. More than 30 days passed without a response. Byck contacted Blue Cross and was told the appeal letter was being rejected. The insurer claimed that a previous phone call by Kate had counted as a verbal appeal, Byck said, and the plan only allowed a single appeal.

Byck called it a “sneaky” move by the insurer to count a phone call as an appeal. So she complained about it to the Illinois Department of Insurance, the regulator for insurance plans in the state. Within a week, a Blue Cross representative called, she said, saying they would consider the appeal letter.

The call to the regulator might have helped. The appeal worked! Blue Cross agreed to abide by state law. It reprocessed the claim at in-network rates. Advocate Lutheran hospital got paid and the $183,000 bill got resolved. The couple ended up paying about $5,700, which was their fair share under the terms of their plan.

That’s an incredible victory! But like many of these wins, it’s bittersweet, because it exposes an outrage. Neither the hospital nor the insurer had been complying with the Illinois law.

Kate didn’t want her full name used in this column, but she agreed to waive her HIPAA privacy rights so I could contact Blue Cross and Advocate Lutheran and they would be allowed to tell me their side of the story. I wanted to know: Why did they send a family deep into debt and require a professional patient advocate to spur them to comply with the law?

Blue Cross did not get back to me after I reached out to its PR person. The Advocate Lutheran PR person responded with a vague statement that did not address the situation. “We understand dealing with an emergency medical situation and the accompanying bills can be stressful,” the hospital statement said. “…We are committed to compliance with policies at the state and federal levels.”

These parents should not have been hit with a massive medical bill. They should have been immediately reassured that they had no need to worry, because Illinois legislators had enacted a policy solution. Byck said she’s handled several similar cases where she had to cite the law to get the insurance company and the hospital to comply. “Everyone I helped with this situation had no idea there’s this law,” Byck told me. “And you certainly don’t get that information from the insurer or the customer service person in the billing department.”

Byck said this story provides a warning about the new No Surprises Act. It’s wonderful that the law gives patients a similar type of protection, she said. But it must be applied in order for patients to benefit.

I sometimes say that our health care system can be cruel in the way it treats patients. Byck agreed that “cruel” is a fair word to use. How would a consumer know about this law, she said. They’re in a vulnerable situation just hoping their baby will survive. “The average person would have no knowledge of what to do,” Byck said. “She called the hospital and the insurer and got nowhere.”

Takeaways:

1. If you’re charged out-of-network rates for emergency services, you now should be protected by the federal No Surprises Act. Check the law, and make sure your medical providers and insurance company comply with it.

2. Don’t buy it if your insurance company tells you your appeals are expired, just because you made a phone call. Insurers often set rules that are not fair. Fight them.

3. Complain to state regulators who oversee insurance companies and medical providers. It creates a paper trail and might increase your leverage to get things worked out in a way that’s fair.

4. Consider hiring a patient advocate if your case is complicated or you hit a roadblock. They charge an hourly rate but could save you a lot of money. The AdvoConnection website has a directory to find one near you.