House Bill 3987 was filed this session to create a committee to review health benefits from TRS, but the bill did not move past the House Pensions, Investments & Services Committee.

Health insurance premiums burden Montgomery ISD teachers, employees

By Jules Rogers and Danica Smithwick | 6:51 pm June 20, 2019 CDT

Local school teachers have said health insurance premiums are too high—and going up.

Montgomery ISD employees are insured through Teacher Retirement System of Texas ActiveCare health insurance, established by the Texas Legislature in 2001 to offer affordable health insurance to small districts that had few options. Districts with fewer than 500 employees were required to participate, but not larger districts. Conroe ISD and Willis ISD are not insured through TRS.

MISD Benefits Specialist Teresa Tipton said in 2009, the district put together a benefits committee of 30 members representing each campus and department.

“The self-insured plan was in trouble as far as financially,” Tipton said. “At that time TRS was the most affordable way to go in regards to premiums and insurance plans themselves—it took the district out of managing health insurance.”

But Tipton said over the past five years, TRS plans have changed.

“When we first jumped on board … we had three or four options. Premiums were very low, and even the high deductible was reasonable,” Tipton said. “We’re down this current year to only two options to choose from.”

She said MISD employees can choose a high-deductible plan with a $2,700 deductible for the employee only, in which everything including prescriptions is paid up front until the deductible is met. However, adding a dependent causes the deductible to jump to $5,500 and could see additional premiums attached to plans.

She said MISD employees can choose a high-deductible plan with a $2,700 deductible for the employee only, in which everything including prescriptions is paid up front until the deductible is met. However, adding a dependent causes the deductible to jump to $5,500 and could see additional premiums attached to plans.

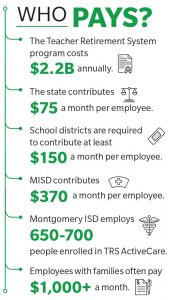

Tipton said the district contributes $370 a month per employee enrolled in TRS, and MISD employs 650-700.

“Most [districts]do the state minimum, which is $225 a month—ours has been $370 for as long as I’ve been here,” Tipton said.

She said if employees are covering families, costs are astronomical even with board contributions—amplified for lower-paid employees such as bus drivers, paramedics and aides.

“On the high-deductible plan, if an employee is trying to cover a family, the premium is over $1,000 a month—not just educators,” Tipton said.

State efforts

Katrina Daniel, TRS chief health care officer, said while the state has not increased its annual contribution, TRS has worked to create systems that keep patients healthy and costs manageable. Daniel said between benefits and administration, the state covers about $285 million of the program’s annual $2.2 billion cost. While the state provides a $75 monthly insurance allotment per educator, districts are required to spend at least $150 per educator to cover health insurance.

Katrina Daniel, TRS chief health care officer, said while the state has not increased its annual contribution, TRS has worked to create systems that keep patients healthy and costs manageable. Daniel said between benefits and administration, the state covers about $285 million of the program’s annual $2.2 billion cost. While the state provides a $75 monthly insurance allotment per educator, districts are required to spend at least $150 per educator to cover health insurance.

House Bill 3987 was filed this session to create a committee to review health benefits from TRS, but the bill did not move past the House Pensions, Investments & Services Committee.

According to state law, once a district enrolls in TRS ActiveCare for health care coverage, it cannot opt out.

“So regardless of how the plans or premiums change, a participating district is not allowed to seek other options for their employees regarding health care coverage,” Tipton said. “They are stuck.”

Facebook Twitter EmailSHARE THIS STORY

Originally from the Pacific Northwest, Jules Rogers has been covering community journalism and urban trade news since 2014. She moved to Houston in June 2018 to become an editor with Community Impact Newspaper after four years of reporting for various newspapers affiliated with the Portland Tribune in Oregon, including two years at the Portland Business Tribune. Before that, Jules spent time reporting for the Grants Pass Daily Courier in Southern Oregon. Her favorite beats to cover are business, economic development and urban planning.