Here’s proof miracles do happen within the deep recesses of the underwriting world…….

Posted December 4, 2021

Denton ISD has received an offer they can’t refuse: Competitive health insurance rates with better benefits guaranteed 9 months in advance of the effective date, all made possible by way of limited TRS ActiveCare claim data.

See “Guaranteed Rates” starting slide 12 for Plan Year 2022-2023: Denton ISD Group Health Review and Solution

How is it possible to guarantee rates 9 months in advance of a 9/1/2022 effective date (with rates guaranteed through August 31, 2023) based on limited TRS ActiveCare claim information?

How is it possible to guarantee rates 9 months in advance of a 9/1/2022 effective date (with rates guaranteed through August 31, 2023) based on limited TRS ActiveCare claim information?

Who holds the pen? Marketing or underwriting?

Marketing’s philosophy is “We will only be as successful as our underwriter wants us to be.”

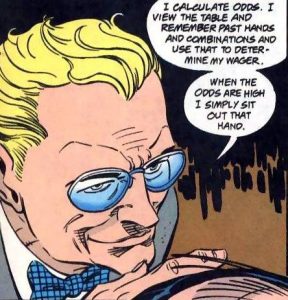

Traditional underwriting philosophy is “Success is determined by underwriting results, not sales results.”

The struggle between sales and underwriting is constant with upper management acting as the ultimate tie breaker.

Who shares the risk? Whoever they are they have a lot of capacity and willing to use it.

Is there a “Secret Sauce” we’ve missed in our +45 years of experience rating group health insurance plans? If so it’s got to be one of the best kept secrets known to mankind, rivaling the ever so elusive Coca Cola recipe and Col. Sanders famous blend of special spices.

A plausible and partial explanation involves Aggregate Only coverage and quota sharing of risk among several carriers. Aggregate only coverage eats up claim funds faster than a melting raspa in deep South Texas on a hot August day leaving the plan sponsor with less opportunity to realize savings in a good claim year that they would have otherwise had under a tradition self-funded arrangement with appropriate specific coverage. In return for potentially higher profits tied to turbocharged fixed costs the carrier is willing to assume more risk because the rewards can be far greater. However the potential for losses can be huge too.

A plausible and partial explanation involves Aggregate Only coverage and quota sharing of risk among several carriers. Aggregate only coverage eats up claim funds faster than a melting raspa in deep South Texas on a hot August day leaving the plan sponsor with less opportunity to realize savings in a good claim year that they would have otherwise had under a tradition self-funded arrangement with appropriate specific coverage. In return for potentially higher profits tied to turbocharged fixed costs the carrier is willing to assume more risk because the rewards can be far greater. However the potential for losses can be huge too.

The House almost always wins but there are notable examples when an underwriter’s miscalculations produce unexpected and heavy losses. El Paso ISD’s $18,000,000 Health Plan Deficit is a good example of underwriting gone wrong.

The vetting process must have been thorough, one would hope, because “A Too Good to be True” offer deserves one.

Denton ISD is in a good position. They have a guaranteed offer for next September 2022 to fall back on if a subsequent competitive bidding process fails to produce better rates and benefits.

This will be a case worth watching.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.