If 400 low cost generic drugs can satisfy +90% of one’s pharmaceutical needs, how important is it to cover the remaining <10% of pharmacy needs which drive up overall Rx spend by +80% or more?

A PBM is offering a generic only program covering +400 generic drugs for a capitated rate of less than $7 per employee per month. No co-pays, 100% free drugs, overnight home delivery for maintenance medications and brick & mortar pickup for acute medicines.

Walmart and HEB have hundreds of $4 and $5 generic drugs. Plan sponsors can eliminate their PBM and simply direct plan members to Walmart or HEB for their prescription drug needs, saving hundreds of thousands of dollars to their profit and loss ledgers.

A Direct Primary Care provider offers hundreds of free prescription drugs to members sourced from a distributor whose cost per pill averages 1 cent per day. The plan’s savings on drugs alone can pay for the DPC capitation rate.

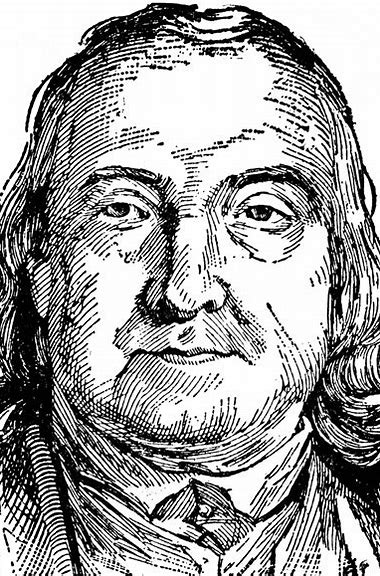

The philosophy behind employing these strategies is based on utilitarianism, the moral system founded by English philosopher Jeremy Bentham (1748–1832) and encapsulated in the principle of “the greatest good for the greatest number.”

The problem with applying this philosophy to modern day health insurance schemes is the problem of attracting and retaining quality employees. If the employer down the street offers broader coverage, and the pay scale is equal, guess where the talent goes.

Since employees pay the entire cost of their health insurance through lower wages, plus pay deductibles, copays and coinsurance when they use it, what would you think the collective mindset would be if plan members knew the monetary effect to their take home pay if Jeremy Bentham was magically reincarnated as the company’s CFO?

We hazard to wonder if Jeremy would embrace proven cost reducing risk management strategies while improving benefits at the same time for +90% of plan participants, gifting the savings to 100% of the employees in the form of more take home pay. Would Jeremy care about the few leaving for employment elsewhere? Would he have empathy for his competitor down the road for picking up a $500,000 liability on $45,000 a year employee?

FROM INSURANCE CONSULTANT

This is excellent. Our goal and purpose should be “retention of healthy employees”. What savvy employer would not go for that? A plan designed to give the best benefit and attract healthy ees. 100% primary care, 100% of concierge coordinated care? No copay on commonly used drugs/no coverage for specialty drugs.