SOURCE: Darren Fogarty – Associate Director, Purchaser Value at PBGH

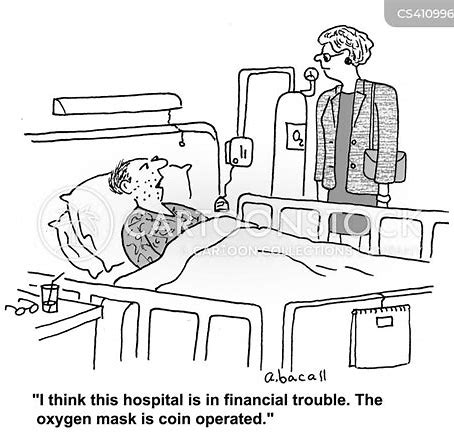

5 days ago, the Texas Hospital Association issued a “fact” sheet that lies by omission in citing $3.2 billion in losses for Texas hospitals with nary a mention of where those losses came from.

Health systems are reporting financial strain, even as the worst of the pandemic has passed. This financial strain is driven primarily by investment losses. Stock markets struggled in 2022, with the S&P 500 declining in value by approximately 20 percent. Hospital systems that invest heavily in stock markets, like many large nonprofit organizations, may be particularly exposed to these financial headwinds. Hospital systems that also invest in private equity funds, such as Ascension, are also subject to the financial risks of their specific funds.

If losses were driven by persistent labor and supply cost increases, then it might be reasonable to ask patients, employers, and insurers to consider these underlying cost drivers in their payments to hospitals. However, when losses are driven by risky financial investments, which generated positive returns in many previous years and will do so in many future periods, it is not clear whether patients, employers, insurers, and taxpayers should be responsible for paying higher prices to offset the impact of overall market declines.

FROM GEORGIA HEALTH CARE ADVISOR

They should disclose how much money each hospital received from the government over the covid years. Small hospitals in Georgia sometimes got 52 weeks of their average revenues from the government. They were swimming in money. As you know, hospitals operate off of multiple sets of books and won’t disclose their foundation revenues. Lying bastards just like the representatives in Austin and in DC who take their donations.