“In our industry we rely on the past to have a glimpse of the future………..”

16th December 2022 – Author: Kane Wells

SOURCE: In our industry we rely on the past to have a glimpse of the future: Mican, PCS – Reinsurance News

In an interview with Reinsurance News, Alex Mican, Director, Specialty Lines Product Development, PCS, Verisk Claims, suggested that given the events of the past year, having access to additional loss data sources will be vital to a successful January 1st renewal.

Discussing what challenges specialty lines underwriters have faced this year, Mican stated that there are always questions about what shows up in submissions, making independent benchmark data crucial to pricing and underwriting.

“It’s always data, data, data,” he said. “And given the events of the past year, including the conflict in Ukraine and slow flow of loss data, having access to additional data sources should be critical to a successful 1/1 renewal.

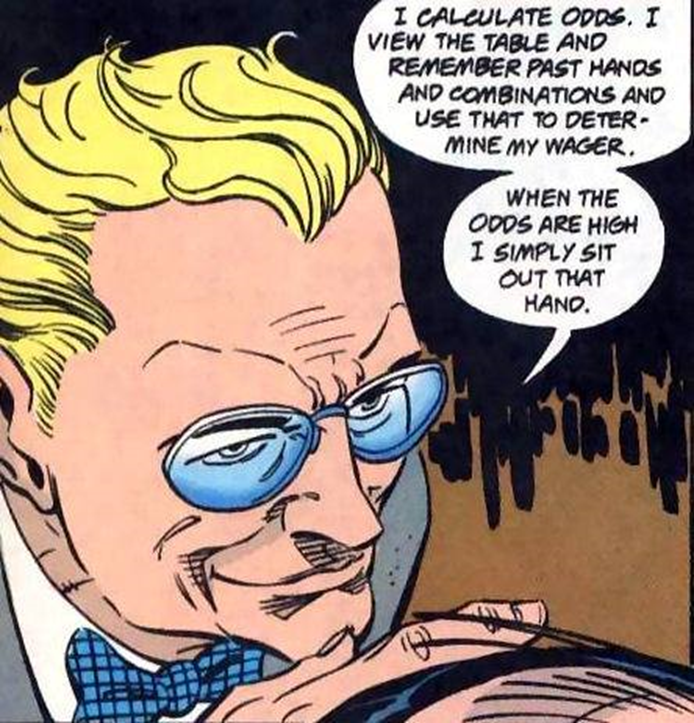

“That said, data requires context, and that means underwriters will need to truly understand the current environment – causes of volatility, factors contributing to losses, and broader trends. They need to constantly ask themselves, ‘What’s coming next? Why?’

“In our industry, we rely on the past to have a glimpse understanding of the future, however, this year has been made particularly challenging given that you’ve got to deal with a conflict that called into question a wide range of assumptions.”

Mican noted that the notion of a post-pandemic recovery came to a close when the aviation losses in Russia began to mount almost a year ago. Furthermore, he suggested there are multiple similar examples coming out of the cyber and marine lines as well.

Underwriters have had to adapt to all the challenges this year has thrown at them – recalibrate their assumptions, absorb knowledge, and make good use of the historical data already available in the industry, Mican added.

Meanwhile, PCS is also working on helping the industry understand the environment by bringing context through various webinars about how the situation in Ukraine is affecting the market, which highlights just how hungry the market is for useful and actionable perspective, explained Mican.

Commenting on the impact of the war in Ukraine on specialty writers specifically, Mican told Reinsurance News that losses have started trickling in.

“It’s slow going, particularly given that access to loss sites is difficult given the ongoing conflict. The most relatable precedent is the PCS Global Terror event we designated in southeastern Turkey in 2016. It took six months for adjusters to get access to damage sites, and even then, it was only for an hour or two a day at first. Our market sources, though, have confirmed several limits losses and more accounts being monitored.

“Even if the conflict were to end tomorrow (and that seems unlikely), it will still take a significant amount of time to get boots on the ground and to get further clarity. While some aspects of the loss event may take years to resolve – as they would with any cat – some losses could become evident more quickly.”

When asked whether the firm is seeing more interest from reinsurers and retro providers in the specialty lines business given the current property catastrophe business, he said, “The challenging loss environment right now has made reinsurers look beyond property cat.

“A lack of capacity driven by such factors as the pandemic, supply chain issues, social inflation, and geopolitical instability have made ILWs an important form of capital for accessing and growing the specialty market. Discussions around composite ILW structures have circulated the market in recent weeks to include what we’ve begun to call the “MEAT” structure (marine, energy, aviation, and terror).”

As for the outlook for 2023 for the specialty lines space, Mican suggested that the situation continues to change rapidly, driven largely by the conflict in Ukraine and aviation losses in Russia.

He added that demand for risk transfer capacity across the MEAT pillars has certainly risen, and capital constraints are likely to be evident throughout 2023.

Further, Mican anticipates specialty ILWs should become crucial to risk and capital management, although buyers will need to understand the product better.

He concluded, “Hesitation by those new to specialty ILWs may cost them access to much-needed protection. We saw this almost a year ago, and the situation should become only more acute after 1/1. Also, look for the risk of further capital constraint from Hurricane Ian and other cat losses from 2022 and before.”