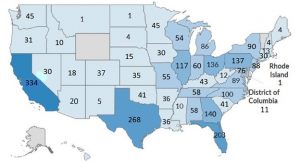

Davita Locations

Certain payors have been attempting to design and implement plans by limiting the number of in-network providers, setting arbitrary provider reimbursement rates,……….

This blog entry is a follow-up to yesterday’s story posted here about the Supreme Court decision adverse to Davita’s business foundation. A read of Davita.s 2021 10-K report provides corporate insights which should be of interest to plan sponsors.

Below are some interesting excerpts:

Certain payors have been attempting to design and implement plans that restrict access to ESRD coverage both in the commercial and individual market. Among other things, these restrictive plan designs seek to limit the duration and/or the breadth of ESRD benefits, limit the number of in-network providers, set arbitrary provider reimbursement rates, or otherwise restrict access to care, all of which may result in a decrease in the number of patients covered by commercial insurance. Payors have also disputed the scope and duration of ESRD benefit coverage under their plans, and, among other things, have required patients to seek Medicare coverage for ESRD treatments. The U.S. Supreme Court has accepted review of a case evaluating the scope and impact of the Medicare as Secondary Payor Act (MSPA).

Other interesting excerpts:

“The concentration of profits generated by higher-paying commercial payor plans for which there is continued downward pressure on average realized payment rates, and a reduction in the number or percentage of our patients under such plans, including, without limitation, as a result of restrictive plan designs, restrictions or prohibitions on the use and/or availability of charitable premium assistance, which may result in the loss of revenues or patients, or our making incorrect assumptions about how our patients will respond to any change in financial assistance from charitable organizations….”

- Medicare becomes the primary payor for ESRD patients receiving dialysis services either immediately or after a three-month waiting period. For a patient covered by a commercial insurance plan, Medicare generally becomes the primary payor after 33 months, which includes the three-month waiting period, or earlier if the patient’s commercial insurance plan coverage terminates. When Medicare becomes the primary payor, the payment rates we receive for that patient shift from the commercial insurance plan rates to Medicare payment rates, which are on average significantly lower than commercial insurance rates.

- Medicare pays 80% of the amount set by the Medicare system for each covered dialysis treatment. The patient is responsible for the remaining 20%. In most cases, a secondary payor, such as Medicare supplemental insurance, a state Medicaid program or a commercial health plan, covers all or part of these balances. Some patients who do not qualify for Medicaid, but otherwise cannot afford secondary insurance in the form of a Medicare Supplement Plan, can apply for premium payment assistance from charitable organizations to obtain secondary coverage. If a patient does not have secondary insurance coverage, we are generally unsuccessful in our efforts to collect from the patient the remaining 20% portion of the ESRD composite rate that Medicare does not pay. However, we are able to recover some portion of this unpaid patient balance from Medicare through an established cost reporting process by identifying these Medicare bad debts on each center’s Medicare cost report.

- Our commercial contracts typically contain annual price escalator provisions.

- Approximately 25% of our U.S. dialysis patient services revenues and approximately 10% of our U.S. dialysis patients are associated with non-hospital commercial payors for the year ended December 31, 2021. Non-hospital commercial patients as a percentage of our total U.S. dialysis patients for 2021 were relatively flat compared to 2020. Less than 1% of our U.S. dialysis revenues are due directly from patients. No single commercial payor accounted for more than 10% of total U.S. dialysis revenues for the year ended December 31, 2021.

- We have over 1,000 individual physicians and physician groups under contract to provide medical director services. Medical directors for our dialysis centers enter into written contracts with us that specify their duties and fix their compensation generally for periods of ten years. Our medical director contracts and joint venture operating agreements generally include covenants not to compete or own interests in dialysis centers operated by other providers within a defined geographic area for various time periods, as applicable. These non-compete agreements do not restrict or limit the physicians from practicing medicine or prohibit the physicians from referring patients to any outpatient dialysis center, including dialysis centers operated by other providers.

- CMS released regulations associated with “surprise billing” which necessitate, among other requirements, that certain providers provide patients with information regarding patient financial accountability and costs of services in advance of care being provided. While the ultimate impact of these regulations remains uncertain, any changes by group health plans, health insurance issuers in the group and individual markets, or consumer choices resulting from these regulations could have a material adverse impact on our business, financial condition and results of operations, and could materially harm our reputation.

- Insurance – We are predominantly self-insured with respect to professional and general liability and workers’ compensation risks through wholly-owned captive insurance companies. We are also predominantly self-insured with respect to employee medical and other health benefits. We also maintain insurance, excess coverage, or reinsurance for property and general liability, professional liability, directors’ and officers’ liability, workers’ compensation, cybersecurity and other coverage in amounts and on terms deemed appropriate by management, based on our actual claims experience and expectations for future claims.. Physicians practicing at our dialysis centers are required to maintain their own malpractice insurance, and our medical directors are required to maintain coverage for their individual private medical practices. Our liability policies cover our medical directors for the performance of their duties as medical directors at our outpatient dialysis centers.

- A substantial portion of our U.S. dialysis net patient services revenues for the year ended December 31, 2021 was generated from patients who have commercial payors (including hospital dialysis services) as their primary payor. The majority of these patients have insurance policies that pay us on terms and at rates that are generally significantly higher than Medicare rates……… The payments we receive from commercial payors generate nearly all of our profit and all of our nonacute dialysis profits come from commercial payors.

- When Medicare becomes the primary payor for a patient, the payment rate we receive for that patient decreases from the employer group health plan or commercial plan rate to the lower Medicare payment rate. If the number of our patients who have Medicare or another government-based program as their primary payor increases, it could negatively impact the percentage of our patients covered under commercial insurance plans.

- Our arrangements and negotiations with payors also impact the number or percentage of patients with higher-paying commercial insurance. We continuously are in the process of negotiating existing and potential new agreements with commercial payors who aggressively negotiate terms with us, and we can make no assurances about the ultimate results of these negotiations or the timing of any potential rate changes resulting from these negotiations. Sometimes many significant agreements are being renegotiated at the same time. A material portion of our commercial revenue is concentrated with a limited number of commercial payors, and any changes impacting our highest paying commercial payors or our relationships with these payors will have a disproportionate impact on us.

- We believe payor consolidations have significantly increased the negotiating leverage of commercial payors, and ongoing consolidations may continue to increase this leverage in the future. We continue to experience downward pressure on some of our commercial payment rates as a result of these and other general conditions in the market, including, among other things, as employers shift to less expensive options for medical services, as commercial payors dedicate increased focus on dialysis services.

- In addition, some commercial payors are pursuing or have incorporated policies into their provider manuals limiting or refusing to accept charitable premium assistance from non-profit organization