This is one of Aldeen’s best Sunday Morning Bathroom Reads. We suggest it should be extended as a Monday through Saturday Bathroom Read for his irregular readers.

Aldeen’s Sunday Morning Bathroom Read (“If you RBP, you gotta check the FAP” Part I of II Edition)

By Doug Aldeen

A new lawsuit claims that Sky Lakes Medical Center is flouting requirements that it ensure its poor patients can access free care. Instead, the suit states, the Klamath Falls hospital is using a debt collector to potentially hound thousands of low-income people for payments. The lawsuit seeks $1 million each in punitive payments from Sky Lakes and Carter-Jones, the debt collection agency it contracted with, “to deter additional wrongdoing.” Additionally, it seeks damages on behalf of thousands of patients to be proven at trial or $200 for each violation of Oregon Unlawful Trade Practices Act, whichever is greater.

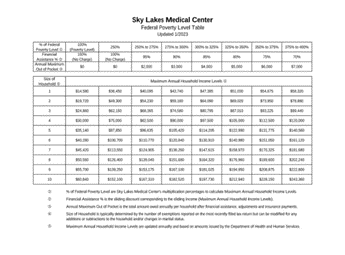

More importantly, the Sky Lakes financial assistance program ( attached) provides that at income levels between 375% and 400% of the FPL for a family of four ( $112,500 -$120,000/AGI) has a maximum out of pocket exposure of $7000.00 at participating facility’s. That represents about 85% of the US population at 400% of the FPL and probably more in this geographic location of Oregon. Any balance bill that is member responsibility is subject to the applicable ( either in whole or in part) facility financial assistance program based upon their respective local income demographic.

Key Facts to Consider:

85% of the population of the US earns income at or below 400% of the FPL. In this part of Oregon, it is probably much higher;

The trifecta of plan sponsor data includes: medical, Rx AND employee financial data such as tax returns, wages etc, which must be verified at the time of enrollment. ERISA plan assets need to be prudently managed. In other words, is there an ability to fully or even partially transfer risk back to the facility OR contract directly with the facility at its AGB percentage or otherwise the facility will be fully at risk for 85% of the group in perpetuity for all medically necessary and emergency services.

Plan Design Strategy #1:

(ICHRA + 501r for those whose income(AGI) is <400% of the FPL and RBR for those whose income (AGI) is >401% of the FPL and/or MEC +DPC+501r (<400% of the FPL) +RBR(>401% of FPL);

Plan Design Strategy #2: A direct contract between the plan sponsor and facility at its AGB percentage. I have actually done this in Orange County, CA with Providence St. Joseph at a very favorable Medicare rate. It took a year and over 300 plan participants were getting shelled. But we got it done.

Net result: A community owned health plan by fiat aptly titled “For the People, By the People and AI Free Health Plan” with an annual budget consistent with the community supported tax exemptions.

Most Important Man in the Room: Jerome Powell, the Fed Chairman? Nope. It is the newly designated “FPL Czar” who has the ability to directly impact financially 85% of the US population at 400% of the FPL.