As a benefits consultant actuary services are core to your business proposition value……..

An actuarial study should include:

- Mid-year renewal projections

- Plan design analysis

- Stop-loss analysis

Independent actuary services are a critical element forming the foundation upon which comprehensive risk management services are based. Without an actuarial analysis a plan sponsor cannot be certain recommended risk management strategies will produce anticipated results.

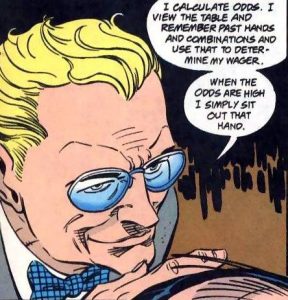

“Actuarial attention is directed to the following areas: (1) The benefit structure should be sound, (2) The contributions levels should be reasonable and adequate, (3) Adequate reserves should be calculated and maintained, (4) The level of self-funding should be reasonable when tested against risk theory. The role of the actuary is not promotional nor adversarial. Rather, the actuary is a presenter of facts. The facts are that self-funding financial outcomes will vary from year to year due to (1) Judgement errors, (2) secular trends, and (3) Random statistical fluctuations.” – Carlton Harker, Society of Actuaries

Mid-year renewal projections are often accurate to within 2-4% allowing plan sponsors plenty of advance notice of what to expect instead of last minute renewal news leaving little time to seek alternatives.

Plan sponsors should periodically engage an independent expert to perform an actuary analysis with financial projections. The cost is less than a cure for an unexpected renewal headache.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.