Ever wonder the purpose of the Cadillac tax? In a portion of this 4 minute video Gruber explains that the tax , affecting only 8% of health plans in today’s market, will eventually affect 100% of all health plans, thus bringing an end to employer sponsored health insurance.

Month: November 2014

Will Wellness Programs Be Declared Illegal?

COUCH POTATOS CLAIM DISCRIMINATION ?

“They (employers) don’t understand why a plan in compliance with the ACA (Affordable Care Act) is the target of a lawsuit”

Continue reading Will Wellness Programs Be Declared Illegal?

Medical Executive Post Publishes RiskManagers.us White Paper

The PPACA [Game Changer for Health Care Financing]

The fuel which fires the self-funded engine of employee health and welfare plans

[By William Rusteberg]

A SPECIAL ME-P REPORT

Introduction

The Affordable Care Act (ACA) has had a fundamental impact on health care financing in this country. It has effectively provided added incentives for plan sponsors to consider modified self-funding arrangements for their employee health and welfare plans in lieu of fully-insured plans. The advantages of doing so are clear.

Continue reading Medical Executive Post Publishes RiskManagers.us White Paper

More States To Offer Work Comp “Opt-Out”?

Summary:

A national coalition has formed to take the benefits achieved in Texas and anticipated in Oklahoma and spread them to other states.

As we are all too familiar, the handling of workers’ compensation is dictated by statutes in all states. Only Texas and Oklahoma offer the freedom to “opt out” of the statute, and their approaches are quite different.

J Patrick Rooney (1927 – 2008)

AMPS CEO Mike Dendy Awarded 2014 Professional Achievement Award by Georgia State University Institute of Health Administration

ATLANTA, Nov 13, 2014 (BUSINESS WIRE) — Advanced Medical Pricing Solutions (“AMPS”), a healthcare cost management company serving the self-funded (ERISA) payer community, today announced that its CEO and president Mike Dendy received the 2014 Professional Achievement Award from the Georgia State University Institute of Health Administration (IHA).

Happy Thanksgiving From The Obama Administration

“In keeping with their grand tradition of issuing major regulations late on a Friday afternoon and right before a national holiday with comments due smack in the middle of both Advent and Hanukkah…………”

“The rule also proposes requiring that all marketplaces, QHP issuers and web-based health insurance brokers provide telephonic interpreter services in at least 150 languages in addition to the existing requirement of providing language services…”

Editor’s Note: www.150languages.com is going to thrive under ObamaCare

Continue reading Happy Thanksgiving From The Obama Administration

Health Care A $30 Billion Industry in San Antonio

The Alamo, San Antonio, Texas

“More than one in six San Antonio workers are employed by the industry.”

Continue reading Health Care A $30 Billion Industry in San Antonio

Corpus Christi ISD Seeks Insurance Consultant

Men’s Health Month – Award Winning Video

![Sponsored by IPMG [Insurance Program Managers Group]](http://benefitslink.com/bnrs/2014/IPMG_services_top.jpg)

Explore the advantages of a Self-Funded Health Plan! By bringing together cutting edge cost containment strategies, excellent service and outstanding resources, IPMG’s EBS division can help you make a difference for your plan.

http://www.ipmg.com/overview-of-services/employee-benefits-services.aspx

The Phia Group – Reference Based Pricing Webinar

“Assessing the steps we need to take to continue down the path of Reference Based Pricing………..”

Continue reading The Phia Group – Reference Based Pricing Webinar

A Brief History of Managed Care

Clear Health Costs / Knight Foundation Project A Success

![]() Exciting news: Our Knight Foundation prototype project has been a smashing success.We’re thrilled to report our successful project with KQED Public Radio in San Francisco and KPCC in Los Angeles……….

Exciting news: Our Knight Foundation prototype project has been a smashing success.We’re thrilled to report our successful project with KQED Public Radio in San Francisco and KPCC in Los Angeles……….

Continue reading Clear Health Costs / Knight Foundation Project A Success

More Skirmishes From The Provider Network War

State regulators are working on model law revisions that could have a big effect on which doctors, hospitals and other providers are in your health insurance customers’ provider networks.

Continue reading More Skirmishes From The Provider Network War

|

|

|

Do you know an insurance agent in need of cash, whether it be for the holidays, upcoming taxes, or preparing for the New Year? Refer them to us and earn a percentage of their final purchase price, with no limit to how much you can earn! At Access Capital Group, we help agents find the capital they need to take care of life’s unexpected expenses. By providing a free, no obligation valuation of an agent’s block of renewal commissions, we can determine a present-day value and purchase price. If we buy their block of business, we’ll give you a cut of that purchase price for sending them to us. Spread the word about Access Capital Group and earn! It’s the easiest money you’ll make all day. Send us an email or call us at (888) 816-1365 to learn more |

What Could Be The Republican Alternative To ObamaCare?

By Bill Rusteberg

With the mid-term elections of 2014 there will be new impetus towards improving ObamaCare by the new Republican majority in Congress.

ObamaCare is simply not working well.

What are the alternatives? These may be the Republican’s answer to fixing ObamaCare:

1. Maintain some provisions such as prohibition of pre-existing condition clauses, guaranteed renewability, portability.

2. Removal of coercive aspects of ObamaCare, i.e. the employer and individual mandate

3. Creation of a national re-insurance pool (Medicare?) for catastrophic claims to protect carriers and self-funded groups

4. Allow insurers to structure benefits at will thus removing the “one shoe fits all” approach under ObamaCare

5. Provide tax credits to the “poor.”

FOR THE DEMOCRATS : Items 1, 3 and 5 should appeal to Democrats. Number One maintains certain ObamaCare mandates, Number two allows for an expansion of Medicare and Number 3 continues the expansion of the American welfare state.

FOR THE REPUBLICANS : Items 2 and 4 appeals to the Republican’s innate repulsion of big government. Items 1, 3 and 5 appeal to their desire to be re-elected.

University Places Drug Vending Machine on Campus

Phoenix, Ariz. (CBS LAS VEGAS) – An InstyMeds vending machine has been installed on Arizona State University’s campus, allowing any student or university employee to pick up prescription drugs from the dispenser.

Phoenix, Ariz. (CBS LAS VEGAS) – An InstyMeds vending machine has been installed on Arizona State University’s campus, allowing any student or university employee to pick up prescription drugs from the dispenser.

Continue reading University Places Drug Vending Machine on Campus

Stupid Americans & The Passage of ObamaCare

https://www.youtube.com/watch?v=iHihDa_VPWw

(Start at 21:00 and listen to the next 25 seconds of Gruber’s strategy for passage of ObamaCare)

United HealthCare San Antonio Blitzkreig Continues

United HealthCare (UHC) has replaced Humana Insurance Company at two large San Antonio school districts recently. Two weeks ago Harlandale ISD voted to change from Humana to UHC. Now the San Antonio Independent School District succumbs to aggressive UHC sales warriors.

Continue reading United HealthCare San Antonio Blitzkreig Continues

Be Prepared For A DOL Audit Because It’s Coming

Texas’ Commercial Health Insurance Market Growing Less Competitive

Texas’ commercial health insurance market is growing less competitive, a new study shows.

Blue Cross Blue Shield of Texas is the dominant player in 25 of 26 Texas metropolitan areas, said a report issued Thursday by the doctors’ group the American Medical Association.

Continue reading Texas’ Commercial Health Insurance Market Growing Less Competitive

Why Do Drugs Cost So Much?

“So this person, my patient, with a raging headache, left her pharmacy empty handed because she was unable to afford a medication which had been marked up over $500 above cost, a medication which has been available as a generic for over half a decade.”

Will Government Make Us Buy Broccoli Next?

WASHINGTON (CBSDC/AP) — Americans will see their bank accounts shrink if they don’t sign up![]() for Obamacare in its second enrollment season.

for Obamacare in its second enrollment season.

Uninsured Americans who decide not to enroll will face a penalty of $325 per person, more than tripling the $95 penalty those who did not enroll had to pay the first time around.

Children under the age of 18 will be fined $162.50. The maximum amount an uninsured family![]() will be penalized is $975 under the flat-rate method.

will be penalized is $975 under the flat-rate method.

Texas Company Offers Community Rated Health Plan?

By Molly Mulebriar

A Texas company is marketing a group medical plan that has some employers excited. Employers can enroll their employees in a Base Plan for $482.71 per month or a Buy Up Plan for $598.18 per month. See here: Benefits & Rates

A visit to their website (www.cpr-aso.com ) provides details of the offering.

The medical plan is represented to be insured by Aetna. However, an Aetna representative we know is puzzled.

An employer and their insurance agent should always be cautious when selecting an insurance provider. A quick check with the Texas Department of Insurance would be a good start. Additional resources include the North Carolina Department of Insurance. (NC Comm. Order).

An interesting read can be found here: ASOexperience . We have no idea who wrote this, nor can we say for certain this article has any connection here. We leave it up to the reader to decide.

Veterans Day 2014

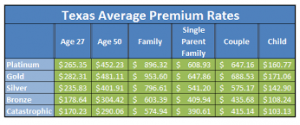

Texas Exchange Plan Comparison Calculator

Otra Vez! Supreme Court Takes Up ObamaCare Case

John Roberts – An opportunity for redemption ?

“Supporters of the health care law were flabbergasted and accused the court of veering into politics…….The legal challenge to the subsidies is “the most serious existential threat” facing the Affordable Care Act…….”

Continue reading Otra Vez! Supreme Court Takes Up ObamaCare Case

Government Closing Loopholes

If you read this blog, you will notice on this page alone there are three entries relating to government’s focus towards various loopholes and blivets within the ACA.

Government momentum to secure the handcuffs is accelerating.

Insurance brokers and consultants are worried. For some, the thrust since passage of ACA was to prove value to clients by finding ways to skirt onerous mandates and punishing government sanctions.

Others have simply become government organs spitting out continuous updates of the do’s and don’ts. They are called “compliance officers.”

And then there are the others, and a growing number of them, who have retired or quit the business, or are seeking their fortune through other means such as voluntary employee benefits.

The shackles of government mandates continue to tighten. Escape seems uncertain, except for those who seek freedom by leaving the plantation.

Is Exchange Dumping Illegal?

By Molly Mulebriar

In a Memorandum issued 6 November 2014 the Department of Labor’s Benefit Security Administration issued their opinion that I believe effectively prevents an employer from Exchange Dumping.

Aetna Buys Bswift: Why Benefits Brokers Must Pay Attention

”In a not-so-obvious way the health care world is changing in a way that most brokers are not recognizing. Consumer-centric; mobile; doctors as wellness facilitators; employers out of the risk business? Maybe. So get ready.

Continue reading Aetna Buys Bswift: Why Benefits Brokers Must Pay Attention

Government Slams Door On Loophole

SPBA Email Alert – November 4, 2014

Agencies Release a Notice on Group Health Plans that Fail to Cover In-Patient Hospitalization Services

In IRS Notice 2014-69, the agencies state that plans that fail to provide substantial coverage for in-patient hospitalization services or for physician services (or for both) do not provide the minimum value intended by the minimum value requirement and will shortly propose regulations to this effect.

According to IRS Notice 2014-69, employers should consider the consequences of the inability to rely solely on the MV Calculator (or any actuarial certification or valuation) to demonstrate that a Non-Hospital/Non-Physician Services Plan provides minimum value for any portion of any taxable year ending on or after January 1, 2015, that follows finalization of such regulations.

The link to the guidance is below. SPBA is reviewing this guidance and will reach out to agency officials for clarification as needed.

http://www.irs.gov/pub/irs-drop/n-14-69.pdf

Aetna’s Medsure Program – A Best Seller For 2015?

Aetna’s Medsure Plan offers employers a Bronze Plan of benefits requiring only 10% employee participation. This plan satisfies both the employer and individual mandate. Costs are age bracketed. Available for groups of 300+ employee lives.

Aetna’s Medsure Plan offers employers a Bronze Plan of benefits requiring only 10% employee participation. This plan satisfies both the employer and individual mandate. Costs are age bracketed. Available for groups of 300+ employee lives.

Aetna will sell a lot of this, especially virgin groups. With 2015 just around the corner, Aetna reps. will be very busy during the next 45 days.

PPACA Enrollment Expected To Surge

Houston based Community Health Choice expects 15,000 – 40,000 new individual health insurance enrollments during the upcoming PPACA Open Enrollment period. This is up from 500 last year. https://www.chchealth.org/

Fully Insured Rates Skyrocketing – How To Mitigate Increases

Continue reading Fully Insured Rates Skyrocketing – How To Mitigate Increases

The shared vision of RiskManagers.us and clients who retain our services is to establish and maintain a comprehensive employee health and welfare plan, identify cost areas that may be improved without cost shifting to any significant degree, and ensure a superior and sustained partnership with a claim administrator responsive to members needs on a level consistent with prudent business practices.

Plan costs, in all areas including fixed expenses and claims are open for review on a continuing basis. Cost effective plan administration and equitable benefit payment to providers are paramount to fulfilling our mutual fiduciary duties. As we proactively monitor and manage an entire benefit program we are open to any suggestions members may make or the dynamic health benefit market may warrant in order to accomplish these goals.

Duty of loyalty to our clients, transparency and accountability are essential to the foundation of our services. To that end, we expect our clients to realize a substantial savings based upon the services that we will deliver.

2014 RiskManagers.us All Rights Reserved