Cost Plus Insurance, Reference Based Pricing plans should take note of recent federal edicts that may affect the core nature of these plans: RBP Under Seige

Month: October 2014

The Incredible & Mysterious Tale Of Death-Cheating Mike Malloy

A GRIM TALE OF LIFE INSURANCE FRAUD

Back in the 1930s, the legend of “Mike the Durable” or “Iron Mike” Malloy was born. A former firefighter, Mike Malloy was a homeless drunk man who lived in New York City. Malloy had a favorite watering hole, Marino’s, a speakeasy bar owned by Tony Marino.

Continue reading The Incredible & Mysterious Tale Of Death-Cheating Mike Malloy

The Evolution of Cost Plus Insurance

National Health Care Scheme Defrauds 17,000 Victims

The defendants collectively operated as an unlicensed, unregulated and fraudulent insurance company collecting more than $28 million in premiums for health care coverage then denied or unjustly turned down legitimate claims submitted pursuant to the health care plans.

Continue reading National Health Care Scheme Defrauds 17,000 Victims

Exchange Dumping

Over 214,000 Doctors Refuse ObamaCare

Reimbursements under Obamacare are at bottom-dollar – they are even lower than Medicare reimbursements

Providers Devise New Fees To Levy Against Patients

Challenged by insurers ratcheting down their payments, hospitals and medical groups are creating more fees and charges for patients to pay as part of the care they receive, The New York Times reported.

Continue reading Providers Devise New Fees To Levy Against Patients

Study Finds Average Health Premiums “Skyrocketing” After ACA

The Washington Times ![]()

![]() (10/28, Richardson) reports that a new study of insurance policies before and after the implementation of the Affordable Care Act “shows that average premiums have skyrocketed, for some groups by as much as 78 percent.”

(10/28, Richardson) reports that a new study of insurance policies before and after the implementation of the Affordable Care Act “shows that average premiums have skyrocketed, for some groups by as much as 78 percent.”

Average premiums for the 23-year-old demographic rose “dramatically,” with men in that age group seeing a 78.2 percent price increase before government subsidies (welfare) , and women seeing premiums rise 44.9 percent, according to a report by HealthPocket to be released Wednesday. (War on Women or is it War on Men?)

The study, shared Tuesday with the Times, also found that premium increases for 30-year-olds increased 73.4 percent for men and 35.1 percent for women. Kev Coleman, head of research and data at HealthPocket, stated, “It’s very eye-opening in terms of the transformation occurring within the individual health insurance market.” (Eye-opening? Where have you been Kev?)

The article says that reasons for the premium increases include the ACA’s “prohibition on rejecting applicants with pre-existing conditions” and the heightened benefit mandate under the law. (Duh!)

Humana May Exit Markets

Humana Inc. (HUM), the fifth-biggest U.S. health insurer, said government cuts in Medicare may lead the company to change benefits and exit markets.

Physician Kickback Scheme Costs Firm $350,000,000 Penalty

“Companies seeking to boost profits by paying physician kickbacks for patient referrals — as the government contended in this case — undermine impartial medical judgment at the expense of patients and taxpayers,” said Daniel R. Levinson, Inspector General for the U.S. Department of Health and Human Services, in the statement.

“Companies seeking to boost profits by paying physician kickbacks for patient referrals — as the government contended in this case — undermine impartial medical judgment at the expense of patients and taxpayers,” said Daniel R. Levinson, Inspector General for the U.S. Department of Health and Human Services, in the statement.

Continue reading Physician Kickback Scheme Costs Firm $350,000,000 Penalty

Should You Be Able To See Any Doctor You Want?

People don’t like being told “no,” especially when it comes to something as personal as their health care. They also don’t like rising health-care costs. And therein lies the health-care system’s existential debate about narrow networks.

Editor’s Note: Forget networks. Employer plans should pay Medicare rates only to any provider of choice. It’s up to the insured to deal with balance billing issues. The employer is not your Mama anymore…..

Continue reading Should You Be Able To See Any Doctor You Want?

The Affordable Care Act: A Game Changer For Health Care Financing

Hospitals Attack Skinny Plans

Hospital groups have slammed the so-called “skinny plans,” saying they almost certainly will be blocked by regulators.

“These plans are like buying homeowners insurance that covers broken windows from the first dollar but excludes coverage for your house burning down.”

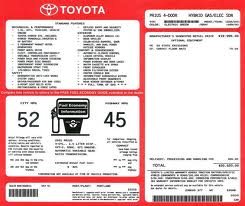

Are You Paying The Sticker Price? If So, Your An Idiot!

Costs At Hospital-Owned Physician Groups Up To 20% Higher

By Anne Zieger | October 24, 2014

Dive Brief:

- A new study by researchers from UC Berkeley has concluded that hospital ownership of physician groups in California generated 10% to 20% higher overall costs for patient care.

- The research, which was published in the Journal of the American Medical Association, found that total spending per patient was 10.3% higher for hospital-owned physician offices than with doctor-owned practices. Meanwhile, when health systems ran multiple hospital-owned groups, per-patient spending was 19.8% higher.

- One factor in the higher costs observed by researchers is that newly-acquired physician groups often face pressure to refer patients to more expensive imaging and outpatient treatments that can be less expensive at freestanding clinics.

Continue reading Costs At Hospital-Owned Physician Groups Up To 20% Higher

Cancer Cure?

In a recent study it “wiped out cancer in 14 of 16 people with acute leukemia”the scientific journal Nature reported.

Direct Contracting For Health Care Services

Variations on traditional group insurance via insurer-administered self-funding remain the norm for many large employers. But some health systems are considering alternatives in the face of high costs, new regulations and demand for more choice.

Variations on traditional group insurance via insurer-administered self-funding remain the norm for many large employers. But some health systems are considering alternatives in the face of high costs, new regulations and demand for more choice.

Continue reading Direct Contracting For Health Care Services

HHS Prescribes $840 Million To Help Doctors Transform Their Practices

The federal government will spend $840 million over the next four years to help doctors move their practices away from a volume-based business model to one that’s focused on rewarding them for good patient outcomes.

Continue reading HHS Prescribes $840 Million To Help Doctors Transform Their Practices

Insurers Exclude Ebola From Policies

By Carolyn Cohn, Richa Naidu and Avik Das

(Reuters) – As fear of Ebola infections spreads to developed economies, U.S. and British insurance companies have begun writing Ebola exclusions into standard policies to cover hospitals, event organizers and other businesses vulnerable to local disruptions.

Revenue Drops 25% At Texas Health Presbyterian Hospital After Ebola Cases

Ebola is a devastating disease for its victims, and in the first 20 days of October it has had a devastating effect on the finances of Texas Health Presbyterian Hospital in Dallas.

Continue reading Revenue Drops 25% At Texas Health Presbyterian Hospital After Ebola Cases

With 2015 Looming, More Employers Adopt Skinny Plans

By ANNA WILDE MATTHEWS – Wall Street Journal

Can an employer avoid all of the health law’s penalties by offering a plan that doesn’t cover hospital care?

Continue reading With 2015 Looming, More Employers Adopt Skinny Plans

Government (taxpayers) Provides Health Care Coverage For 50% of Texas Children

Can Americans Buy Health Insurance Offshore?

Yes, but you can’t reside in the United States although you can elect to take treatment there. Here is an excerpt from an offshore health insurance policy marketing piece:

OPTIONAL COVER IN THE USA

To ensure that you only pay for the cover you really need, you can choose whether or not you want to include the USA in your Lifeline insurance cover.

Please Note: Due to the extremely high cost of healthcare treatments in North America, coverage which includes the USA is generally an average of three times the cost of cover for other parts of the world. Therefore, unless you will be spending significant amounts of time in the United States, we recommend that you DO NOT select this option.

Some Americans want to self-insure their health risk up to a point. But under current law, Americans can’t purchase a plan with deductibles higher than $6,600. Gone are the days with Americans could purchase $10,000 deductible plans from carriers like Blue Cross. It is now illegal for an American health insurance company to sell you a deductible of $10,0000, $25,000 or more.

Buying health insurance offshore allows a full array of choices in plan design, at costs significantly lower than one would expect.

A LLoyds syndicate, for example, could underwrite a health policy to be sold to Americans with coverage extended to the USA . However the purchase would necessarily have to be made offshore. To our knowledge no one has come up with such a product yet. The first one that does will do well.

Editor’s Note: Imagine coming back from a trip abroad, going through customs and having to answer the common question we all get asked: “Do you have anything of value to declare?”………..”Why yes, a high deductible health insurance plan from an English insurance company, reinsured through a consortium of carriers from India, China, Singapore, Austrailia and Peru, which I purchased from RiskManagers.us while I was in Costa Rica deep sea fishing.”

Ebola Insurance

Oct 17 (Reuters) – Two privately owned insurance brokers have teamed up with Lloyd’s of London underwriter Ark Syndicate to sell hospitals a product that insures against any loss of profit from Ebola quarantine shutdowns.

British broker Miller Insurance Services LLP said the product it created with U.S. broker William Gallagher Associates would also protect hospitals against any potential losses to revenue in the aftermath of a quarantine. (bit.ly/1pkS72L)

The policies, which Ark began underwriting on Friday, are the first of their kind.

There has been “considerable interest” in the product throughout the United States, Mark Sleet, Professional Risks broker at Miller, told Reuters.

The news comes as U.S. health officials said they were monitoring 16 people in Ohio, including one in quarantine, who had close contact with Ebola-infected Texas nurse Amber Joy Vinson.

Aon Plc said it had created an Ebola task force to monitor the outbreak and help its clients prepare for potential risk exposures, duty of care and human capital concerns.

“The healthcare industry is at the forefront on the Ebola situation and faces a unique and augmented set of risk exposures,” said Gigi Norris, managing director of Aon Risk Solutions’ healthcare practice.

The death toll in the epidemic has risen to 4,546 out of 9,191 known cases in Guinea, Liberia and Sierra Leone, including 239 health workers, according to the World Health Organization. (Additional reporting by Carolyn Cohn in London; Editing by Simon Jennings

Why Health Insurance Companies Are Doomed

“If something cannot go on forever, it will stop” – Herbert Stein

Custom Design Benefits Presents TrueCost Referenced-based Pricing at Conference

Julie Mueller, Disruptive Health Care Revolutionary

TrueCost offers employers a simple payment structure in which health provider reimbursements are based on fixed Medicare pricing plus a set percentage. “Using a reference based pricing model is consistent, rational and transparent,” said Julie Mueller, president of Custom Design Benefits.

“TrueCost has caught on with many local healthcare providers that have embraced its simplified and efficient reimbursement system.”

Continue reading Custom Design Benefits Presents TrueCost Referenced-based Pricing at Conference

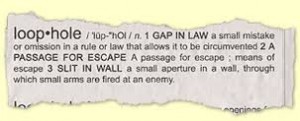

Government Preparing To End Loophole

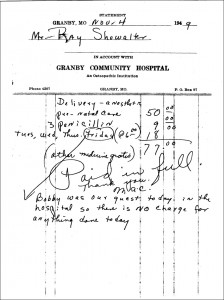

Consultant Advises 2,000 Life Case To Remain Fully-Insured

By Molly Mulebriar October 17, 2014

By Molly Mulebriar October 17, 2014

Last night a +2,000 life South Texas school district was advised by their insurance consultant to remain fully-insured.

The consultant informed the Board of Trustees that over a 6 or 7 year period there would only be a 4% savings under a self-funded arrangement. The consultant informed the board that he has clients with three to four thousand employee lives and “they are, and should be fully-insured.”

A survey of the district’s employees was conducted to determine if plan participants wanted to remain fully-insured or participate in a self-funded health plan.

During the presentation a board member opined that a self funded employee health plan could jeopardize district bond issues “because losses come out of reserves.”

The district is in the midst of a Request for Proposal for Group Medical Insurance for district employees.

Editor’s Note: Mulebriar is a free lance reporterette from Waring, Texas and former Miss Texas. (www.MollyMulebriar.org)

Write RiskManager@RiskManagers.us

From A Consultant

Who is the consultant? Who is the district? Are you hiding their identity to protect them from public embarrassment?

From An Insurance Agent

Makes perfect sense to me. What better way to hid agent commissions

From A TPA

It is obvious there was a hidden agenda here. The consultant was simply “going along to get along.”

From A Former TPA Owner

There is a software app that tells what a broker makes on a case. It is available by State, Region, and Nationwide. It’s called miEdge. I have used it and it appears to be pretty accurate.

Cost Plus / Reference Based Pricing Gains 10% Market Share

Managed Care Contracts & Trend Factors

From an actuary: “Medical cost trends include components for many drivers. Net unit price increases from providers drives half of the effect in general. So a 5% increase in a schedule will drive a 10% overall cost increase. The rest of the components include: increased utilization, coding creep, deductible leveraging, etc…”

Editor’s Note: Is this confirmation from an experienced actuary/underwriter that escalator clauses common to all Managed Care Contracts are the driving force behind trend factors?

Coverage For Lawsuit Doughnut Hole

New Hepatitis C Drug Costs $94,500

(Bloomberg) — Gilead Sciences Inc. won U.S. approval for the first all-oral hepatitis C treatment for the majority of people infected with the virus.

BUCA Renewal – The Story Behind The Numbers

“I THOUGHT THERE WOULD BE NO TAX INCREASES FOR THE MIDDLE CLASS, ONLY TAX INCREASES FOR RICH BASTARDS WHO NEED TO PAY “THEIR FAIR SHARE” – Homer G. Farnsworth, M.D.

“I THOUGHT THERE WOULD BE NO TAX INCREASES FOR THE MIDDLE CLASS, ONLY TAX INCREASES FOR RICH BASTARDS WHO NEED TO PAY “THEIR FAIR SHARE” – Homer G. Farnsworth, M.D.Continue reading BUCA Renewal – The Story Behind The Numbers

Hospital Bills Are Worse Than You Thought

Today’s Plan Sponsor

Today’s Plan Sponsor

Fact of the Week: The price that hospitals and pharmacies pay for a bottle of 500 tablets of doxycycline, a decades old antibiotic, rose from $1,849 in April from $20 in October 2013 –

“Plan sponsors who don’t audit their group hospital bills ought to have their heads examined” – Homer G. Farnsworth, M.D.

The Top Ten Most Affordable Hospitals In Texas

Using public information found through hospital’s annual cost reports to CMS, this article pinpoints the lowest cost hospitals in Texas. To see cost-to-charge ratios at any hospital as reported to the government, go to www.ahd.com

Using public information found through hospital’s annual cost reports to CMS, this article pinpoints the lowest cost hospitals in Texas. To see cost-to-charge ratios at any hospital as reported to the government, go to www.ahd.com

Continue reading The Top Ten Most Affordable Hospitals In Texas

Will Government Castrate Reference Based Pricing Plans?

The Department of Treasury, Labor and Health and Human Services released a four page FAQ documenton reference pricing. The FAQ reiterates that the administration will consider that large group and self-funded plans that use a reference-based pricing model for their in-network providers have met their maximum out-of-pocket requirements as long as they take steps to ensure adequate access to care.

The Department of Treasury, Labor and Health and Human Services released a four page FAQ documenton reference pricing. The FAQ reiterates that the administration will consider that large group and self-funded plans that use a reference-based pricing model for their in-network providers have met their maximum out-of-pocket requirements as long as they take steps to ensure adequate access to care.

Editor’s Note: What is the definition of “adequate access to care?” To consumers (i.e., voters), adequate access to care is a network that includes every doctor and hospital in town. Do Texas Medicaid recipients have “adequate access to care” when less than 30% of Texas physicians accept Medicaid patients? When you mix politics (politicians and bureaucrats) with free market dynamics, politics win every time.

California Encourages Citizens To Sue Health Insurance Companies – Taxpayers To Help Pay For Cost of Lawsuits Against Mean, Greedy Health Insurance Companies

Why would any health insurance company want to continue to do business in California?

ACA To Prompt Decline In Group Health Insurance

Group Health Insurance Broker

75% of employers predicted to drop their group health insurance plans…………………….

Continue reading ACA To Prompt Decline In Group Health Insurance

The Affordable Care Act – A Game Changer For Health Care Financing

ObamaCare Individual Health Insurance Rates – It’s All About Perception

Remember when “queer” really mean’t “gay” although we didn’t know it at the time?

Continue reading ObamaCare Individual Health Insurance Rates – It’s All About Perception

RAC’s Collected Nearly $4,000,000,000 (Billion) In 2013

We received the following from one of our three readers:

- The RAC audits are performed by independent contractors nationally whose process is much like those of AMPS

- All hospitals know that the RAC auditors are in place and looking for overcharges and mistakes

- When the RAC auditors find overcharges (they call them overpayments) hospitals are charged a fine plus the hospital has to rebate overpaid funds

- The RAC auditors are technically marshals of the federal government and have open access to all billing and claim detail as well as the hospital’s internal communications (google the article on Beth Israel Hospitals “Turbocharging”)

Medical Bill Auditing Firms Gaining National Recognition

The scope of the inaccurate billing issue is well documented,” said Dendy, who established the medical billing auditing firm in 1995 and also serves as senior healthcare consultant for M&A Equity Advisors, a Miami-based mergers and acquisitions firm. “Whatever the causes for inappropriate and inaccurate hospital billing, the problem is universal and large in scale.”

Continue reading Medical Bill Auditing Firms Gaining National Recognition

Risk – Gaming The System Is Now An Actuarial Endeavor Under ACA

Governmental interference in health care financing (ACA) has had a man made impact on actuarial science. The definition of “insurance” now needs to include terms such as re-distribution of societal wealth ratios, “fairness” loads or debits, sanction penalty calculations, taxation margins, etc.

Continue reading Risk – Gaming The System Is Now An Actuarial Endeavor Under ACA

Federal Judge Rules Subsidies (Welfare) Illegal

“Federal judge rules Obamacare subsidies illegal. Will Supreme Court weigh in? – US District Judge Ronald White said the IRS lacked the authority to enact a regulation that allows the federal government to provide tax credits to qualified health care policyholders through health care exchanges.” By Warren Richey for The Christian Science Monitor, September 30, 2014

http://news.yahoo.com/federal-judge-rules-obamacare-subsidies-illegal-supreme-court-220821581.html

Compare Auto Insurance Online

When Miranda entered her zip code at Insurance.Comparisons.org, she was shocked. She found out her local insurance agent was ripping her off, and she could get car insurance much cheaper.

60% Of Health Plans Are Illegal

Professor Bob Graboyes, in the compelling and entertaining video presented below, explains another big problem with Obamacare’s AV regulations: They outlaw 40 percent of possible AVs above the 60 percent minimum. That is because the AVs defined as floors in the law for the four “metallic” plans (60 percent for bronze, 70 percent for silver, 80 percent for gold, and 90 percent for platinum), are interpreted in regulations as narrow corridors of 4 percentage points.

http://www.youtube.com/watch?feature=player_embedded&v=p9BJ6bL0a-M

Ocean Surgery Center

Ocean Surgery Center explains why they chose the cash-friendly model (it’s not clear if they’re cash-only or also accept insurance). For regular readers of this blog, most of this will sound very familiar:

The critical flaw in our for-profit healthcare system is the absence of price transparency. This flaw has allowed for price distortions to go unchecked, leading to inflated and often excessive medical bills…