Pharmacist points to a recent PBM transaction wherein the pharmacy earns $32.08 while the PBM earns $1,057.12 on the spread……………………..

- Posted on Linkedin by Brian. Petrucci – Pharma

PBMS are the MAIN driver of EXPENSE when it comes to Medications in the United States. How many more examples do we need to see??????

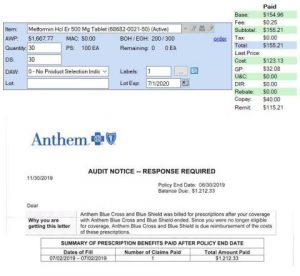

A pharmacist received a call from a patient about this. Her former insurance sent her a bill for a claim paid outside her policy dates. Not uncommon, but this math is funky!

First issue, the claim shouldn’t have adjudicated after her term date, but okay it was only 2 days after (maybe they hadn’t updated the system).

The pharmacy was reimbursed $155.21 for this drug. Drug cost the pharmacy $123.13.

Now here is where the situation gets interesting…The patient received a bill from Anthem for $1,212.33!!! CVS/Caremark is the PBM for this insurance. So Anthem paid CVS/Caremark $1,212.33 for this drug and CVS/Caremark paid the pharmacy $155.21. That means CVS/Caremark pocketed the ‘spread price’ of $1057.12 plus whatever DIR/GER they collect out of the pharmacy’s $32.08 profit.