The North Carolina state employee benefit program will be changing from Blue Cross to Aetna in 2025 for a purported savings. Sounds reasonable but is it true?

“In 2022, after an open, competitive bid process, the Board of Trustees awarded the third-party administrator services (TPA) contract to Aetna®. The change is expected to save North Carolina taxpayers approximately $140 million.”

Since cost is based on claims, and claims are based on pre-negotiated managed care contracts that you can never see nor audit and which change frequently subject to the whims of the Moon, the stars and backroom cigar smokers, are the Aetna network reimbursement rates $140,000,000 less than Blue Cross reimbursement rates?

“Yes!” says North Carolina officials.

That’s what another government health plan was told several years ago. The TRS ActiveCare plan in Texas with over 400,000 members were happy to hear that so they moved from Blue Cross to Aetna hoping to save millions without reducing benefits. At the end of the day it didn’t save them a dime. Rates went up and benefits reduced at the first renewal. And the second renewal. And the third…………Will the same hold true for the great state of North Carolina?

“Quit acting stupid. What kind of question is that? Keep this up and I’ll stop reading your blog!- Molly Mulebriar

Meanwhile across the Fruited Plains innovative health care revolutionaries are proving health care can be solved using common sense, reason and logic in sharp contrast to the status quo solution of doing the same thing over and over again.

According to North Carolina officials just about every Blue Cross doctor and hospital on the planet is on the Aetna network. If everyone is on the same network what incentive is there to reduce prices to gain steerage when there is no steerage mechanism in place at all? And with the federal brain fart passing the minimum loss ratio requirement there is every incentive to raise prices. The higher the price the more Aetna and Blue Cross earn.

“Aetna has an extensive national and in-state provider network. Aetna reviewed millions of State Health Plan claims processed over an entire year, and about 99% of those claims came from providers already in the Aetna network.”

In the case of the Texas government health program for Texas educators, they went back to Blue Cross after several years with Aetna. That move didn’t work either as rates went up again and benefits went down again, and again, and again, year after year.

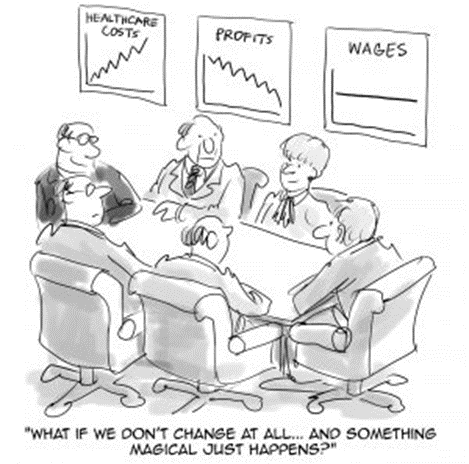

Changing the logo on a health benefit plan does not save money and never has. There is a much better way to reduce costs while improving benefits at the same time but few politicians are willing to listen. Dr. Dave prescribes Health Rosetta hearing aids for hearing impaired politicians. He does not accept insurance. He is not a network provider. His services are free to all who want to hear and understand the truth about what’s driving health care costs and how to fix it. He has like minded collaborators across the nation standing by to assist hearing impaired plan sponsors.

Meanwhile in Texas a handful of private and governmental entities are enjoying benefits with no financial barriers to health care. No deductibles (deductibles are silly and unnecessary), no co-pays, no coinsurance, no kidding. And their rates have remained static for multiple years (5, 10 and 15 year static rates – a Ripley’s Believe It Or Not factoid).