Insurance companies have traditionally required a minimum percentage of employees to enroll in coverage. Participation requirements helps insurance companies avoid adverse selection. Minimum participation requirements have traditionally been 75%.

Not anymore it seems. Here’s one example – Relaxed Participation Promotion

What changed? How is adverse selection factored in rate setting when minimum participation is a paltry 25%?

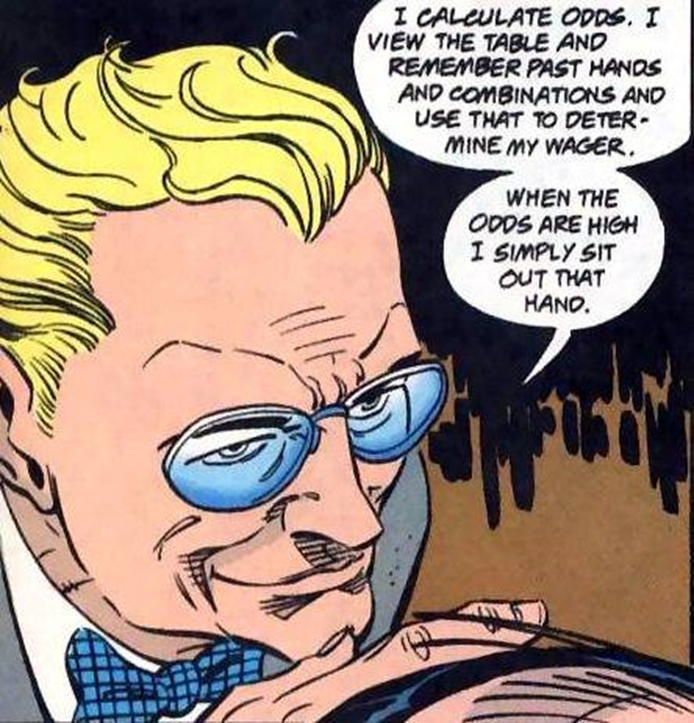

Perhaps all of this has something to do with retrospective underwriting. That’s a marketing strategy that has been used in the past with good success – write new business with scant regard of traditional underwriting parameters. In nine months you know what your picked up. At 12 months you run off the dogs and keep the rest.

Years ago when employed by a BUCA management decided it was time to increase market share in Texas by 2.5%. “You will be pleased to know new market rates are going to be super competitive in the next two quarters. Write as much as you can!” was C-suites message. We wrote everything that moved. When renewal time came the dogs were let go and the profitable groups were kept. The company achieved it’s goal.