By David Stanard VP, Underwriting Manager at Excess Risk Reinsurance Posted on Linkedin

As an underwriter, I’m always surprised by the examples given when discussing RBP. They always seem to omit the fact that RBP has almost NO impact on an employers drug spend. In today’s market, that’s 30-40% of your cost.

In a best case scenario, RBP can only work with 70% of an employer’s claims. Next, the fact that RBP almost never covers physician charges lowers that number even more. I tell my clients and underwriters not to consider a case unless there’s a wrap network for providers only.

In a best case scenario, RBP can only work with 70% of an employer’s claims. Next, the fact that RBP almost never covers physician charges lowers that number even more. I tell my clients and underwriters not to consider a case unless there’s a wrap network for providers only.

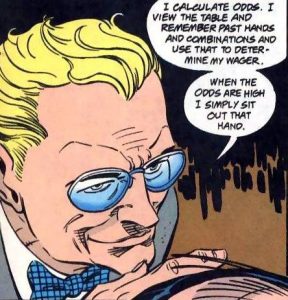

The example article (High RBP Fees Offsets Plan Savings) is several years old and uses a very simplistic approach but the general thoughts are true. I’m not down on RBP but we, as insurance professionals, need to give our clients much better information.

Editor’s Note: We are seeing a growing cult mentality within the brokerage / consultant community towards Reference Based Pricing. Common to cults, critical thinking becomes a casualty leading to blindness. RBP strategies, one could argue, is bait and switch – Pay providers less and pay intermediaries the difference. Moving money into different silos, some disclosed and some not, is in principle no different than status quo strategies of the past 35 years. We too are not “down” on RBP – we are huge supporters. But we realize, as should you, not all RBP vendors are the same.