By Kevin Weinstein – Chief Executive Officer at Renalogic

February 6, 2024

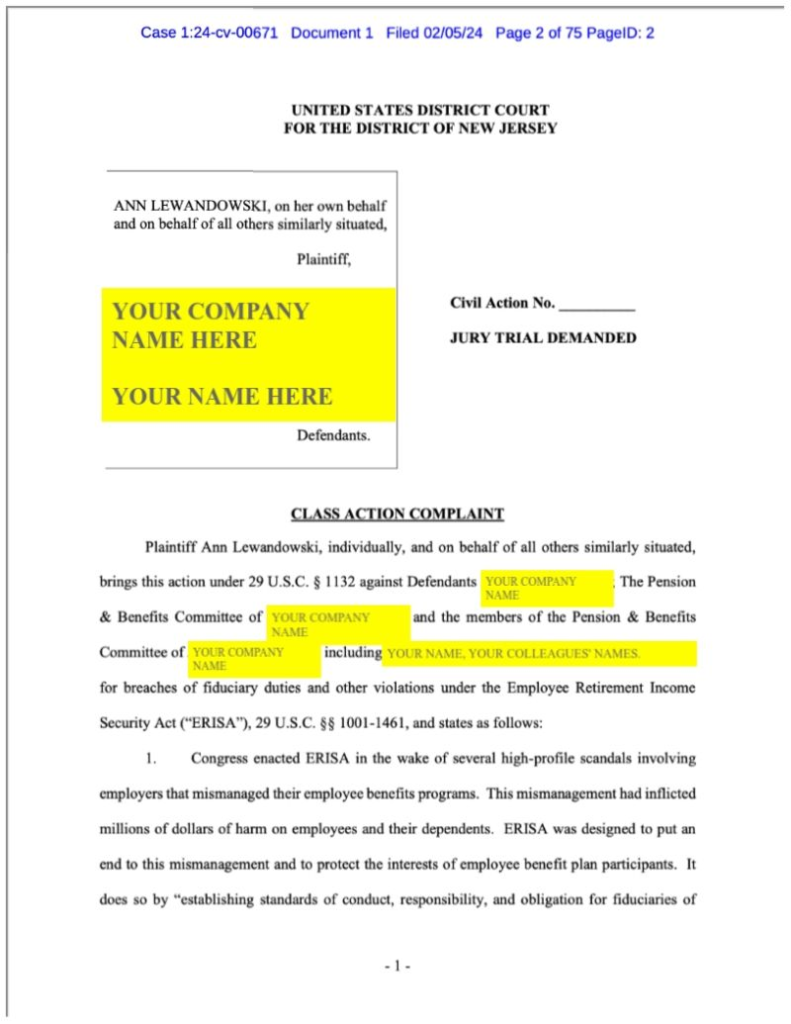

If you haven’t already, everyone involved with employer-sponsored healthcare should read and understand this lawsuit (Lewandowski v. Johnson and Johnson) filed by an employee against Johnson & Johnson’s health plan. The key allegation is that the J&J health plan failed in its fiduciary responsibility to design and oversee a health plan that benefits members and pays reasonable rates for services.

In this article, I’ll try to explain why this lawsuit so important to pay attention to and why it could catalyze needed change around the network model of negotiating rates in healthcare. Specifically, I’ll layout some thoughts about:

- Some historical market context behind the lawsuit

- Why networks work against plans and members in consolidated markets

- How and why plan sponsors need to fight against distorting market forces

- Some questions for the future

Historical Context

Since it’s passage 50 years ago, ERISA has helped shaped the US healthcare system. Today, about 150 million Americans receive their healthcare from their employer, of which about 100 million of those are served by self-funded plans where the employer retains the repsonsibility for paying for medical services for the plan members. As a trade-off during ERISA’s creation, self-funded plans were granted preemptive rights over most state insurance regulations and wide latitude in designing their plans. In exchange, employer-sponsors accepted the fiduciary responsibility of managing these plans, including proper oversight and ensuring reasonable rates were being paid for services.

In an important historical parallel, ERISA also applies to employer-sponsored retirement plans as well as health plans. In the mid 2000’s and culminating with the Pension Reform act of 2014, policy makers began to pay attention to whether employers were meeting their fiduciary obligations to oversee retirement benefit plans. Even as regulators began to take a closer look, the private litigation market leapt at the opportunity to answer that question. A surge of lawsuits ensued, whereby employees sued their employers for failing to protect their interests. In addition to directly costing employers millions of dollars, these lawsuits, and the regulations coming out of Washington, forced very real changes in the way the retirement benefits market worked. The number of “advisors” dropped significantly as fees and economic interests of stakeholders became much more transparent and technology enabled much more direct control of assets, without excessive middlemen. And perhaps most obviously, plans accelerated their move from defined benefit pension plans to defined contribution 401(k) plans.

In the employer sponsored health plan space, these parallels to the retirement benefit market should not be ignored. First, we had transparency rules and regulations change at the federal level (CAA 2021) and legislation affecting PBMs and additional transparency is winding its way through Congress. We recently saw evidence via lawsuits that the Department of Labor is paying more attention to fiduciary responsibilities of health plan adminsitrators. And now we have private litigation between a plan member and a plan sponsor seeking to hold the plan sponsor responsible for not fighting against sky high prices per their fiduciary responsibility.

The Role of Networks and the Impact of Consolidation

In an open robust market, a “provider network” works well because a health plan and its members can seek care from any one of multiple healthcare providers. In such a robust market, healthcare providers exchange lower prices and/or higher quality for greater volume from health plans who access a provider network with specific reimbursment rates. This usually leads to the health plan paying a reasonable rate for services and is usually in favor of plans and members.

However, when the supply side of a market is consolidated, there is no ability to trade increased volume for lower costs or higher quality. Instead, the consolidated suppliers can inflate prices, and unless they are paying very close attention, health plans, especially self-funded health plans, are at risk of blindly paying these inflated rates because of the false assumption that networks are good for plans. In the recent J & J lawsuit, this plays out with consolidated PBMs, where the top few companies control 90% of the market, and the lawsuit cites instances where the nwtrok price for drugs far exceeded normal market rates. In our work in the dialysis market, we see similar dysfunction, where the top two companies control nearly 80% of the market. As a result, employers accessing certain networks regularly pay 7-10x what Medicare does for the same dialysis services.

How Plans Can React

Employer-sponsored plans can react to these evolving changes and market situations in three main ways:

- Better understand what it actually means to be a fiduciary for a health plan;

- Conduct an audit of whether the plan is operating according to best-practices;

- Push back against the use of networks in instances where networks don’t make sense.

For item #1 — understanding current interpretations of being a fiduciary and the risks of not meeting those guidelines — a competent ERISA attorney and compliance company can assist. Some great compliance folks include Julie Selesnick , Doug Aldeen, and MZQ Consulting, LLC, but chances are your current plan attorney can help.

For item #2, you’ll not only want to work with your attorney, but also a claims analytics or price transparency vendor to ensure that you aren’t paying above reasonable rates for services or for fees.

Finally, for #3 plans should understand their rights to obtain, review and share their plan data. They should understand that they have a right to design their plans as they best see fit to benefit their members, including carving out certain treatments or services where consolidation simply means networks don’t work to contain costs. I have previously written about this related to dialysis, but the notion of carving out benefits can extend to any service whereby the plan is not being well served by its trading partners. If you would like a copy of our Health Plan Bill of Rights, just leave us a message in the comments to that affect and we’ll get it to you. And check out companies like Healthcare Highways, Employer Direct Healthcare, and Health Rosetta for other innovative ways to think outside of traditional network constraints.

Questions for the Future

As this and other lawsuits emerge and develop in the coming months and years, I think there are some critical questions to consider to understand how the market will continue to evolve, including:

- How will the FTC and DOL look at provider consolidation directly and through networks in terms of anti-competitive behaviors and inflated prices?

- How will the Department of Labor define and enforce fiduciary responsibilities for self-funded health plans?

- How will private lawsuits, the DOJ and the FTC treat data sharing/access issues and enforce the removal of “gag clauses” in network agreements?

- How will private lawsuits, the DOJ and the FTC treat networks if they seek to directly or indirectly block plans from designing plans that meet their fiduciary responsibilities, including the use of carve-outs in certain treatments or services?

- How will direct contracting between purchasers and providers change the role of networks moving forward?

- Will employers continue to embrace the role of sponsors of health in order to attract talent, or will they switch to a defined contribution approach and exit the health plan business altogether by encouraging employees to buy plans on the exchange?

- Will increased transparency regulations and data sharing accelerate changes, including removing middle men between the purchasers and providers of healthcare, or will it cement the role such stakeholders play?

Certainly there is no shortage of unanswered questions to consider and many of the answers are as yet unclear. What is clear is that this latest lawsuit underscores the need for employers to pay greater attention to their health plans and find innovative ways to serve the needs of their members, including thinking outside the network box.