GoodRx co-founder Doug Hirsh once said: “A company like ours should not have to exist.”

XXXXXXXXXXXXXXXXXXXXXXXX

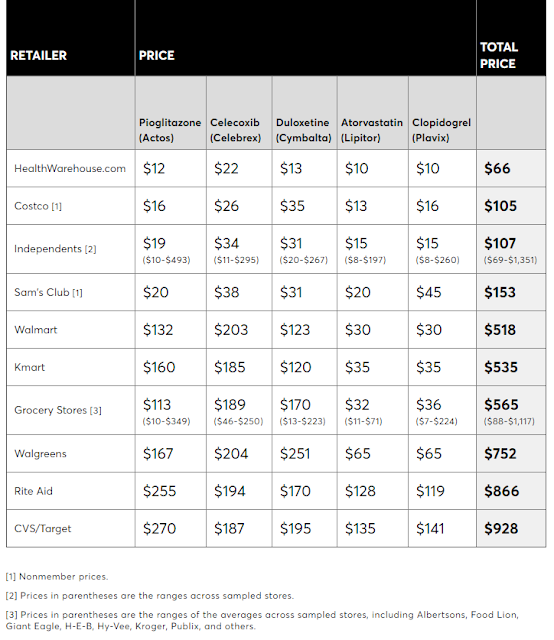

Editor’s Note: What if plan members had access to Rx pricing from multiple PBM’s at the point of sale? Not all PBM’s have the same pricing, so members would know at the point of sale what the lowest price would be for the drug they need. The pricing difference can be substantial as illustrated above .

Replacing your PBM with GoodRx may make sense to some plan sponsors. However, for it to work best a plan would necessarily need to change their current fixed dollar co-pay to a percentage. For example, the co-pay could be 25% or even 50%. There is no better way for consumers to understand Rx pricing than to see it. Under current fixed dollar co-pays consumers have no idea what their drug actually costs and therefore they don’t care because they have “daddy’s” credit card.

Members would be required to pay for the drugs at the point of service. They could pay with a credit card. The member would then submit their bill in time for their next monthly credit card statement.

This strategy represents a return to what insurance used to be – REIMBURSEMENT of covered expenses. Gone would be the easy advanced financing scheme central to a PBM managed program.

But how do you limit what drugs are covered at the point of sale? You don’t. The law of supply and demand empowers consumers in making those choices.

XXXXXXXXXXXXXXXXXXXXXXXXXX

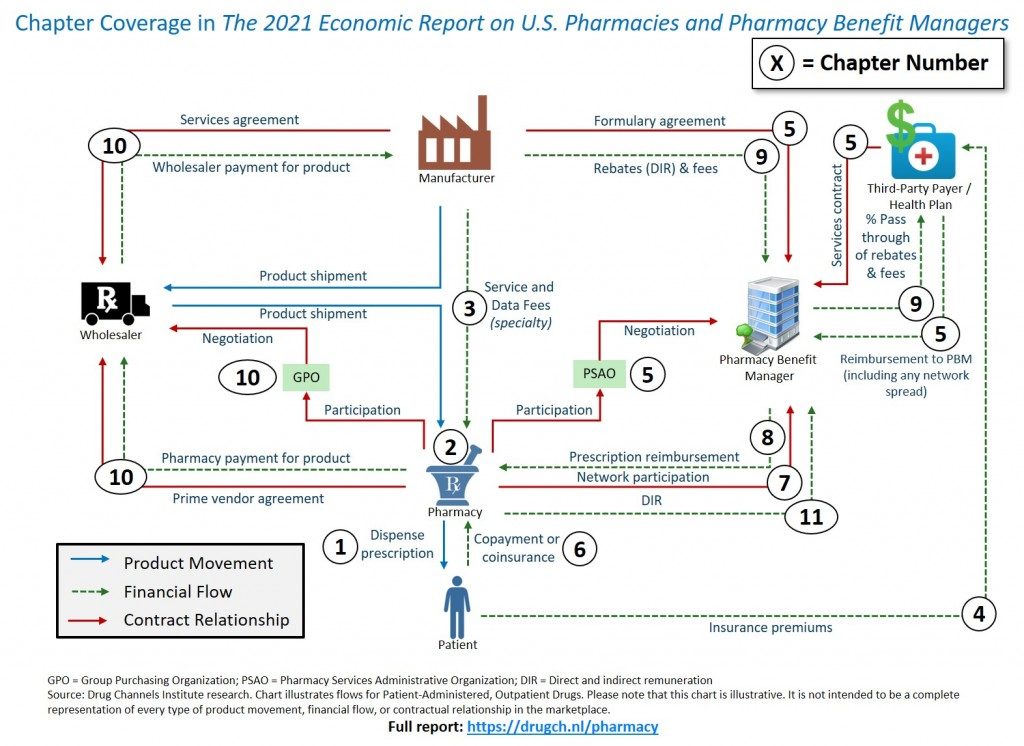

SOURCE: www.drugchannels.net

“Three out of four consumers who used GoodRx already had commercial, Medicare, or Medicaid insurance. This means that someone—the consumer, their employer, and/or the government—paid insurance premiums for a pharmacy benefit managed by a PBM. Yet it was still worthwhile for people to bypass their plan’s out-of-pocket costs and PBM network rates in favor of a different PBM’s rates.”

Here is what you need to know about GoodRx.

The GoodRx business model depends on pharmacies charging an inflated usual and customary (U&C) retail list price—the prescription price that a pharmacy charges to a cash-paying consumer.

The U&C cash price for prescriptions varies greatly among pharmacies, especially for generic drugs:

- One study of two generic antibiotics found that cash prices varied from $4 to $229 for one product and from $2 to $134 for a second product. (source)

- In Why Retail Pharmacies Still Overcharge Uninsured Patients—And What That Means for Amazon, I discussed a Consumer Reports survey of retail cash prices for five commonly prescribed generic drugs. The survey found that cash prices for a basket of five prescriptions ranged from $66 to $1,351—a 20-fold difference.

Prescription list prices are generally far above a pharmacy’s actual net acquisition cost. That’s because a pharmacy benefit manager (PBM) will not reimburse a pharmacy above the pharmacy’s U&C list price. Consequently, pharmacies typically establish U&C prices that exceed the maximum expected reimbursement from any payer. The pharmacy eliminates the risk that it could be reimbursed an amount less than what a third-party payer would have been willing to pay.

Prescription list prices are generally far above a pharmacy’s actual net acquisition cost. That’s because a pharmacy benefit manager (PBM) will not reimburse a pharmacy above the pharmacy’s U&C list price. Consequently, pharmacies typically establish U&C prices that exceed the maximum expected reimbursement from any payer. The pharmacy eliminates the risk that it could be reimbursed an amount less than what a third-party payer would have been willing to pay.

FROM A PBM REPRESENTATIVE

Ahhh but goodRx IS a PBM in disguise!! That’s who processes the claims behind the scenes. These prices are showing the markup potential in PBM contracts with employers. Love to chat more on this!