“Pam said she was told that if everyone paid the lower cash rates then there would not be any reason for people to use their health insurance.” SOURCE: Yes, You Can Pay Cash for Health Care.

By Bill Rusteberg

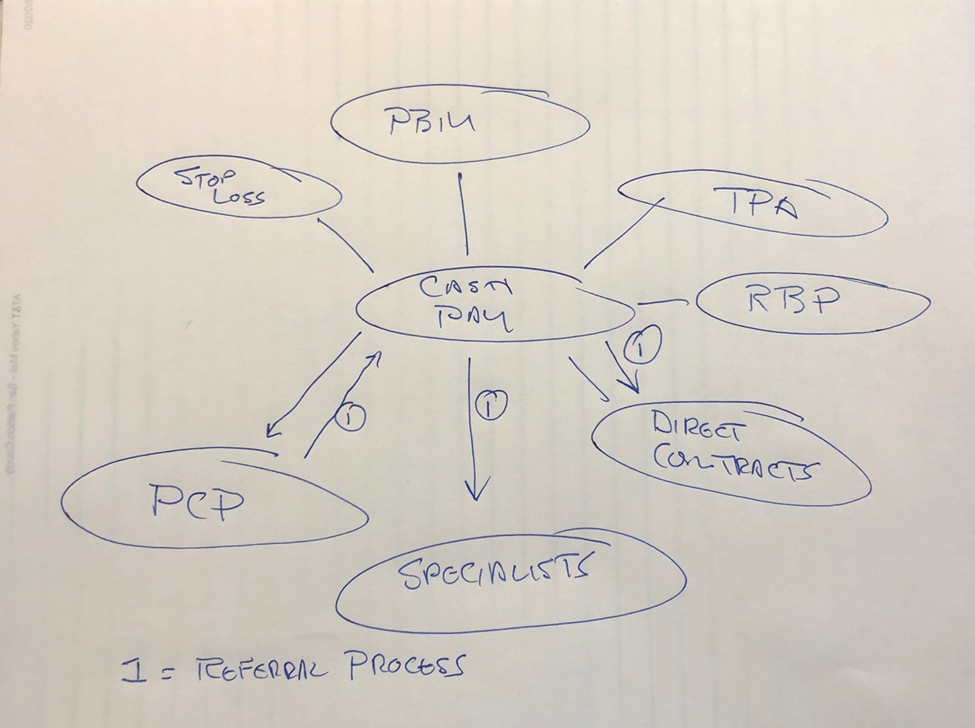

The article in the link above illustrates insurance costs drive higher prices than cash driven pricing. Everyone with any common sense knows that. So why not turn your insurance plan into a cash pay plan?

Yes, that’s possible because we’ve done it.

Some years ago a hedge fund called asking a whole bunch of questions about Reference Based Pricing. As investors in health care related ventures they sensed opportunities as the strategy was beginning to attract market attention. They wanted to learn as much as possible before investing.

After several calls over several months, the hedge fund manager asked “Bill, you have said Reference Based Pricing is a transitory phenomenon. What do you see as the future of health care?”

Without hesitation I replied “Cash, a cash centric health plan with point-of-service payment similar to how plans pay for prescription drugs.”

“I know a guy you might want to meet. Let me see if he wants to meet you before I make the introduction” he said.

That’s how I met the two co-founders of Asserta Health, a startup company at the time. We share the same vision. And it works.

Our cash pay model relegates the TPA to backroom recordkeeping. All calls from providers and plan members are through a central hub taking the TPA out of the customer service business. The plan controls referrals rather than the hit-and-miss strategies of status quo health plans.

What have been the results? It’s been good for all parties. Providers win. Members win too because all patient financial responsibility is waived. And its good for the plan.

Plans savings can be significant. You would be amazed at what hospitals will accept as cash payment compared to what a traditional managed care plan allows. PPO allowed may be as much as 300-400% of Medicare while cash payments below Medicare rates are not uncommon.

Why would a plan sponsor not do this?

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.