By Bill Rusteberg

Years ago a hedge fund operator called seeking information on Reference Based Pricing, a nascent but growing market trend at the time. He continued calling over the next six months to which I was happy to share my experience, both good and bad, with Reference Based Pricing.

On what would be my final call with him he asked “Bill, you have repeatedly said Reference Based Pricing is a transitory phenomenon. What do you see as the future of health care financing”?

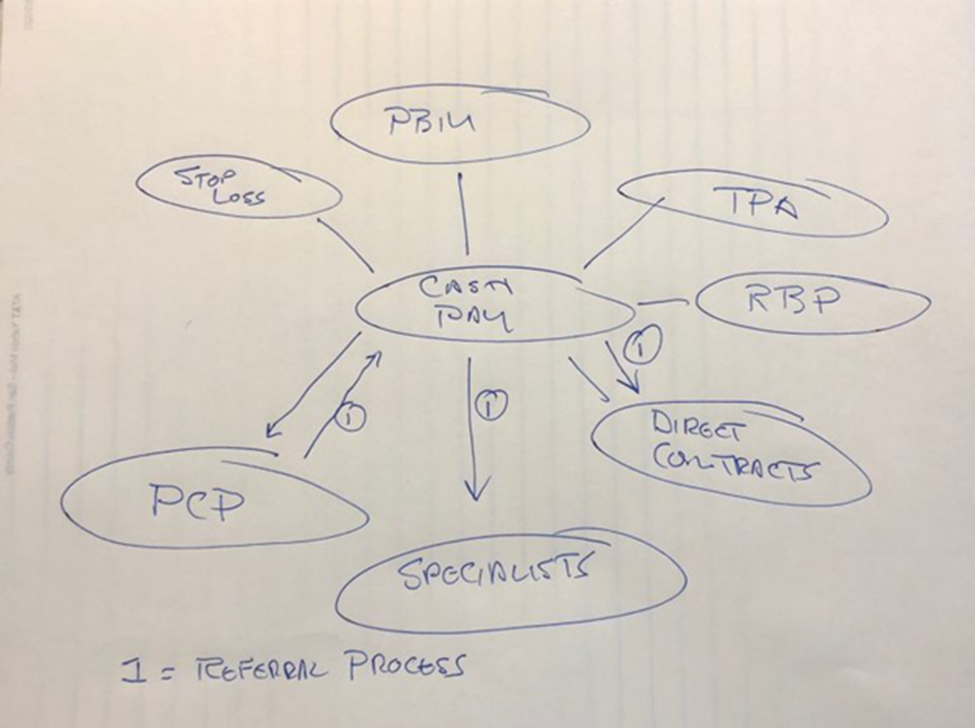

Without hesitation I replied “Cash paid at the point of service funded through plan assets.”

In partnership with a like minded plan sponsor we implemented our first Cash Pay Centric Heath Plan five years ago. The results have been phenomenal.

Cash Pay Centric Health Plans exist and are growing. The plan sponsor mentioned above is moving 80% of plan spend through cash, paid at the point of service. It has had an amazing impact on plan finances, improved patient experience and phenomenal buy-in among community care givers.

This is not rocket science and its easy to implement. It can be placed side by side to any existing health plan giving plan members a choice at the point of service between “Free Care” and “Not so free care.”

There is never a balance bill with associated threats of legal action and ruined credit. Savings are equal to or greater than Reference Based Pricing strategies. Egregious reference based pricing fees, some as high as 12% of savings off billed charges, are gone in place of a set fee averaging, depending on the size of the transaction, less than 2%.

The hedge fund eventually invested in a legacy Reference Based Pricing vendor who we all know. They are still selling Reference Based Pricing backroom support to self-funded health plans and have not moved into supporting Cash Pay Centric Health Plans. That would be against their business model and hurt their bottom line.

A key to business survival is the ability to adapt to change. In a March 2013 blog posting I wrote:

“The challenge facing successful business ventures is to understand the necessity to continuously respond to market forces in a proactive manner since competition will certainly become a factor to consider at some point. To ignore this basic business premise by remaining complacent is business suicide.”

This applies to all, including health insurance brokers. However, market acceptance through legacy distribution channels (insurance brokers) will be slow since transparent cash pricing does not lend itself to more lucrative fees earned through status quo health plans.

We are seeing more interest among plan sponsors in cash pay as a viable alternative to status quo managed care (PPO) plans. Cash pay adjudication at the pharmacy with real time exchange of money for services and supplies, something we have been doing for over 30 years, is now expanding to the medical side of group health plans.

What took so long?

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.