Some consumers who pay far more than the cash price of a medication when using health insurance.

When Should Patients Pay Cash for Prescriptions?

Published Online: Thursday, June 30, 2016

Community pharmacists are certainly accustomed to telling patients to use less expensive generic alternatives when they’re available, but how many are advising patients to pay with cash instead of using prescription drug insurance?

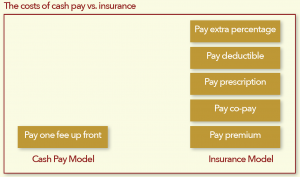

The latter strategy may actually make sense for some consumers who pay far more than the cash price of a medication when using health insurance. Unfortunately, this is especially true for generics. In fact, the added cost can run as high as $30 per prescription, according to a recent analysis by Kaiser Health News.

Cash prices started to dip below co-pays a decade ago, when several stores started offering dozens of generic drugs for as little as $4 per prescription. But, as co-pays increase and high-deductible insurance plans become more common, patients may be overpaying for their prescriptions when using insurance.

This phenomenon illustrates the complexity of how drugs are priced in the United States, which has spurred debate about who’s benefiting and who’s to blame. Pharmacists say the large pharmacy benefit managers (PBMs) handling benefit clams for millions of Americans are pocketing the difference, while PBMs say pharmacists are being greedy.

At the pharmacy counter, the patient pays their co-pay as set by their insurance plan. Days or weeks later, the PBM takes back a portion of that payment from the pharmacy after it determines what it will actually pay for the drug—a practice sometimes called a “clawback.” That money doesn’t go to the consumer, but is generally kept by the PBM.

“It’s a fraudulent misrepresentation to the patient of what is the cost of the drug,” Susan Hayes, a principal with a company that audits pharmacy programs on behalf of insurers, told Kaiser Health News.

Members of the National Community Pharmacists Association (NCPA) provided examples anonymously in a recent survey. None of the pharmacists surveyed would speak on the record in fear of being kicked out of PBM networks, so their anecdotes couldn’t be independently verified.

Nevertheless, one respondent indicated a major PBM required the pharmacy to collect a $35 co-pay for a generic allergy spray, then took $30 back from the pharmacy. Another said a PBM charged a $15 co-pay for zolpidem, then took back $13.05.

My initial impression was that pharmacists need to do what’s best for our patients, so we should be pushing them to pay cash for their medications if that’s the least expensive option. In some cases, however, pharmacists are specifically barred from discussing the cash price under terms set by contracts between them and the PBMs. In a survey of 650 pharmacists, more than 38% said they were unable to tell patients about cheaper cash prices 10 to 50 times in the previous month.

“We are required to run it through insurance and we do not have the option of advising the patient regarding matters of the terms of their plan or their options, or we run the risk of being cut from the network,” NCPA vice president for policy and regulatory affairs Susan Pilch told Kaiser Health News.

For their part, PBMs say patients pay the amounts specified by their insurance plan benefit design, and the amounts they take back can help hold down costs and slow future premium increases to the insurers and employers who hire them.

So, it seems community pharmacists are caught in a price war where they’re forced to charge patients higher prices for medications. Fortunately, several state legislators are stepping in to put a stop to these practices.

This month, Louisiana lawmakers passed legislation directing pharmacists to tell patients about their options, including less expensive alternatives. And last year, Arkansas lawmakers passed a law that bars PBMs and pharmacies from collecting more from customers for medications than the pharmacy will ultimately be paid.

I think these legislative efforts are a good start in curtailing price-inflating practices. In the meantime, community pharmacists can consider the following addition options:

- Cigna, Express Scripts, and other insurers have apps and websites where members can check drug prices at multiple pharmacies and decide for themselves how best to proceed.

- If a health plan or PBM doesn’t offer such an app, pharmacists can direct patients to check the cash price for prescriptions through websites like GoodRx.

- Although it might be less expensive to pay cash, pharmacists need to be mindful that cash payments don’t usually count toward annual drug deductibles. Therefore, patients who use cash and circumvent the insurance system may take longer to hit their annual deductible, or never do so.

- The high cost of medication is frequently cited as a contributing factor to nonadherence. Therefore, unless you’re prohibited by your PBM contract, consider offering your patients the lowest price possible. This is especially important for patients of lower socioeconomic status or those on a fixed income, where even a few dollars could make the difference between taking a medication or skipping a dose.

Reference

Appleby J. Filling a prescription? You might be better off paying cash. Kaiser Health News. cnn.com/2016/06/23/health/prescription-drug-prices-pbm. Published June 23, 2016. Accesssed June 29, 2016.