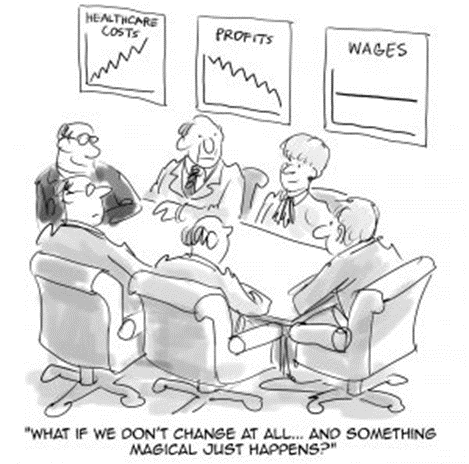

Attention Health Rosetta Advisors: Here’s an opportunity to bring sanity back to health care finance. This city’s reliance upon the BUCA’s has failed to control costs. Legacy brokers and consultants have failed to deliver desired results too. Doing the same thing over and over again is the definition of…………………..

Article Referred By Alex Zuniga (One of our three readers)

BY DINA AREVALO – STAFF WRITER – McAllen health plan faces big shortfall – MyMonitorNews.com (newsmemory.com)

McALLEN — As healthcare costs have risen nationwide, officials here have found that even the city’s penchant for conservative budgeting hasn’t been enough to keep pace — so much so that McAllen’s health insurance plan is facing a $3.2 million shortfall by the end of the fiscal year in September.

And if city leaders don’t take action soon, that deficit could top $7 million next year.

“As we look to the next fiscal year — as I mentioned, a 17% expected industry increase for our plan based on underwriting — you know, we’ve got some challenges ahead,” Jolee Perez, the director of employee benefits, said during a special joint meeting of the McAllen City Commission and the McAllen Public Utility Board Wednesday afternoon.

Officials first projected that health plan costs would go up beyond the level of funding that had been allocated during the fiscal budget planning process last fall.

As a result, the commission approved a series of adjustments in an attempt to head off the funding deficit, but it hasn’t been nearly enough.

“Had the changes that we implemented (on Oct. 1, 2022) not been … approved, we would be looking at a $6.5 million deficit at the end of this fiscal year,” Perez said.

The changes mitigated some $2.6 million of that deficit during the first half of the fiscal year so far, Perez explained. However, unless more changes are implemented, McAllen’s health plan ledgers will still wind up in the red.

“Now that we’re six months (into the fiscal year) … we believe we’re gonna actually end up this year at a negative $3.2 million in the active fund,” Perez said.

“That’s about a $3.8 million variance from what we had originally budgeted,” she said, explaining how far beyond the city’s original projections the deficit had grown.

And if the current shortfall isn’t corrected before the fiscal year ends on Sept. 30, then the city could be facing a much larger deficit in the following fiscal year.

“At the end of next year … with no changes, we would be looking — assuming the carryover deficit of $3.2 (million remains unaddressed) — at a $7.7 million deficit,” Perez said.

Perez explained that multiple variables, or “anomalies,” have contributed to the skyrocketing costs associated with insuring the city’s employees.

“If you look at the historical factors on these items, this is something that was outside of trend, outside of any kind of inflation impact. It was beyond something that we had enough data to predict was coming,” Perez explained.

Some of those variables include a higher-than-expected number of employees using their primary care and pharmacy benefi ts, an increase in “high dollar” claimants, a rise in administrative expenses and a lag in the processing of some claims.

In the first half of this fiscal year, primary care utilization was up by 30%, outpatient care by 21% and pharmacy benefits costs were $400,000 higher than expected, Perez said.

Another factor that has contributed to higher costs was the exit of Affordable Homes, according to Perez.

Affordable Homes was under the auspices of the economic development corporation, according a fiscal year 2021-22 budget.

The loss of those employees from the city’s health plan not only weakened McAllen’s bargaining power, but also meant that the costs of the plan were distributed across a smaller pool of people.

In order to combat the deficit, McAllen will have to make use of as many methods to mitigate costs as it can, Perez said.

One thing the city can do is to use money that has already been allocated for healthcare expenses, but that has not yet been used due to unfilled staff vacancies.

For example, if a particular department has 10 employees when at full capacity, then the city’s budget typically takes into account the payroll and benefits costs for all 10 employees for a full 12 months.

But, if that department is short one person for a few months out of the year, then that’s a few months’ worth of money the city has saved on those already approved expenses.

Perez recommended pulling those funds from the departments that have experienced vacancies and instead infusing them into the health plan deficit.

But perhaps the most impactful recommendation involves potentially joining up with the Health Action Council, a group purchasing nonprofit.

Currently, McAllen is covered by United Healthcare and Optum RX.

But when the city approaches insurance companies like United, Blue Cross/Blue Shield, Humana or others, it does so with the bargaining power of its nearly 4,000 city employees.

Becoming a member of the Health Action Council would allow the city to bring the might of its approximately 2.6 million members to the bargaining table.

Those employees represent 230 employers who use the service, including other Texas cities like Corpus Christi, Euless and Texarkana.

Neither the city commission nor the PUB took action on the recommendations Wednesday.

But it is something they will continue to mull as McAllen begins to work on the 2023-24 fiscal budget in a series of department workshops this summer.

If all the changes are implemented, Perez expects the health plan to climb back into the black by about $400,000.

“That’s not a comfortable surplus. It’s not a comfortable surplus, but we’re still trying to maintain being in the black so that we can … build that surplus for a rainy day,” Perez said.

Editor’s Note: It’s frustrating to read stories like this one. We know health care can be fixed and it’s simply not hard to do. Yet we keep seeing stories like this. Recently we were invited to a dinner at an expensive steakhouse in a major Texas city, hosted by a local political mover and shaker. After several martinis the conversation flowed towards topics that could later be labeled under “Plausible Deniability.” Seems a major Texas city was quietly selling off surplus city property in order to fund continuing deficits in their self-funded health plan.