By Bill Rusteberg

Last year I had the privilege to make a presentation to the Board of Trustees of a Texas independent school district. The district’s self-funded health & welfare plan was in trouble and they wanted to hear how we have been able to keep costs static over time for other school districts we have been fortunate enough to manage over the past twenty years. Those districts have beaten medical trend while improving benefits at the same time and at half the cost.

The situation this district found themselves in is not uncommon. The scenario that follows is common to most plan sponsors today who fail in their fiduciary duties to properly manage their second biggest budgetary expense and who rely on status quo consultants.

Typical Scenario

A self-funded health plan is imploding. Cost overruns have put the plan in a deficit position. The problem is obvious – the plan is under funding the risk plus expenses and the plan’s fiduciaries are crossing their fingers and hoping for the best. They take comfort in knowing they have a trusted, knowledgeable insurance consultant from a nationally recognized insurance brokerage in their corner.

A status quo insurance agent posing as a “consultant” offers status quo solutions. “Let’s cost shift to the plan members and save money! and “let’s throw more money at the plan and hope it’s enough and we have a better year next year!” This is the same spiel I used back in the 70’s proving some things never change.

To justify their recommendations these consultants point to the rising cost of new technology, an aging population, and new and expensive drugs.

And then there is the big one – unhealthy life styles. “If we take better care of ourselves we won’t need all this expensive health care treatment! Let’s implement a Wellness Program!” In other words, it’s all our fault that we are paying too much for health insurance. Shame on us!

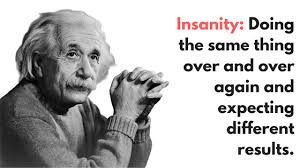

Pointing the finger at cost drivers over which a plan sponsor has been told there is no control solves the accountability issue of ROI of consulting services, a central protective thought process of status quo consultants. “There are some things beyond my control and it is what it is! I know your costs have increased under my tenure so far, but please renew my consulting agreement and let’s do the same thing all over again!. Maybe we’ll get lucky next year!” and “Let’s go to bid and pick the lowest cost vendor to manage our plan!” Deflecting blame for higher costs is a time tested self-preservation tactic of status quo consultants.

Pointing the finger at cost drivers over which a plan sponsor has been told there is no control solves the accountability issue of ROI of consulting services, a central protective thought process of status quo consultants. “There are some things beyond my control and it is what it is! I know your costs have increased under my tenure so far, but please renew my consulting agreement and let’s do the same thing all over again!. Maybe we’ll get lucky next year!” and “Let’s go to bid and pick the lowest cost vendor to manage our plan!” Deflecting blame for higher costs is a time tested self-preservation tactic of status quo consultants.

Cost shifting doesn’t lower costs. Throwing more money blindly into the black hole of health care financing created by secretive managed care contracts guarantees continued double digit cost increases. Wellness programs never work either.

So the plan sponsor renews their consultant’s contract and the process is repeated with the same results accompanied by condescending explanations. Some things never change.

New Age Consultants

Then there are those few consultants that produce amazing results without cost shifting of any kind. In fact these New Age Consultants employ strategies to not only reduce costs by as much as 20% and more, but improve benefits at the same time. Some even put their fees at risk. Plus, they guarantee no conflicts of interest, either direct or indirect. Their only compensation are fees paid to them by clients who retain their services.

![]() Rosetta Health consultants, and others, base their business model on this philosophy.

Rosetta Health consultants, and others, base their business model on this philosophy.

The later point on status quo compensation is important since most plan sponsors don’t realize that many status quo consultants rely on undisclosed compensation from vendors they recommend. This is common knowledge of those of us in the industry and is not disputed as a common practice. Through clever language these consultants can disclaim any direct compensation earned through work performed on behalf of their client. This conflict of interest drives recommendations.

Although I make it a habit never to respond to a public Request for Proposals for Insurance Consultant, I once did only to learn the low bid got the nod at a price I knew no one could not make a profit on such a low fee. In fact, it was obvious the winner would lose money on the case. Several years later this same consultant, who worked for a major nationally recognized brokerage was indicted for bribes, earning undisclosed compensation for recommendations he made to Texas school districts. He plead guilty and his license was revoked. He served no prison time.

The Board of Trustees Reaction

In my fifteen minute presentation I walked the audience through the complicated maze of the American health care system, exposing some of the most guarded and egregious secrets the health care industry doesn’t want anyone to know. I showed empirical results and documented evidence outlining cost drivers of which they have failed to control and to which they could control if they choose to do so. I had their attention. At least I thought so.

After I finished, one board member asked “How much do you charge?” The question should have been “How much will you save us?” Some things never change.

It is my understanding the district has failed to act on any of the strategies I outlined for them. Their costs continue to escalate and their status quo consultant remains in place.

Some things never change.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.

The shared vision of RiskManagers.us and clients who retain our services is to establish and maintain a comprehensive employee health and welfare plan, identify cost areas that may be improved without cost shifting to any significant degree, and ensure a superior and sustained partnership with a claim administrator responsive to members needs on a level consistent with prudent business practices.

Plan costs, in all areas including fixed expenses and claims are open for review on a continuing basis. Cost effective plan administration and equitable benefit payment to providers are paramount to fulfilling our mutual fiduciary duties. As we proactively monitor and manage an entire benefit program we are open to any suggestions members may make or the dynamic health benefit market may warrant in order to accomplish these goals.

Duty of loyalty to our clients, transparency and accountability are essential to the foundation of our services. To that end, we expect our clients to realize a substantial savings based upon the services that we will deliver.

2019 RiskManagers.us All Rights Reserved