Why did our fund balance fall so sharply last year? And why is it still declining? Our decline in fund balance is primarily due to our self-funded health insurance program, which is simply not sustainable as presently designed.

Due to our financially lopsided health plan, the district had to bail out our self-funded health insurance to the tune of $6.8 million in 2013-14. Based on current projections, we will need at least another $2.5 million bailout from our fund balance this year. Hence, another large fund balance decline this year.

Should we choose to continue the present course, our district, in all likelihood, will be at risk of running out of funds in 2015-16.

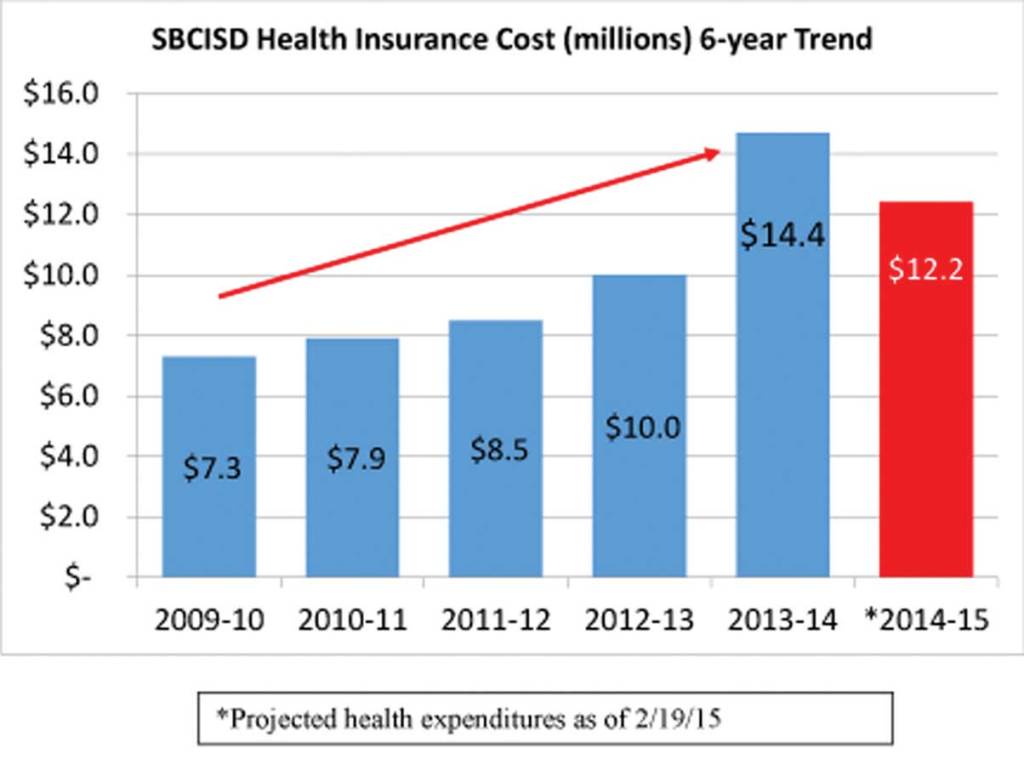

The graph shown above trends our health care expenditures over the last six years. Clearly, healthcare costs continue to escalate and our district simply can’t keep pace. This year’s amount is only a projection.

I will be presenting viable options to trustees that will enable our district to get out of the health care business, including the option of shifting over to the Texas Teacher Retirement System (TRS) insurance plan. The TRS state health insurance plan covers Texas public schools, universities, and charter schools. In 2014-15, out of 1,029 school districts, approximately 970 currently participate in the TRS insurance program.

Taxpayers, obviously other districts have figured out that their core business as a school district is teaching and learning–not health insurance. Shifting over to TRS health insurance makes smart business sense for our district. Remember, the critical importance of a balanced budget. This solution provides a mechanism to help ensure it happens, and equally important, helps us get back on the road to fiscal recovery.

See Full Article Below:

The Supt’s Scoop: Truth to the Taxpayer

By Dr. Marc A. Puig, Superintendent of Schools

As an educator, I firmly believe that the district’s budget is a moral document that determines whether districts are making “budgetary” decisions with the best interest of children in mind. We must be honest with ourselves as an organization before we can truly change the organization for the better.

We are making every attempt to do just that and all of us are working diligently to bring back the focus of operating with the best interest of students, staff and community in mind. It is absolutely critical that those of us that have been entrusted to safeguard the district’s coffers closely monitor our expenses and re-evaluate the way we conduct business from this point on.

With this said, as the district’s current leader, I am working with our trustees and key personnel to make progress while safeguarding the district’s current fund balance, which is at an all-time low. Today, I will discuss some of the measures that we are implementing to improve the district’s current financial standing. I trust that you, our community members, will remain patient and understanding while we work to resolve our current financial predicament.

Fact #1

The district began the school year with a budget deficit of $700,000; therefore, we are currently tasked with the “opportunity” to completely revamp the way we do business in SBCISD moving forward. My attempt is to work with leaders to balance the budget by instituting a zero-balance budgeting approach. I implemented this approach at another district by working with the board to solve their budget woes, thus enabling district officials there to balance the budget for three consecutive years. This is not rocket science. This simply means rebuilding the budget from the ground up. This approach involves efficiently allocating resources based on needs of the organization, rather than “wants” and “history.”

Taxpayers, I am in the process of working with my team to do the same in San Benito CISD. In taking the necessary steps in order to balance our district’s budget, we must make every effort to make decisions that are being done in the best interest of students, and as such, we must carefully evaluate the way we do business from this point on. And, you have my word that I will propose a balanced budget to the school board come August.

Fact #2

In last week’s article I presented a five-year fund balance trend analysis. This week, I illustrated our projected fund balance based on remaining estimated revenues and expenditures for 2014-15. In other words, this is how much money we will have in the bank at the end of the 2014-15 fiscal year (8/31/15) and when we open our 2015-16 fiscal year (9/1/15).

It takes approximately $8 million to run SBCISD every month. The projected $4.3 million fund balance places the district in an even greater financial danger. The Texas Education Agency recommends school districts maintain 2 to 3 months of operating expenses. As it stands today, we are projected to have only half a month of operating expenses on 8/31/15. Note the additional decline in our projected fund balance below.

Taxpayers, I share these stark facts because you must be completely aware of the need for urgency to swiftly improve our financial situation. I have proposed to trustees early solutions that will remedy our fiscal crisis, both in the short and long term. In the coming days, we will weigh these solutions very carefully. I greatly appreciate the board’s ongoing support and response to this urgency.

Fact #3

Why did our fund balance fall so sharply last year? And why is it still declining? Our decline in fund balance is primarily due to our self-funded health insurance program, which is simply not sustainable as presently designed.

Due to our financially lopsided health plan, the district had to bail out our self-funded health insurance to the tune of $6.8 million in 2013-14. Based on current projections, we will need at least another $2.5 million bailout from our fund balance this year. Hence, another large fund balance decline this year.

Should we choose to continue the present course, our district, in all likelihood, will be at risk of running out of funds in 2015-16. The graph below trends our health care expenditures over the last six years. Clearly, healthcare costs continue to escalate and our district simply can’t keep pace. This year’s amount is only a projection.

I will be presenting viable options to trustees that will enable our district to get out of the health care business, including the option of shifting over to the Texas Teacher Retirement System (TRS) insurance plan. The TRS state health insurance plan covers Texas public schools, universities, and charter schools. In 2014-15, out of 1,029 school districts, approximately 970 currently participate in the TRS insurance program.

Taxpayers, obviously other districts have figured out that their core business as a school district is teaching and learning–not health insurance. Shifting over to TRS health insurance makes smart business sense for our district. Remember, the critical importance of a balanced budget. This solution provides a mechanism to help ensure it happens, and equally important, helps us get back on the road to fiscal recovery.

Fact #4

Per the state’s school financial accountability rating system, known as the School Financial Integrity Rating System of Texas (FIRST), a district our size should maintain a staff to student ratio of no less than 7.0. This would mean a total staff of 1,569. At the start of 2014-15, the district had 1,716 employees.

The chart below illustrates our staffing and enrollment patterns. It is important to note that between the 2012-13 and 2014-15 school years, the district added a staggering 100 new positions while losing 186 students over the same period. This means for every student the district lost during this time frame, it added .54 staff. This lack of strategic staffing cost the district approximately $3.0 million during this span.

Solution

The good news is that we are on the road to recovery. We will be introducing a plan where our resources are spent strategically, thus allowing us to keep our staffing needs in line with our student enrollment counts. We are taking measures to carefully evaluate our hiring practices and determine our current staffing needs. For example, as positions become vacant, we are choosing not to fill those positions. It’s important to remind the community that as of January 5, we have already realized a savings totaling over $1,047,690 due to resignations, retirements and separation of personnel. Additionally, I am leading our team in preparation of responsible staffing solutions, including reductions across all departments.

Someone once said, “The truth is heavy, therefore few care to carry it.” While heavy, I ask that you join me in carrying this truth. As taxpayers, the district owes you accountability. You have my oath that I will work tirelessly to create a financial system that is both effective and efficient for those we serve first: our students. This will take careful planning, unwavering commitment and willing sacrifice from trustees, faculty and staff, and the broader community. I trust we will stand together in the truth. Our children are counting on us.

Sincerely yours,

Dr. Marc A. Puig

Further Reading:

Why Doesn’t Brownsville ISD Join The TRS ActiveCare Plan?

El Paso Independent School District Ditches Self Funded Health Plan