At TSHBP’s 2024 Spring Regional Meetings explore cost-cutting solutions for districts and employees facing budget deficits.

Continue reading TSHB Offers Free Food and Gift Cards For The Hungry & Gifted

At TSHBP’s 2024 Spring Regional Meetings explore cost-cutting solutions for districts and employees facing budget deficits.

Continue reading TSHB Offers Free Food and Gift Cards For The Hungry & Gifted

United HealthCare says they have hired nearly 20,000 doctors in 2023 alone, according to reports. It also counts an additional 40,000 advanced practice clinicians among its ranks.

Continue reading Puppets On A String

Ardent Health Services with 26,000 employees, 30 hospitals and over 200 sites of care in six states partners with a legacy Reference Based Pricing TPA to administer their own employee health plan powered by “a powerful alternative to high-cost managed care networks.”

Continue reading Hospital System Adopts Reference Based Pricing For 26,000 Employees?What Texas hospitals got in 2023 as a reward for their service – from a coalition of health insurance interests and like-minded lawmakers – was blame, and even a degree of demonization.

Continue reading “Cry Me A River” by the Texas Hospital AssociationMost hospitals offer discounts or bill forgiveness based on income. On average, a family of 4 earning less than $100,000 a year will qualify. We can help you apply — for free.

Continue reading Get Relief from Hospital BillsBy Paul Miller

Here is part of an insurance claim made by Mme. Léontine Pauline Aubart, a first-class passenger aboard RMS Titanic.

Throughout her twenties, Mme. Aubart was a nightclub singer, living at 17 Rue Le Sueur, Paris. She boarded the Titanic at Cherbourg with her maid Emma Sägesser, occupying cabin B-35.

Aubart was the mistress of millionaire Benjamin Guggenheim, who was also travelling on the Titanic’s maiden voyage. After the collision, she and her maid entered Lifeboat No. 9. As they clambered aboard, Guggenheim spoke to Mme. Sägesser in German, saying: “We will soon see each other again! It’s just a repair. Tomorrow the Titanic will go on again.”

Continue reading More Lloyds History By Miller

The Ozempic Pushers

Some fat patients say doctors are pressuring them to take the miracle drug instead of listening to their immediate health concerns.

Continue reading White Collar Drug Pushers Snub Fat People

A recent review of an Aetna ASO Agreement between a county and Aetna revealed the following provision:

“ASO rates are guaranteed until 10/1/23. If County changes medical and or pharmacy vendors in 2022, all unpaid pharmacy rebates from Aetna will be forfeited.”

Continue reading Aldeen’s Sunday Morning Bathroom Read (ASO Fiduciary Plan Design 101/Bart Simpson Chalkboard)

HOSPITAL ADMINISTRATOR: “Attention Employers, Give Me Your Poor, Your Tired, Your Huddled Employee Masses………….Why Pay For Health Insurance For Those That Don’t Need It?

This technology aims to streamline access to patient assistance programs, empowering individuals to apply for relief in minutes.

Continue reading IRC 501r Debt Dismissal Technology

Dear Father, Hope you and Mother are doing well since you left many years ago. Others have joined you since and I will too as soon as God allows. I’m happy you and Mother are dead as times have changed and you would be greatly disappointed if you were to come back for a day and read today’s paper as you used to do during your lunch break, coming home for a sandwich and a cold glass of beer in our sitting room while listening to the farm report on Channel 4. I’m glad you’re dead so you won’t have to live this and wonder what’s to come next. Your daughter and I will never forgo the values you and Mother instilled in us as we grew up. I still say “Sir” and fly the American flag in our front yard every day. Rest in Peace Dad!

Continue reading Dear Father, I’m Glad You’re DeadAs they walked in I thought “OMG, this has got to be one of the unhealthiest bunch of people I’ve ever seen in one room at one time!”

Continue reading America’s Most Flesh Heavy City

Judy, a purebred pointer, was the mascot of several ships in the Pacific, and was captured by the Japanese in 1942 and taken to a prison camp.

There she met Aircraftsman Frank Williams, who shared his small portion of rice with her. Judy raised morale in the POW camp, and also barked when poisonous snakes, crocodiles or even tigers approached the prisoners.

Continue reading Judy“Health insurance has long, long ago stopped being insurance; it’s an extremely expensive way of pre-paying for things that you know are going to happen”—Dr. Tony Dale,

SOURCE: Paul Alexander: ‘Man in the iron lung‘

Paul Alexander contracted polio in 1952 when he was six, leaving him paralysed from the neck down.

Continue reading The Man In The Iron Lung

Feeling bad? Sue the pharmaceutical company! And while you’re at it………..

Continue reading Here Come The Lawsuits!

You don’t want to miss this one! Schuessler knows how to rock an audience and get his message across at the same time, all delivered at levels both Joe Sixpack and the POTUS can easily understand. Much to the delight of eager attendees of previous speaking engagements, Schuessler, through his strange and foreign magical powers has proven over and over again the Ebbinghaus effect does not apply when he’s in the room.

Continue reading Carl Schuessler To Speak At Direct Primary Care Nuts & Bolts to 2.0 Conference

The majority of Texas school districts are members of the TRS ActiveCare’s (TRSAC) defined contribution government health plan representing more than 400,000 member lives.

Continue reading TRS ActiveCare Alternative – ICHRA

If you had bought Marpai stock when it was down near $1 days ago you could have doubled your money.

Continue reading Holy Smoke!

Pearlroth, who was fluent in 14 languages, spent upwards of seven days a week at the library…………..He was so relentless that library officials sometimes had to ask him to leave at closing time.

Continue reading Mr. Pearlroth

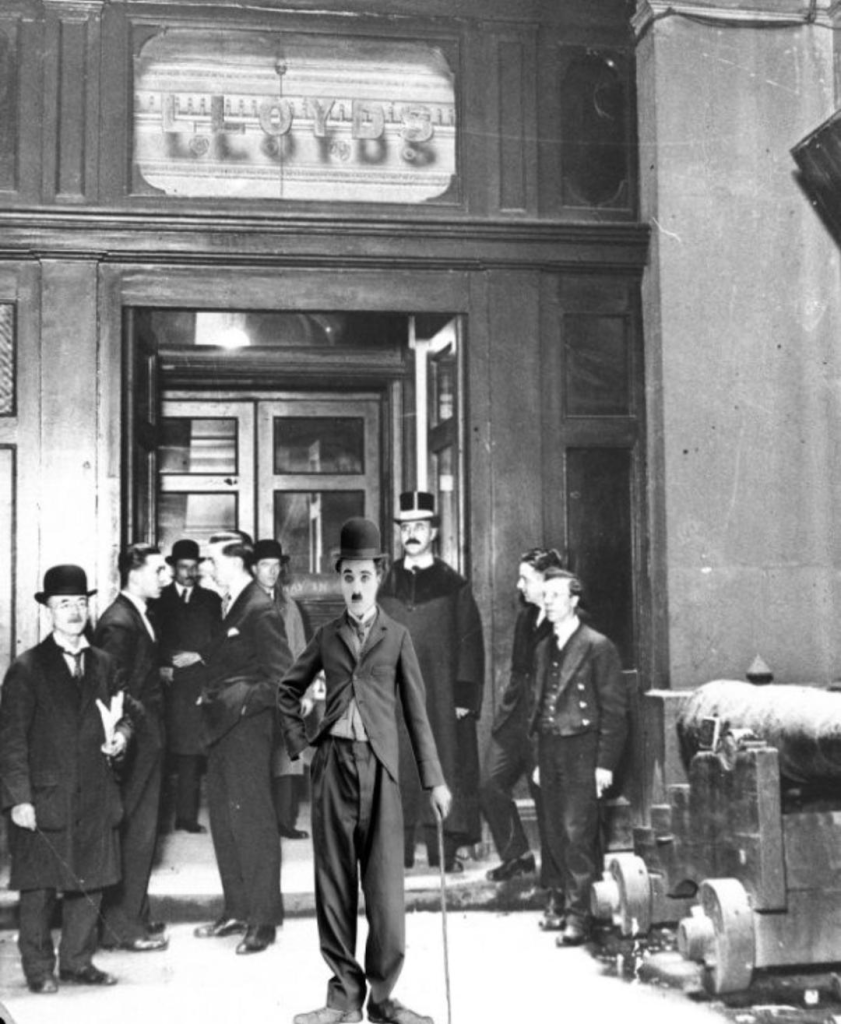

Charlie Chaplin’s original costume was insured at Lloyd’s of London in the mid-1920.

By Paul Miller

The cutaway coat, baggy trousers, over-large boots, felt hat and cane were covered whilst being transported to an exhibition in New York. Whilst they were said to be “worth two shillings to an old-clothes dealer”, they were insured for £10,000. Under the terms of the policy, the clothes had to be guarded at all times and kept in a vault when not being worn.

Continue reading More Lloyds of London History By MillerTRS ActiveCare has published a prospect list for insurance brokers interested in Texas public school business.

Continue reading Attention Insurance Brokers: Here’s Your Texas School District Prospect List

“I don’t find myself speechless very often” ` – Chris Bomberger,

” The Texas School Health Benefits program sent out the distress signal to districts that had pulled out of the state’s benefits system for educators: their reinsurer had pulled out of covering 51 Texas school districts who had negotiated their own benefits to find better cover coverage, better prices or both.”

Continue reading Reinsurer Pulls Out Leaving Texas School District Risk Manager Speechless

FAP Text Book Example: Memorial Herrman Financial Assistance Policy

Sunday Morning Bathroom Read (“If you RBP, the CAA requires you to check the FAP” /ERISA Plan Fiduciary/Part 2 of 2):

Continue reading Aldeen’s Sunday Morning Bathroom Read

Marpai Announces “Off-Cycle” New Client Agreement

Source: Marpai (Nasdaq: MRAI), 3/5/2024

Tampa — Marpai, Inc., an independent national Third-Party Administration company transforming the $22 billion TPA market supporting self-funded employer health plans with affordable, intelligent, healthcare, announced that it has signed a three-year agreement to provide healthcare benefit services to a regional organization based in the southeast.

Continue reading Marpai Announces Something But We’re Not Sure What It Is“Please don’t refer to our employees as Belly Buttons. It’s a very serious concern actually!”

SUMMARY: Brownsville ISD goes to bid for PBM services. Proposals received were ranked after an evaluation process lead by the district’s insurance consultant.

Continue reading Largest Employer South of San Antonio Hates Belly Buttons

“It used to be that pharmaceutical companies were working with the doctors. Now, unfortunately, pharmaceutical companies are captured by the price of their stock. Venture capitalists own the pharmaceutical companies, they own the clinical research organizations, they own the site, and they own the institutional review board. They own the advertising and the marketing. They influence through the media. And so, unfortunately – it’s a loaded question – but it’s a big market. And what we saw during this pandemic was the price of the stock mattered more than the price of a life.”

Continue reading Fear-Based Propaganda Profits Big Pharma

How To Find Out How Much Your Broker Is Getting Paid

Under new federal transparency laws health insurance brokers must disclose commissions /compensation to clients and prospects. Most have chosen to ignore the law and continue to do business as usual. Jeffrey Hogan offers tips for employers who are curious how much they are paying their broker but don’t know how to ask.

Continue reading Don’t Ask, Don’t Tell

The following information is not subject to any gag clauses, NDA’s or Non-compete agreements common to traditional managed care contracts. Students passing this test earn an honorary Doctorate from RiskManagers.us and will forever be addressed in the most appropriate manner, commanding respect and adoration within the close-knit world of fee-for-service health insurance consultants from sea to shining sea.

Continue reading What Do These San Antonio Medical Providers Have In Common?

Without rhyme or reason Marpai was up 30% yesterday, If you want the thrill of a roller coaster ride buy Marpai and fasten your seatbelt. Join us in gondola #1 for a front row seat.

Continue reading The Marpai Roller Coaster

One Saturday night, he was at a local pub which was also visited by five sailors who were on shore leave. Upon seeing Reed, they challenged him to a drinking contest. He out-drank them all, downing eight pints of beer, twelve shots of rum, half of a bottle of whiskey, and a couple of large glasses of cognac.

Continue reading More Lloyds of London History By Miller

McAllen doc, Edinburg medical assistant convicted of healthcare fraud

Continue reading Doctor Hides Bribes As Rent PaymentsYou can learn amazing things from retired people, i.e., old people who don’t have a dog in the fight anymore (that’s why ink flows better after age 65).

Continue reading Sugar, Sugar“

“I can make the case that almost no healthcare vendors care about anything other than setting themselves up to be acquired by the PE industry. Once purchased, all the PE firms care about is expanding profits quickly to allow for a quick flip. This includes RBR firms, TPAs, brokers, and PBMs. No one is advocating for the employer and when the efficient market concept kicks in, everyone will be sorry. Employers will eventually get their revenge on all the players who abuse their relationships many of which have fiduciary responsibility.” – Mike Dendy

Continue reading Quote Of The DayOne third of the government has decided Direct Primary Care is good for poor people too (the other two thirds are the Senate and the Executive Branch). It’s likely the other 2/3 will approve Crenshaw/Schrier Medicaid Primary Care Improvement Act.

Continue reading House Approves Direct Primary Care For Poor People

“We have a Frankenstein Health Plan! PLEASE tell us about your Sleeping Beauty Health Plan!” – Struggling in Pretoria

A recent post on Linkedin rings true:

“It’s a bit crazy that many brokers are so terrified of Medical Cost Sharing + DPC that they will put together the ugliest Frankenstein of a health plan with 12 different vendors and like 20 contracts for an employer who has no clue how it all works. The employees are utterly confused and need to be handheld by some random RN who serves as care coordination. Still almost no consumerism injected into the plan. Just a ton of steerage, coordination, and handholding. Is that really “innovative”? Yeah, I guess you saved the employer money for a few more years, but it still seems pretty unsustainable.” – Ben Butler

Continue reading An Antidote For Frankenstein Health Plans?

There’s good news for proponents barking “We need Medicare for all!”. It’s here.

Continue reading Medicare For All Is Here!

There’s been a lot of hype over this bill. But is all the enthusiasm warranted?

U.S, Senate Bill To the Public Health Service Act to provide for expanded hospital and insurer price transparency will probably pass but will it have it’s entended effect? We think its not so likely as evidencd by past history in which most hospitals simply choose to ignore the law and pay the fines.

Continue reading U.S. Senate Bill Sounds Good But How Effective Will It Be?

This is one of Aldeen’s best Sunday Morning Bathroom Reads. We suggest it should be extended as a Monday through Saturday Bathroom Read for his irregular readers.

Continue reading Aldeen’s Sunday Morning Bathroom Read (“If you RBP, you gotta check the FAP” Part I of II Edition)

Healthcare Class 101 is now in session. Read each question carefully and answer to the best of your ability. There are no trick or multiple choice questions. You have three minutes to complete the test.

Continue reading Managed Care Network Quiz

Most Americans have health insurance through their employer. But according to this article 45% of employees have medical debt and its impacted their ability to put food on the table……….

Continue reading American Health Insurance Will Bankrupt You

“Somewhere in the world there is the world’s worst doctor and someone has an appointment with him this afternoon” – George Carlin

Continue reading What Do You Call The Guy Who Graduated At The Bottom Of His Class In Medical School?

It’s tough being a health insurance broker these days. Fewer carriers to work with and the new pesky transparency law requiring commission disclosure is enough to drive one to drink……………….or voluntary benefits selling.

Continue reading How Health Insurance Brokers Can Avoid Extinction & Earn Bigger Bucks

Blue Cross CEO saw pay cut to $15.7M amid jump in medical, pharmacy claims

JC Reindl – Detroit Free Press

The top executive at Blue Cross Blue Shield of Michigan took home slightly less pay last year as the insurance giant experienced an underwriting loss amid a 12% jump in medical and pharmacy claims, including growing cost pressure from popular weight-loss drugs like Ozempic.

Continue reading Blue Cross CEO Suffers $1.2 Million Pay Cut

Editor’s Note: Years ago, many years ago, I leased my services and talents to a major BUCA in return for a salary and benefits (I was labeled an “employee”). I was very good at sales and made the company a lot of money. Then six years later my client (The BUCA who paid me for my services and talents and who recognized me as an “employee”) asked me and all the other employees to sign a non-compete agreement. I refused. “Bill, if you don’t sign you will be terminated!” my boss said. “Ok, terminate me” I replied. They didn’t. Anyone who signs a non-compete is an idiot. BTW – NDA Agreements are Bullshit too.

Continue reading Non-Compete Clauses Are BullshitDoctors who accept health insurance forfeit more than half their pay to do so through labor costs and fixed cost overhead.

Continue reading Why Doctors Don’t Accept Health InsuranceStart 38.15

Edinburg Independent School District’s insurance consultant discusses international sourcing of prescription drugs as a cost effective option to high cost American specialty drugs.

Continue reading ECISD Considers International Rx Sourcing

The newer generation of people you’re trying to recruit and retain want more choices and more say in selecting the benefits that fit them best.

Continue reading ICHRA – A Game Changer

“Sutter left Donovan with no other option. Thus, in early December, Donovan filed her claim in Superior Court of California for Alameda County: Leslie H Donovan v. Sutter Health Billing Department.”

Continue reading A Hospital Bullied a Mom With an Overpriced Medical Bill. She Bullied ‘Em Back.

Taking a job as a door-to-door salesman for Combined Insurance the slick-talking salesman was a natural. He broke a company record by selling 271 policies in one week.

Continue reading He Broke The Company Record By Selling 271 Policies In One Week

Double Indemnity is a 1944 thriller. It stars Barbara Stanwyck as a housewife who is accused of killing her husband for insurance money and a claims adjuster whose job is to investigate.

Continue reading More Lloyds Of London History By Paul Miller

“I’m at a healthcare conference. Was talking to a presenter this morning about our health plan. He said we are progressive, so much so even most of the consultants here are behind us. A nice testament to the excellent work you did for us.”

Continue reading Text Message From Former Client Is What Business Should Be All About

THE PROBLEM

Competing for hourly workers is tough business. It’s a price war. Employees leave at the drop of a hat, chasing nickels and dimes, flipping burgers right down the street in plain view instead of serving your customers at a dime an hour less.

Continue reading CAPITATED PER LOCATION BENEFIT PROGRAM FOR HOURLY EMPLOYEES

TX Drivers :You may be eligible to receive a massive discount on your insurance. New rules greatly favor those who drive less than 50 miles/day, and insurers are scrambling as drivers learn about this. Those who live in qualified zip codes can get even larger discounts.

Continue reading Texas Insurers Scramble After Drivers Learn About Hidden Rebates

By Guy Culpepper MD

The supply of family physicians cannot be raised or lowered based upon yearly market fluctuations.

Continue reading Primary Care Is Not Scalable

Name Redacted At Request Of Family

A prestigious cardiologist died last week and was given an elaborate funeral by the hospital he had worked for most of his life.

Continue reading Room Temperature Cardiologist Departs In Style

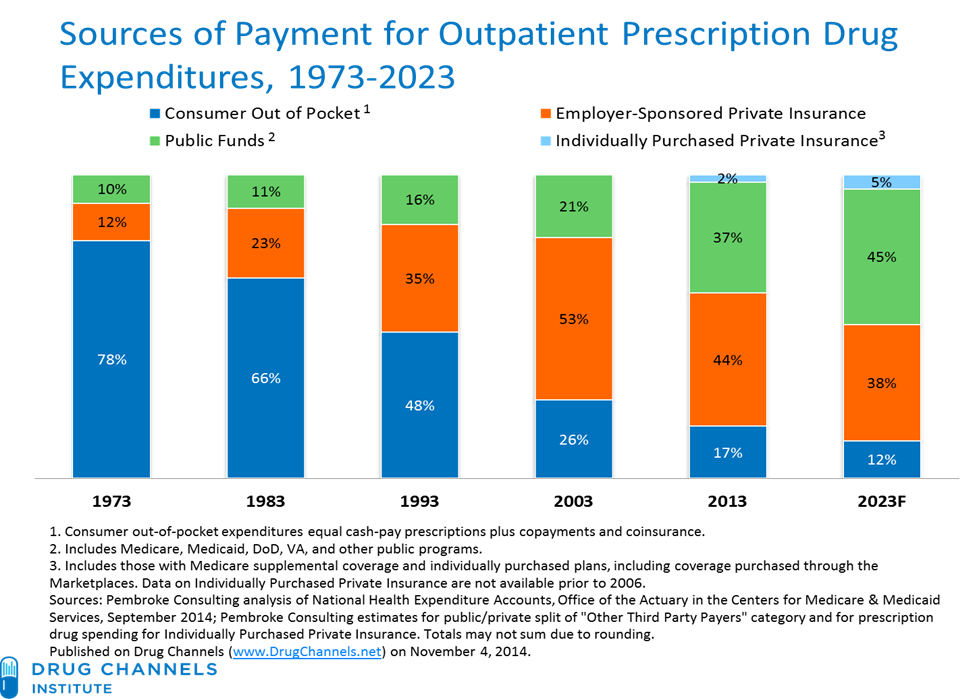

If you are a Public Organization with a self-funded plan it is expected you will be part of the 46% total expenditures of prescription public cost in 2024! The chart above shows changes in absolute spending, by payer.

Continue reading Public Employers Rx Spend Expected To Skyrocket

At the end of the Mexico-Tenochtitlan Conquest, Hernán Cortés began the construction of the hospital known as “El de la limpia Concepción de Nuestra Señora,” at the place where he had first met Moctezuma.

Continue reading Oldest Hospital In North AmericaBlue Cross agent bonus program is limited to a measly $500,000. Aetna competes for the same brokers by offering an unlimited bonus program. Now we see United Healthcare matching Aetna’s unlimited bonus program with a program of their own.

Continue reading 2024 UnitedHealthcare Agent Bonus Plan Announced!

Blue Cross pays brokers a “Loyalty Bonus” of up to $500,000. Now we see Aetna competing for brokers with what appears to be an unlimited “Loyalty Bonus.”

Continue reading Aetna Competes For Broker LoyaltyBy Julie Selesnick, Attorney

Seriously, all the handwringing over how complex our healthcare system is and why cost containment is so difficult is silly—the answers are pretty obvious. Here is reason Number #1: The #BUCA billions—this is what we are overpaying for—the billions raked in annually by UnitedHealth, CVS, Elevance, Cigna, Centene & all the other major carriers & PBMs.

Continue reading An Obvious Indication Of Why Health Care Costs Are High

Paying health insurance claims is more than just paying providers. You’ve got to pay a whole lot of other people first and it’s adding up fast.

Continue reading Third Party Fees Add Up Fast

“What brings you in today?” asks the admissions clerk. “What brings you in today asks the nurse?”

Continue reading Why See The Nurse When You Can See The Doctor?

In response to a previous blog posting (SEE POSTING HERE) we received an email from a primary care physician we know asking if insurance sales was an opportunity for him and “if so, how?”

“By Golly!” I thought, “He’s on to something!”

Continue reading Independent PCP Considers Insurance Sales

BCBSTX announces 2024 bonus program for individual and group sales……..

This bonus program is in addition to (and separate from) all other BCBSTX bonus programs. The maximum payout per contracted producer or agency is $500,000 per participating plan state.

Continue reading Earn An Extra $500,000 Under BCBSTX 2024 Bonus ProgramNewly minted dentist treats his first patient who is in immense pain.

Continue reading Dentist Treats His First Patient

Be aware whatever you tell your insurance company can be weaponized against you faster than a speeding bullet by armed politicians working against your vested interests.

Continue reading Beware Of Insurance Company Rats

Ozempic, Mounjaro makers hit with ‘stomach paralysis’ lawsuit

Stomachs remain full of days-old rotting food, which is unusual because less than 10% of food consumed is left in the stomach four hours after a meal

Continue reading Jaclyn Bjorklund Files Rotting-Food Stomach-Paralysis Lawsuit

The UNITED STATES and some other countries require a prescription on all medications sold from Mexico. They further require documentation in English and an invoice of all medicines sold for customs. For these countries, Medicina Mexico is now delivering your medicines to Dr. Isaac Reyes, MD (Ced. Federal 644884) (Ced. Estatal 1537-02/05) along with the required documentation including documentation on each medication sold in English is from Wolters Kluwer.

Continue reading MexRx

Health insurers mark up prices of generics for cancer, multiple sclerosis and other complicated diseases

Continue reading Generic Drugs Should Be Cheap, but Insurers Are Charging Thousands of Dollars for Them

By Armando Polanco

Great read below on who sets the prices on prescriptions in the United States

Continue reading Pharma CEOs Grilled By Senate