Ralph Weber

Ralph says bundled health care pre-negotiated cash pricing comes in at an average of 108% of the Medicare rate. That’s a very good number in case you’re wondering……………….

MediBid is Pleased to Announce Its New Medicare Allowable Lookup

MyHealthGuide Source: MediBid, 6/4/2019

TEXAS – MediBid is bringing convenience and price transparency to the next level. When a patient/employee of a MediBid member organization makes a request for a procedure, they see an estimate of the allowable charges, and the average bid on the procedure in the last 6 months (price transparency). The request is sent, via MediBid, to 19,000 providers who are allowed to place a “Bid” on the procedure (market thickness).

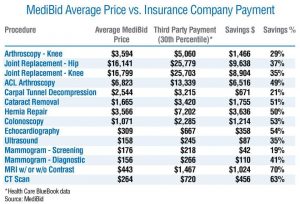

The providers see the average bid placed in the last 6 months, so they actively are competing for the business unlike current pricing models. The employee logs in to their account, sees an estimate of maximum allowable charges, and estimates of what insurance companies would pay as well as bids and often second opinions specific to their request (bid benchmarking). Along with the cost, the employee sees the location, the quality and outcomes of the provider, as well as their training, education and experience. The matching process is seamless and stakeholders are empowered with insights on prices.

Based Pricing is growing very rapidly with many employers adopting the concept as well as the states of North Carolina with 727,000 employees, Montana with 35,000 employees, and pending legislation in Tennessee involving 280,000 employees. Reference Based Pricing removes the Preferred Provider, or “PPO” Network from a plan, and uses a Reference Price plus a margin. That reference is usually the rate that Medicare pays plus a percentage margin. Reference Based Pricing can reduce employer healthcare costs by 25% to 35%. MediBid’s model has reduced employer healthcare costs by 35% to 67% through the introduction of the market forces of competition and transparency.

Although Reference Based Pricing concepts are a quantum leap in cost containment, some models are uncomfortable for HR professionals. There are 2 main models for RBP: Prospective, and Retrospective. In a retrospective model, the Third Party Administrator (TPA) tells the employee to go anywhere they want and then if and when they receive a balance bill, they will attempt to settle, negotiate or litigate it after the fact. Some Prospective Reference Based Pricing Models involve Direct Contracting. This is less confrontational, but usually the facilities will charge the maximum allowable charges minimizing the savings for the employer.

MediBid enhances the prospective model:

- (i) we show employees what prices to expect, based on private insurer and Medicare pricing, as well as MediBid previous auctions’ bid prices;

- (ii) when providers bid, they see prices for pertinent procedures paid by insurers and CMS; and

- (iii) we match each employee request with a thick market of bidders.

Result: a transparent, thick market that gives employees the best value and providers to compete and maximize market reach.

In 2018 over $74.8 million dollars of requests were made with bids coming in at an average of 108% of the Medicare rate. While the “fight after the fact model” involves the employee actually RECEIVING a balance bill and the direct contracting model involves a narrow network by another name. To quote Shakespeare, “a rose by any other name…”. MediBid employs a fully transparent proactive automated platform built to embrace competitive forces of an auction model.

In the last 3 years, Amazon has hired over 200 PhD economists, and in the last 10 years no less than 3 economists have won a Nobel Prize for studying auctions and market design, now, MediBid is applying the cutting edge market design knowledge to transform healthcare. We have been in discussions with the states of Washington, North Carolina, and Tennessee, as well as CMS about deploying our model to reduce healthcare costs.

About MediBid

Most marketplaces thrive with transparency and competition, and we believe that a lack of transparency in medical care has resulted in higher prices. Most of the time the cost of medical care is determined after the care is received, and you can’t negotiate prices properly because there is no way to give back the medical care if you’re unhappy with the price. We believe this inability to negotiate is why health care is now the single largest component of the American economy. We believe the only solution is to get the price in advance, and shop for care based on value in medicine. Contact Ralph Weber atRalph@medibid.com, 888-855-MEDI and visit www.MediBid.com.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The following excerpt is from a John Goodman article published in Forbes 22 May 2018:

The average knee replacement on MediBid costs around $15,000. The normal charge by U.S. hospitals is around $60,000 and the average insurance payment is about $36,500. A similar range exists for hip replacements, with an average Medibid price of about $19,000.

Medibid currently has 265,000 paid subscribers. That is, 265,000 individuals have paid for access to MediBid to shop for medical care, including 83 employer groups. Weber says employers using MediBid generally will save between 40% and 65%. He says they reduced the costs for one employer with 260 people from $2.3 million annually, to only $900,000. Another employer with 285 employees saw a reduction from $2.1 million to $1.1 million.

Medibid currently has 265,000 paid subscribers. That is, 265,000 individuals have paid for access to MediBid to shop for medical care, including 83 employer groups. Weber says employers using MediBid generally will save between 40% and 65%. He says they reduced the costs for one employer with 260 people from $2.3 million annually, to only $900,000. Another employer with 285 employees saw a reduction from $2.1 million to $1.1 million.