RBP can save a self-funded plan a lot of money and create immense opportunity to permanently improve the benefits for employees in that plan; however, RBP can also create an environment for conflict, individual tragedy for plan members, and protracted litigation…………….

Published on May 8, 2018

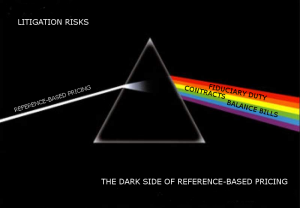

For many employers, Reference-Based Pricing (RBP) is a shining light of hope to contain rising health care costs, but, like light through a prism; it is possible to “shine” RBP through a few court cases to separate out and better understand all of the risks. I don’t plan on weaving this analogy into the rest of the article, but feel free to print this out and use different colored highlighters as you read.

RBP can save a self-funded plan a lot of money and create immense opportunity to permanently improve the benefits for employees in that plan; however, RBP can also create an environment for conflict, individual tragedy for plan members, and protracted litigation. These risks sound harsh when listed in a single sentence, and they are not unique to RBP: risks certainly exist in any endeavor to reduce cost in health care and should be objectively considered before adopting any new approach. Therefore, when RBP is a viable option; the best approach may be to:

- learn the risks;

- conduct an informed implementation based on your risk tolerance; and,

- remain open to compromise and pivot if a better alternative becomes available.

This article focuses on the first step in the above process for an employer: learning the risks in the implementation of an RBP program. The sources for this article – publicly-available pending federal court cases – provide a window into the conflicts occurring at the moment. However, an important theme in this article is that the courts have not yet passed judgment, and neither should the reader.

Over the past year only a few (seven) important federal lawsuits have surfaced in Oregon, California, Colorado, Nebraska, Utah, and Florida against patients, employers, employer plans, third party administrators, and the RBP vendors (see case cites below). Some of these cited cases are narrow (focusing on a specific claim) and some are global (covering all past RBP activity relating to a major hospital system spanning multiple years). The numerous claims alleged in these cases include fraud, breach of contract, misrepresentation, unfair business practices, and ERISA violations. That said, these cases are all in early stages, appear vigorously defended by the vendors, and could settle or be dismissed prior to any damaging precedential decision identifying any wrongdoing.

Generally there are twelve significant challenges in these RBP cases, briefly summarized in the following list. These summaries are not comprehensive and should be read in context with the primary sources, which are available to the public on www.pacer.gov.

Do not use this article to broadly condemn a product, RBP company, or hospital until the judicial process is concluded, and reserve judgment until you have completed a proper cost/benefit analysis of all medical service and RBP products, including successes.

RBP Challenges:

Recent lawsuits have identified the following problems arising out of plans adopting an RBP model:

- Plan Language Issues.

In the Salinas case (California) the hospital argued that the plan language broadly defined the benefit payment as usual and customary, then the plan later used less prominent language to explain that payment was limited to Medicare amounts and costs. This argument indicated the total plan document was ambiguous and confusing and attempted to void the less prominent limitation on payments.

- Access.

Hospital systems in a number of the cases have requested injunctions to prevent certain aspects of an RBP program, which, if granted, could cause a plan to restrict access to that system for its employees. Also, as a response to prior encounters with RBP products, some hospitals have begun to send out preemptive letters to brokers and partners to cut off implementation of an RBP solution and threatened to balance bill the patient on any RBP claims.

- Breach of Fiduciary Duty.

Generally hospitals have made broad claims for breach of fiduciary duty against a plan for implementing an RBP program. These claims allege improper payment according to the plan language and an arbitrary claim process. Also, in the Nebraska case, the plan claimed that the RBP vendor entered into a prohibited transaction where the RBP vendor and other vendors benefited from a transaction that involved alleged conflicts.

- Injunction and Declaratory Judgment.

Hospitals have asked the court to issue injunctions against the plan to prevent further RBP vendor marketing activity. They have also asked that the RBP vendor be required to identify itself on all insurance cards. Further, the Centura Health case (Colorado) asked the court to declare whether or not related contracts the hospital has with other parties (patients or administrators) are valid, which could expand collection efforts to all claims where the contracts were in place and not just the claim in the lawsuit.

- Unlawful Trade Practices.

The San Antonio Regional case (California) alleged that the payment was unjustly reduced and violated California’s unfair business practices act. The hospital requested interest at 10-15% per annum in the lawsuit.

- Implied Contract and Unjust Enrichment.

The Homestead Hospital case (Florida) outlines the basic arguments that an implied-in-fact and implied-in-law contract was created when the services were provided, and it should be enforced. The hospital identifies that the plan administrator knew the members would seek services, approved the services, and gave notice through ID cards that the plan would be responsible for the payment for services (implied in fact). Also, the plan administrators voluntarily enjoyed the benefits of the medical services and were unjustly enriched by the retained benefits; therefore, it would be inequitable for the plan administrators to retain the benefits (implied in law).

- Misrepresentation, Injurious Falsehood, and Fraud.

The Salinas Case (California) and IHC case (Utah) alleged misrepresentation and fraud in the RBP products. In the Salinas case the hospital outlined how the plan stated the coverage would be 80% of the hospital bill when the plan knew the payment would be 80% of the RBP calculated amount. In the alternative, the hospital argues the plan should have known about the differences in payment (negligence). The IHC case alleges that the RBP vendor misrepresents to employers and plan members that they can go to any provider, sign any agreements presented to gain admission, and later disregard claims under those agreements for payments beyond the RBP determined amount. IHC argues that any statements that the hospital will accept the RBP payment as payment in full is false and/or reckless. Further, IHC alleges that the member cards presented by the members give a false appearance of third party liability on the claim without clear reference to the RBP product. IHC also claims the misrepresentations are intentional, which elevates the accusation to fraud.

- Balance Billing, Maximum Out of Pocket (MOOP), and Patient Collections.

All of the RBP cases include collection activity or the threat of collection activity related to the patient. The Colorado case and Oregon case name the patients as parties in the lawsuit and seek direct damages from those plan members, while the other cases reference additional patient liability on the claims. Also, the preemptive letters issued by hospital systems provide notice that balance billing will occur on each claim. There are allegations in the complaints that RBP violates MOOP restrictions and requirements because patients end up paying more than the maximum out of pocket and the use of RBP creates an inadequate “network.”

- Breach of Contract and Account Stated (patient).

The Centura Health case provides an outline of the breach of contract claim against a patient: Centura recites the provisions from the contract signed at admission to pay any balance, argues the services were performed and that a balance remains unpaid according to the contract. Further, Centura alleges the elements of a claim for account stated: 1) Centura presented statements of the balance owed, 2) and Centura and the patient expressly or impliedly agreed that the amount owed was correct and accurately explained.

- Interference with Economic Relations.

In the Utah case, the hospital asserts that there were existing and potential economic relations with employers and plan members, and the RBP vendor interfered using improper means. IHC alleges the RBP vendor induced employees to enter into admission contracts with the hospital with the false promise that the employees could go to any provider and obtain care by signing admittance agreements; IHC alleges the RBP vendor did so with the intent to prevent later collection of the balance on those agreements.

- Indemnity.

The Salinas case questions whether the RBP vendor has provided indemnity to other parties in order to determine liability for the balance owed. Also, a number of the cases identify that the RBP vendor has already provided defense services to the patients and the plan, and possibly directed the defense. There hasn’t been a court ruling yet on whether there is an indemnity or defense obligation in the RBP vendor agreements with plans.

- Claims Between the Plan and Vendors: Fees, Reporting, and Breach of Fiduciary Duty.

The Nebraska case is unique in that it involves a lawsuit by the plan against the RBP vendor as a result of an earlier hospital collection action against the plan and its members. Generally the complaint alleges the fees and reporting were not accurate, requests an accounting, and accuses the RBP vendor and administrators of wrongdoing.

General Concluding Statement Regarding RBP in the Courts

While the overall RBP savings for an employer can be unprecedented in today’s health care market; Reference-Based Pricing (RBP) is not without risk, litigation, and potential collection actions for some unlucky plan beneficiaries and their employers. Yet, with hundreds of plans implementing RBP and hundreds of millions of dollars in savings at stake, there is definitely a utilitarian argument for these products in this tumultuous market. At this early stage, it is difficult to determine whether these few cases are campfires in the forest, or small forest fires near a campground. Until the courts have issued opinions on these challenges, savvy consultants might recommend cautious optimism for any plan succesfully utilizing RBP, and a willingness to eventually pivot or compromise in order to protect the fund, and most importantly, the beneficiaries.

Case List:

Oregon: Filed 03-17-2017

- Providence Health & Services-Oregon vs, S.P.M. Personal Representative of the Estate of R.K.P, in official and personal capacities, and ELAP Services LLC.

- Claims: Breach of Contract, Breach of Fiduciary Duty, Breach of Oregon Unlawful Trade Practices Act.

Nebraska: Filed 10-31-2017

- Central Valley AG Cooperative and Central Valley AG Cooperative Health Care Plan vs. Advanced Medical Pricing Solutions, et al.

- Claims: Breach of Fiduciary Duty, Injunctive relief to halt further services.

Utah: Filed 12-01-2017

- IHC Health Services, INC. vs. ELAP Services LLC.

- Claims: Intentional Interference with Existing and Potential Economic Relations, Injurious Falsehood, Fraud, Negligent Misrepresentation, Declaratory Judgment, Preliminary and Permanent Injunction.

Colorado: Filed 01-31-2018

- Centura Health Corporation (Littleton Adventist) vs. D. A., MYR Group, ELAP Services, Professional Benefit Administrators, Inc.

- Claims: Declaratory Judgment (validity of contract for all patients), Breach of Contract (against patient), Account Stated (against patient).

California: Filed 12-08-2017

- Salinas Valley Memorial vs. Envirotech Molded Products Inc. and ELAP Services.

- Claims: ERISA violations, Intentional Misrepresentation, Negligent Misrepresentation.

California: Filed 03-08-2018

- San Antonio Regional Hospital vs. ELAP Services and Group and Pension Administrators, Inc.

- Claims: Quantum Meruit, Monetary Damages and/or Permanent Injunction, State Unfair Business Practices.

Florida: Filed 04-24-2018

- Homestead Hospital, Baptist Hospital of Miami, et al. vs Group & Pension Administrators Inc.

- Claims: Breach of Implied-in-Fact Contract, Unjust Enrichment/Breach of Implied-In-Law Contract, Promissory Estoppel.

** This document contains general, condensed summaries of actual legal matters, statutes and opinions for information purposes. It is not meant to be and should not be construed as legal advice. Readers with particular needs on specific issues should retain the services of competent counsel. Released under the Creative Commons License Attribution.