The parents of Maddux Brown saved big when they learned that nonprofit hospitals are required to provide financial assistance. You and your loved ones could, too!

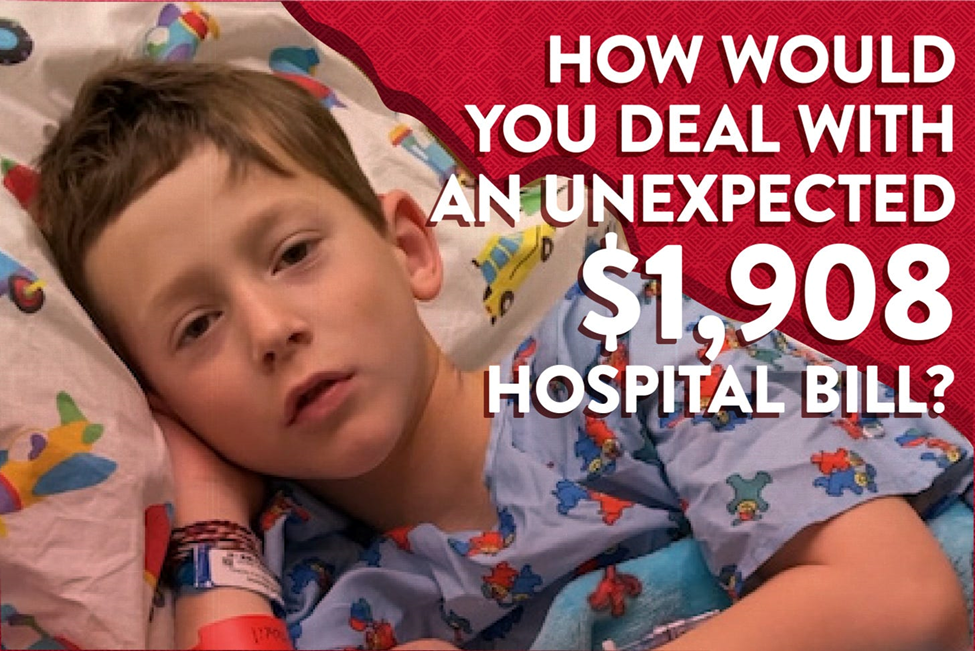

When 6-year-old Maddux Brown underwent a 15-minute surgical procedure his dad Jason didn’t expect the bill to empty his bank account.

Doctors had removed a concerning mole from the boy’s neck on Valentine’s Day at Children’s Healthcare of Atlanta, and the procedure had been a success. But weeks later Jason did a double take when he saw the bill. His insurance plan paid $3,634 and he was billed for an additional $1,908.

Jason felt like he’d been punched in the face. He thought he’d only have to pay a few hundred dollars. Jason and his wife have two young sons. He is a technical writer and editor for a transportation consulting firm, and the author of two personal finance books. The family didn’t have an extra two grand lying around. That’s true for many of us. Unexpected medical bills are crushing family budgets across the country. About 2 in 5 Americans either could not pay a $500 medical bill or would have to pay it off over time, according to a recent Kaiser Family Foundation poll.

Jason and his wife didn’t want to go on a payment plan and considered letting the bill go to collections. He felt frustrated by the whole experience as a health care consumer. “When you get these bills it’s like they’re just pulling numbers out of a hat,” he said.

As the couple was wrestling with this new financial burden, Jason heard about my appearance on the How To Money podcast. He listened and heard me talk about my book, “Never Pay the First Bill: And Other Ways to Fight the Health Care System and Win.” “It was good inspiration,” Jason told me. “I was like, ‘Let me just see.’”

The next day, he called the hospital billing department. “Look, we’re not going to be able to pay this,” he told the billing rep. “I don’t know what to do.”

“You can apply for assistance,” the representative told him.

I write about hospital financial assistance policies in my book and have a helpful how-to video about them in my Never Pay Pathway health literacy videos. The IRS requires nonprofit hospitals to provide financial assistance to patients who can’t afford their bills. The programs are supposed to be well publicized but patients often don’t hear about them. The criteria to qualify are based on income and may vary — some hospitals are stingier than others — but people with modest incomes could have their entire bill forgiven. Middle class families can benefit, too. The Children’s Healthcare of Atlanta policy, for example, shows that a patient from a family of four qualifies for financial assistance if the family income is up to about $90,000!

It only took about 30 minutes for Jason to complete the paperwork. The hospital required him to verify his income, so he attached a pay stub and W2 form to his email. He hoped for a discount of 20 percent, or at the best 50 percent.

A letter from the hospital arrived about two weeks later and Jason’s wife almost fainted when she read it. “We are pleased to tell you that you are eligible for free services because of your income,” the letter said. “We are therefore writing off the above hospital balance.”

The discount was 100 percent!

“It was a massive relief to have that financial burden removed,” Jason said. “I had to look at that letter several times and make sure I read it correctly: ‘Did they say the balance was zero?’”