No one has been able to determine how much a PBM is profiting from its secret “deals” with manufacturers………..Express Scripts lawsuit raises eyebrows…………..

Express Scripts Lawsuit Should Raise Everyone’s Eyebrows

SOURCE: nationalprescriptioncoveragecoalition.com

For years, every PBM has refused to disclose the “rebates” that it earns on a drug-by-drug basis. As a result, no one has been able to detect the “net cost” of any drug (factoring in rebates), which means no one can assess whether a PBM’s formularies and programs favor higher-cost or lower-cost drugs.

Every PBM has also refused to disclose how much in “other monies” the PBM is secretly being paid by manufacturers to favor the manufacturers’ products. As a result, no one has been able to determine how much a PBM is profiting from its secret “deals” with manufacturers, or the amount that the PBM’s clients lose in potential savings because a PBM re-labels “rebates” with another name to avoid sharing those monies with its clients.

But a few days ago, Express Scripts filed a lawsuit against the drug manufacturer kaleo, and while Express Scripts’ lawyers heavily redacted the Complaint, they did not redact certain information that Express Scripts has long maintained as closely guarded secrets.

The information that’s revealed is shocking.

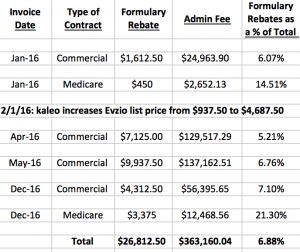

According to Express Scripts’ Complaint, Express Scripts entered into “rebate agreements” with kaleo in 2014 concerning its opioid overdose treatment Evzio that required kaleo to pay Express Scripts far more in secret “administrative fees” (that Express Scripts presumably retained for itself) than kaleo paid in “formulary rebates” (that Express Scripts presumably passed through to its clients). The Complaint reveals that in 4 of its monthly invoices to kaleo, Express Scripts invoiced kaleo $26,812 in total “formulary rebates”, but $363,160 in total “administrative fees”.

Thus, based on the structure of Express Scripts’ rebate contracts, Express Scripts would pass through in these 4 months about 6.88% of the total amount it collected. Stated otherwise, Express Scripts would retain about 13 times more in “administrative fees” than Express Scripts would pass through in “formulary rebates” to its clients.

Here’s a summary of the information included in the Complaint:

What was Express Scripts doing – if anything – to earn so much in Administrative Fees? Obviously, no one knows.

But every Plan administrator and fiduciary should demand full disclosure of this information. After all, unless Express Scripts was engaged in actual work meriting these payments, Express Scripts should have used the label “rebates” for the “Administrative Fees” it collected and passed through all such monies to Plans to reduce their costs.

The federal government should also want to know what work Express Scripts actually performed to earn its “Administrative Fees” under the Medicare contracts. And the government should ensure that Express Scripts appropriately reported the amounts as Medicare obligates Express Scripts to do.

Medicare rules require that Express Scripts only retain the “fair market value” of services that Express Scripts actually performed, and Express Scripts report such money to the government as “bona fide service fees”. Therefore, assuming Express Scripts retained these monies, Express Scripts was obligated to perform services commensurate with the amounts it retained.

On the other hand, if Express Scripts did nothing – or little – to earn these fees, Medicare rules require that Express Scripts label whatever amounts did not represent the “fair market value” of its services as “direct and indirect remuneration”, and report and pass through those amounts to the government.

Bottom line: The federal government should determine whether Express Scripts is accurately categorizing and reporting its “bona fide service fees” and “direct and indirect remuneration”, or whether it is retaining and hiding monies that the government would otherwise benefit from.

Also, we think the government should determine whether any activities Express Scripts did perform under its Medicare contracts were actually in the interests of the government and Medicare beneficiaries, or contrary to those interests.

As a taxpayer, wouldn’t you want the government to investigate and obtain answers on all these matters?

Why Did Express Scripts’ Earnings Increase?

In this day and age, everyone knows that most manufacturers of brand drugs are continually increasing their prices. And some manufacturers are raising their prices exponentially. But no one knows what PBMs are doing to prevent such price increases. Nor does anyone know the extent that PBMs are profiting from manufacturers’ price increases.

The Complaint discloses Express Scripts “Administrative Fees” in January 2016 were $24,963, but in April 2016 they had soared to $129,517 – an increase of more than 400%.

In a separate paragraph, the Complaint states that Evzio’s price dramatically increased in February 2016 from $937.50 to $4,687.50. Our investigation into other data reflects that nationally, the number of Evzio scripts that were dispensed spiked during this period too.

Unfortunately, we can’t tell from the heavily redacted Complaint why Express Scripts earned far more in “Administrative Fees” in April. Was it because the structure of Express Scripts’ contract enabled it to earn more when the drug’s price increased – or more when the number of dispensed scripts increased – or both? Does Express Scripts earn “Administrative Fees” based on a percentage of the “total dollar volume of drugs sold”?

Regardless, obvious questions arise: Did Express Scripts actually perform more work in April 2016 than it did in January 2016? Did its work load increase by more than 400%, meriting increased payments of more than 400%? Or does Express Scripts simply structure its rebate contracts to get paid more and more secret money, as drug prices increase and/or more scripts are dispensed, regardless of the activities Express Scripts actually performs?

The Plot Thickens: “Price Protection Rebates”

Based on the Complaint, Express Scripts also included an additional provision in its contracts if kaleo increased the price of Evzio, namely “price protection rebates”.

From conversations with other industry experts, we’ve long known that some PBMs sometimes include price protection provisions in their manufacturer contracts. These provisions typically state something like the following: ‘If the manufacturer increases the drug’s list price by more than _%, the manufacturer must provide a price protection rebate reimbursing the PBM for all price increases above the stated amount.’

Express Scripts’ Complaint reveals it entered into two rebate contracts with kaleo – for its commercial business and for Medicare. Assuming Express Scripts’ “price protection rebates” created the above-described types of “caps” on acceptable price increases, how much were those “caps”? Unfortunately, the redacted Complaint does not provide us with an answer. But note the following:

Even if Express Scripts named relatively low “caps”- say, 2% – Plans and Medicare would be totally exposed to 2% of Evzio’s price increase. If Express Scripts named a higher “cap” – say, 10% – Plans’ and Medicare’s costs would inevitably soar.

What conclusion can we reach about Express Scripts’ “price protection rebates”? While Express Scripts may have positioned itself in its “rebate” agreements to experience an “upside” if kaleo increased its price, its “price protection rebates” left Plans and Medicare exposed to higher costs from price increases.

Note that Express Scripts – and all other PBMs – could theoretically write “price protection rebate” provisions that entirely offset the full amount of any price increase. But according to everything we’ve learned, they don’t. It’s reasonable to ask “why not?”Is it because PBMs are profiting from manufacturers’ price increases?

Another bottom line: Every plan administrator and fiduciary – and the federal government and taxpayers – should want to find out the amount of Express Scripts’ price protection “caps” – for kaleo’s Evzio and for other manufacturers’ drugs as well. Shouldn’t everyone want to know the extent that Express Scripts (and other PBMs) are leaving their clients and the government exposed to price increases? And how that exposure compares to the additional profits that Express Scripts (and other PBMs) may be realizing from the very same price increases?

In fact, there’s a host of basic questions that every entity should ask of its PBM: What percentage of the PBM’s manufacturer contracts include “price protection rebate” provisions? How many manufacturer contracts don’t include any “price protection rebates” at all? For those contracts with these “protections”, what’s the range of the “caps” below which Plans are entirely exposed to the manufacturers’ price increases? How many manufacturer contracts have “caps” above 5% (or any other number you want to select)? How many manufacturer contracts ensure that the PBM will earn increased revenues if prices increase? How much additional revenues has the PBM earned in the past year (or two or three) as a result of manufacturers’ price increases?

Do Express Scripts – and Other PBMS – Actually Pass-Through “Price Protection Rebates”?

Every Express Scripts client – and every other PBM client as well – should also demand that its PBM state in writing whether the PBM is passing through all “price protection rebates” that the PBM collects from manufacturers. And every Plan that is trying to put in place a new PBM contract – including by conducting a PBM RFP – should explicitly demand that its new PBM pass through 100% of its earned price protection revenue.

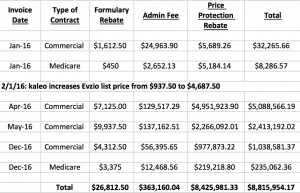

That’s especially true, given the immense sums these rebates represent. The Express Scripts’ Complaint makes that patently clear.

According to the Complaint, in just the 4 months of invoices that are identified in the Express Scripts Complaint, Express Scripts expected to collect more than $8.4 million in total “price protection rebates”:

Express Scripts filed its lawsuit against kaleo, because Express Scripts claims that kaleo failed to pay Express Scripts most of those monies (and some of the “formulary rebates” and “administrative fees” that kaleo also purportedly owed). But assuming Express Scripts collects the $8.4 million in “price protection rebates”, who will actually benefit?

Will Express Scripts pass through all the monies to its clients? Some of the monies? Or none of the monies?

Are other PBMs passing through all – or some – or none – of the “price protection” revenues that they collect to all their clients?

Or do some PBMs only pass through some “price protection” revenues to some clients?

In recent PBM RFPs that our firm has conducted, we’ve observed that the rebates that many PBMs are now promising are far higher than the rebates that PBMs have promised in the past, or that PBMs are passing through to their existing clients. Are PBMs trying to win new clients by sharing some or all “price protection” revenues with new clients, even though PBMs are retaining “price protection” revenues that manufacturers pay PBMs in connection with PBMs’ existing clients? Are Plans that are relying on PBM contracts that are a few years old losing out on large sums of potential rebates?

Every Plan administrator – and Plan fiduciary – should want to know whether its existing contract is obsolete, and if there are ways to dramatically reduce costs by ensuring that all “price protection” revenues are passed through.

Winners and Losers

The revelations in Express Scripts’ Complaint reflect that Express Scripts likely positioned itself to be a Big Winner regardless of kaleo’s actions. If kaleo kept its price “flat”, Express Scripts likely would collect far more in “administrative fees” than it would pass through to its clients in “formulary rebates”. If kaleo raised its prices (which it did) – or dispensed more scripts (which it also did) – Express Scripts’ “administrative fees” would likely increase. And there’s an open question whether Express Scripts would also benefit from retaining some or all of the “price protection rebates” that it included in its rebate agreements.

But Express Scripts placed Plans in a far different position. If kaleo kept its price “flat”, the only “rebates” that Plans would likely collect on kaleo’s high-price drug were the paltry “formulary rebates” revealed in the Complaint. If kaleo raised its prices – and Express Scripts structured its “price protection rebates” as they are typically written – Plans were likely left completely exposed to price increases up to a stated amount. And to the extent that Express Scripts doesn’t pass through its “price protection rebates” to some or all Plans, those Plans were likely left exposed to price increases above any “cap” Express Scripts imposed.

Also, please note that when Express Scripts penned its “rebate agreements” with kaleo in 2014 – before kaleo raised Evzio’s price dramatically – Express Scripts made the decision to include Evzio on its standard formulary, exposing all Plans to Evzio’s far higher costs even though lower cost alternative drugs were available.

Evzio is an auto-injector that delivers a single dose of naloxone, a life-saving drug that, if timely administered, can reverse the effects of an opioid overdose. In 2014, Evzio cost approximately $690 for a two-pack of single use auto-injectors. Depending on dosage strength, generics made by Hospira and Mylan ranged from about $23 to about $63 for a single injectable vial.(1) And there’s a third product that the FDA approved in 2015 – a nasal spray containing naloxone called Narcan – which cost approximately $150 for a two-pack.(2)

Evzio is an innovative product that talks to those using it and explains how to use the auto-injector, as reflected in this kaleo video. But the generic injectors work just as well, as does the nasal spray Narcan (as long as a person is breathing).

Based on the Express Scripts Complaint, in late 2016 when kaleo refused to pay Express Scripts all invoiced amounts, Express Scripts decided to exclude kaleo’s Evzio from its standard formulary and solely provide coverage for the lower-cost alternatives. Since Express Scripts blocked Evzio in 2016 based on Express Scripts’ own financial interests, Express Scripts obviously could have made that decision far earlier based on Plans’ financial interests and saved Plans a lot of money.

Turning to the federal government and Medicare Plan Beneficiaries, how did they fare as a result of Express Scripts conduct? Assuming Express Scripts passed through all “formulary rebates” but retained all “administrative fees”, the government lost out on a disproportionate amount of potential savings. Depending on Express Scripts’ price protection “cap”, the federal government was also exposed to some unknown amount of kaleo price increases. If Express Scripts reported on and passed through all “price protection revenues” as “direct and indirect remuneration”, the government benefited from those monies. But if Express Scripts didn’t do so, or only passed through some of those revenues, the government did not, and it was exposed to even more of Evzio’s exponential price increases.

As for Medicare beneficiaries, since Express Scripts doesn’t negotiate to reduce the drug’s actual cost for beneficiaries – and the government retains all rebates it is paid – Medicare beneficiaries without “gap coverage” were exposed to kaleo’s price increases. Each user’s exposure differed, depending on the phase of coverage the individual was in (deductible, initial phase, donut hole phase, etc.). But Express Scripts’ conduct did nothing to protect Medicare beneficiaries.

The Complaint also raises questions for the federal government in connection with its Medicaid program. The government requires all manufacturers – including kaleo – to report the maximum amount of price reductions they provide in the commercial marketplace – known as their “best prices” – and to match those price reductions for the government when invoicing for Medicaid beneficiaries.

Is kaleo doing so? Are other manufacturers that are secretly entering into contracts with PBMs and agreeing to pay large “price protection rebates” doing so?

The federal government should want to know. As a taxpayer, you should want the federal government to know.

What about Plan beneficiaries? How did they fare? Unfortunately, there’s no simple answer, other than “it depends.”

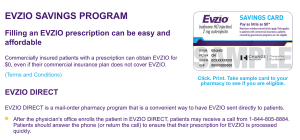

Some beneficiaries weren’t hurt at all. While kaleo inked its secret “deal” with Express Scripts (and perhaps other PBMs) – and raised its prices exponentially – kaleo also did all it could to prevent consumers from screaming in outrage about its price increases. Kaleo made the following savings card available to all who want to use it:

As a result, the drug is free to all users who obtain the downloadable savings card. And everyone with insurance coverage who learns about the “Evzio Direct” program can obtain the drug directly from Evzio, while Evzio balance bills PBMs (meaning ultimately PBMs’ clients) for the the drug’s inflated price.

Note that Evzio may be deducting out each user’s copay or coinsurance and deductible – or it may be balance billing for the entire cost of the drug – meaning your Plan will be forced to absorb the cost of your beneficiaries’ cost share. Check your claims data to find out, because your PBM may not be bothering to do so.

Plans should also want to know whether Express Scripts (and other PBMS) are indirectly assisting kaleo in running its savings card program by giving kaleo information about beneficiaries who are using Evzio or doctors who are prescribing it. Or Express Scripts (and other PBMs) may even be directly informing users and/or doctors about kaleo’s savings card program. If any PBMs are doing so, they would obviously be secretly acting against Plans’ financial interests, since PBMs would be end-running Plans’ deductible and copay and coinsurance designs.

For plan beneficiaries who don’t obtain access to Evzio’s savings card, those with deductibles or coinsurance that need to be satisfied are hurt by Evzio’s inflated price and aren’t helped by any of Express Scripts’ secret rebate deals. As a result, from 2014 to 2016, they may not have been able to afford Evzio’s clever “talking treatment” to reverse opioid overdoses. And now that Express Scripts has blocked coverage of the drug for all Plans relying on Express Scripts’ standard Formulary, all affected Plan beneficiaries will have to buy an alternative drug – or pay for Evzio entirely on their own – unless they can get kaleo to cover the drug’s costs through a patient assistance program.

Conclusion

We believe there’s only one conclusion to reach after studying the revelations in Express Scripts’ Complaint:

It’s time for everyone – Plans, the government and also the press – to demand information about PBMs’ secret deals with manufacturers.

It’s also time for everyone to ask: Are PBMs acting in their clients’ and Plan beneficiaries’ interests, or only in their own?

# # #

Given Express Scripts’ revelations, we hope every Plan – especially Express Scripts’ clients – will start demanding information from their PBMs about their secret deals with manufacturers.

We also hope that larger Plans will take additional action by filing litigation and asking for an “accounting” from their PBMs. The Health Transformation Alliance is perfectly positioned to do so.

In the meantime, our firm will do all it can to expose the deficiencies in the prescription coverage marketplace.

A Big Thanks to our colleague Attorney David McKay for noticing and telling us about the Express Scripts Complaint.

# # #

To read other Rx Drug Alerts, use the top Menu Bar, and click on RxAlerts.

Footnotes:

(1) See Ravi Gupta, Nilay D. Shah & Joseph S. Ross, “The Rising Price of Naloxone – Risks to Efforts to Stem Overdose Deaths,” 375 New England Journal of Medicine 2213 (Dec. 8, 2016). http://www.nejm.org/doi/pdf/10.1056/NEJMp1609578. See also Complaint, paragraphs 3 – 4.

(2) Id.