Several of our clients have established cash pay centric health plans with good success. Plan savings are similar if not better that what one can expect from a RBP plan and it is certainly much better than a PPO plan.

We call this type of plan a CPO (Cash Pay Option).

We receive daily funding requests for cash pay claims like the one below. Payments have ranged from 50% MC to 140% MC. Mean average payment <120% MC. (100-110% MC).

Never any balance billing. Patient pays nothing. Providers paid in full at the time of service (and they don’t even have to file a claim). Everybody is happy.

——————————————

Below is the shared savings calculation for an upcoming procedure for a (Name of Plan) member. The dates of service are 6/21/21 and 07/06/21. The price for the procedure comes out to 109% of Medicare for Chemotherapy.

May we have your approval and send a request for funds of $16,196.76? This will cover the associated medical spend and case fee.

A breakdown of price is listed below. Please let us know if you have any questions.

———————————-

NOTE: A typical PPO would allow double the amount or more and would require a certain amount of patient financial responsibility (deductible, co-insurance, balance bill, etc). Provider would typically receive insurance payment a month or two later all the while chasing patient’s financial responsibility.

————————————-

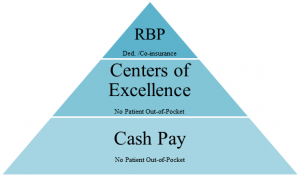

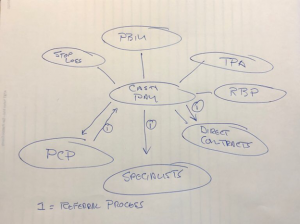

How A Cash Pay Centric Plan Is Structured:

————————————-

Moving from a PPO plan to a Cash Provider Plan (CPO) will cut the cost of healthcare by 40-50%.

Why not try it. You can’t lose.

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods