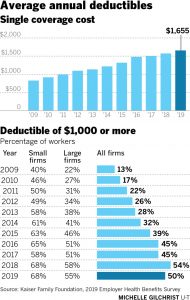

Status quo strategies used to reduce health care spend by employers includes cost shifting to plan members. Higher deductibles and higher out-of-pocket costs reduces insurance premium costs but not health care costs.

Status quo strategies used to reduce health care spend by employers includes cost shifting to plan members. Higher deductibles and higher out-of-pocket costs reduces insurance premium costs but not health care costs.

Back in the day a health insurance deductible equaled one week’s worth of pay. A $100 deductible was standard back in 1975.

Now it’s not uncommon to see annual deductibles of $4000 and more, much more.

It’s evident cost shifting has not tamed the healthcare beast.

And it’s clearly evident size doesn’t matter. A +400,000 life self-funded health plan in Texas has been practicing cost shifting for years. 64% of plan members are on a $2,750 front end deductible with no first dollar coverage (except for preventive care) before benefits are paid.

Deductibles are silly and unnecessary. Deductibles have no material effect on health care costs for plan sponsors. Co-insurance is silly too. In fact, the higher the deductible and out-of-pocket expenses go, the more health care costs increase. Providers factor in their accounts receivables when negotiating PPO contracts. (Everyone Is Paying For Mary’s Deductible Because Mary Isn’t)

Eliminate both, pay providers 100% of Medicare allowable, and watch your group health insurance premium reduce by 50% or more, immediately.

Then tackle your Rx costs by eliminating expensive drugs from coverage. No plan can afford drugs that cost hundreds of thousands of dollars a year for just one plan member, much less than several plan members. The risk exposure can easily be transferred or significantly reduced.