Realizing the decision to purchase will be based on worst case scenario, a broker can deliver the lowest bid every time if he knows how.

Many political subdivisions self-fund their employee health plans. In fact, most do. However it’s been our experience many have no clue why they are. That’s because elections come and go. New trustees inherit past decisions without the benefit of deliberation.

With every election comes changes. “Let’s go to bid on our health insurance!” is a common reaction by new board majorities. “Let’s find the best and lowest bid, it’s our fiduciary duty” is another.

So what constitutes a low bid? “Why, its worst case scenario! It’s how much we need to budget taking account of a worst case scenario. That determines what a low bid is!

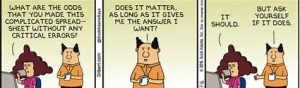

The Power of The Spreadsheet Endures

Realizing the decision to purchase will be based on worst case scenario, a broker who knows how will deliver the lowest bid every time. He uses a side carrier to buy down the industry standard 125% aggregate corridor to 105%. By overlaying this policy the broker now has a bid that’s 20% “cheaper” than his competition. (Fixed costs are higher but not so high it affects the intended outcome).

Since aggregate policies are usually limited to $1 million in cover, with a 5% corridor and premium load of $350,000, underwriters salivate at the prospect of writing this worthless coverage.

Buying down aggregate corridors is dumb. But, if the client wants to buy it, who is to say we shouldn’t sell it?