This expansion of health care choices returns certain risk manager tools stolen by the government with the passage of the Affordable Care Act (ACA):

☐ Allows plans to exclude coverage for maternity care, prescription drugs, mental-health services and other ‘essential health benefits’ the ACA requires of coverage

☐ Plans will have more freedom to charge different prices depending on customers’ ages, genders and locations — something ACA coverage cannot do.

☐ The regulations erase a requirement that any association must already have existed for a purpose unrelated to health insurance.

☐ These plans will also be able to reduce administrative costs and strengthen negotiating power with providers from larger risk pools and greater economies of scale….

☐ Moves health-insurance regulation from the state level to the federal level.

Rand Paul–Endorsed ‘Association Health Plans’ Go Into Effect

The Congressional Budget Office believes the plans can lead to 400,000 currently uninsured getting medical coverage.

Brian Doherty Jun. 19, 2018 7:55 pm

Sen. Rand Paul (R-Ky.) is happy today that what he calls his “months” of work with President Trump and Secretary of Labor R. Alexander Acosta have led to finalizing rules for expanding the availability of Association Heath Plans (AHP). Paul calls AHPs a “pro-patient, pro-worker, and pro-family solution” and “one of the most significant free market health care reforms in a generation.”

The Labor Department’s announcement sums up what problems AHPs are meant to solve and how they are meant to work:

The percentage of small businesses offering healthcare coverage has been dropping substantially. For the self-employed, the individual market exchanges do not offer affordable coverage either; premiums more than doubled between 2013 and 2017 with deductibles increasing even more.

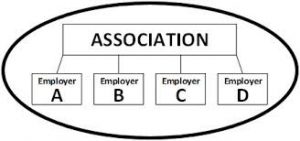

This reform allows small employers – many of whom are facing much higher premiums and fewer coverage options as a result of Obamacare – a greater ability to join together and gain many of the regulatory advantages enjoyed by large employers.

Under the Department’s new rule, AHPs can serve employers in a city, county, state, or a multi-state metropolitan area, or a particular industry nationwide. Sole proprietors as well as their families will be permitted to join such plans…These plans will also be able to reduce administrative costs and strengthen negotiating power with providers from larger risk pools and greater economies of scale….

The Congressional Budget Office (CBO) estimates that millions of people will switch their coverage to more affordable and more flexible AHP plans and save thousands of dollars in premiums. CBO also estimates that 400,000 previously uninsured people will gain coverage under AHPs.

The Washington Post, reporting today on the new rules, notes that this Trump administration action will “allow plans to exclude coverage for maternity care, prescription drugs, mental-health services and other ‘essential health benefits’ the ACA requires of coverage sold to individuals and small businesses…Congressional Democrats and critics across the health-care industry say the availability of cheaper, skimpier coverage will leave some patients stranded when they get sick.”

The AHPs will be “phased in for coverage sold from September to April” and “may not charge more or refuse to cover customers with preexisting medical conditions…But the plans will have more freedom to charge different prices depending on customers’ ages, genders and locations — something ACA coverage cannot do.”

AHPs have already existed, but the new rules will “substantially expand the circumstances under which association health plans can be created and purchased. The regulations erase a requirement that any association must already have existed for a purpose unrelated to health insurance. And for the first time, individuals will be able to buy one of the plans.”

Michael Cannon at the Cato Institute doesn’t love the AHP idea traditionally, since as designed initially the concept “violates Republicans’ federalist principles, because they would move health-insurance regulation from the state level to the federal level. But since ObamaCare went ahead and federalized regulation of small-business health plans, and the association-health-plans rule merely allows small businesses to opt for lighter versus heavier federal regulation, association health plans no longer violate federalism. Credit ObamaCare with making a bad idea good.”

But still not all that good an idea, Cannon thinks, since “Trump’s association health plans rule builds on the broken model of employer-sponsored health insurance.” That model in general, Cannon complains, “deprives workers of control of their health-insurance dollars and decisions. It sticks millions of workers with health plans they would never choose themselves. It leaves millions of workers with uninsurable preexisting conditions, because it disappears for no good reason after workers get sick. It increases prices for health care and health insurance.”

Thus, whatever benefits on the margin for some small businesses might result, the new AHP plan “does nothing to move Americans toward a better system of providing health insurance.” Cannon grants that the plans will create incentives for some of the healthy to leave the current ObamaCare insurance exchanges, likely causing those premiums to rise even more. While ObamaCare fans call this sabotage, Cannon writes, it’s really merely accurately and factually reflecting the actual costs of ObamaCare.

Peter Suderman has reported for Reason on earlier steps in the process of bringing AHPs to law.

RiskManagers HealthCare Purchasing Coalition 2018

RiskManagers.us offers employers the opportunity to participate in the RiskManagers.us Health Care Purchasing Cooperative utilizing some or all of the risk management tools that improve benefits while reducing costs at the same time.

RiskManagers HealthCare Purchasing Coalition is a high performance health care Management Services Organization founded on a simple proposition: Health care cost can be reduced while maintaining or even improving benefits at the same time.

While individual plan sponsors can achieve these goals independent of others, intended outcomes can be turbocharged through economies of scale in collaboration with like-minded plan sponsors.

Economies of Scale can be achieved through numerous channels. For example, several clients joined together for the purpose of reducing stop loss insurance premium for their respective self-funded health plans. Significant savings were achieved by pooling risk through a single stop loss policy contract. Pooled stop loss premium provided the participating employers a 67% reduction in average stop loss premium as reported by the most recent Aegis Survey Average Report.

Similarly, more clients have utilized the power of larger numbers to negotiate direct provider agreements in their respective communities. Sitting at the bargaining table with three or four times the purchasing power of a single employer is a value proposition attractive to sellers of goods and services.

Recognizing that acceptance to change has historically been slow among employers who have traditionally relied on status quo health care intermediaries to guide them through the complex maze of American health care, in today’s environment we find more employers are receptive to change. Realizing a proactive, out-of-the-box approach to addressing the cost of health care can make the difference between profit and loss, more employers are, for the first time, taking direct control of their health care spend.

The shared vision of RiskManagers.us and clients who retain our services centers on adopting new strategies rather than traditional methods employed in the past. RiskManagers.us offers risk management strategies that will accomplish these goals of lowering health care spend without compromising benefits. Our bundle of proven high performance risk management solutions will demonstrate aggregate risk / cost reductions of 25% and more. To that end, we expect our clients to realize a substantial savings based upon the services that we will deliver.

ABOUT RISKMANAGERS.US

RiskManagers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods.

For more information – riskmanager@riskmanagers.us