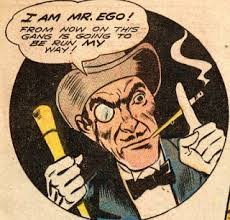

(Reuters) – Health insurers Anthem Inc (ANTM.N) and Cigna Corp (CI.N) were moving ahead to sign a merger deal as Cigna backed down on its differences over governance issues, CNBC tweeted, citing sources. TRANSLATION: Ego’s at play in the boardroom

Thu Jul 9, 2015 12:02pm EDT

(Reuters) – Health insurers Anthem Inc (ANTM.N) and Cigna Corp (CI.N) were moving ahead to sign a merger deal as Cigna backed down on its differences over governance issues, CNBC tweeted, citing sources.

The tweets also quoted sources as saying that UnitedHealth Group Inc (UNH.N) was looking to bid for Cigna.

Cigna shares were up 3 percent at $155.08 in early trading on the Nasdaq. Anthem shares were up marginally at $160.27. UnitedHealth shares were little changed at $119.88.

Cigna declined to comment on the report. Anthem and UnitedHealth were not immediately available for comment.

Anthem had made several offers for Cigna, but a deal had been hung up in part due to differences over leadership. Anthem made its bid public on June 20, offering Cigna $47 billion in cash and stock.

The biggest U.S. health insurers are seeking acquisitions to boost membership in government-paid healthcare plans and the employer-based insurance that is Cigna’s specialty. Being bigger can help them negotiate better prices and improve their network of doctors.

The U.S. Supreme Court’s decision to uphold subsidies for individuals under President Barack Obama’s signature healthcare law removed a large overhang for the insurers who would benefit from increasing enrollments into the Medicare and Medicaid programs.

The report comes less than a week after Aetna Inc (AET.N) said it would buy smaller rival Humana Inc (HUM.N) for about $37 billion in cash and stock.

Experts expect a potential acquisition of Cigna by Anthem to come under antitrust scrutiny.

(Reporting by Vidya L Nathan and Anjali Rao Koppala in Bengaluru; Editing by Don Sebastian)