Plan liability is well defined and budgetable, patient liability is too…………….

Indemnity insurance pays a set amount per episode. For example, a health plan may pay $75 for a routine office visit or $1,500 for a colonoscopy, etc. You typically don’t see deductibles, co-insurance features attached to indemnity plans. It’s “100% coverage.”

Reference Based Pricing plans (as opposed to Reference Based Benefit plans) are indemnity plans. Plan reimbursement is usually based on a multiple of Medicare rates.

Medicare is an indemnity plan.

So we wonder why plan sponsors who adopt Reference Based Pricing continue to employ deductibles and co-insurance?

But we wonder no more. Some of our clients have no deductible, no co-insurance plans through their Reference Based Pricing model. It’s working well. Pent up utilization has not had a material effect on claims. Everyone is happy, especially providers who don’t have to chase patient share. Providers willingly accept less than they would through a traditional insurance plan. It’s a win, win for all.

Plan liability is well defined and budgetable, patient liability is too.

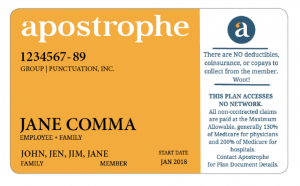

Note: The picture above was posted on Linkedin – www.apostrophehealth.com