“What we’re seeing is the gross billed charges are rising anywhere from three to up to seven times the cost,” Glascott said. “It’s stunning.”……………………..The charge increases while the costs are flat.”

Self-Funded Employers: Quit Losing Money to Hospitals

Source: Allegeant.net

Everybody in the healthcare continuum should care about AMPS. Why? Because reference-based payment is the future, that’s why.

Today’s episode of Healthcare Simplified features John Glascott, Chief Revenue Officer of Advanced Medical Pricing Solutions (AMPS).

Glascott leads sales and marketing at AMPS, including digital marketing. At AMPS, their mission is to provide healthcare cost containment services for self-funded employers, public entities like municipalities and labor unions, and others who need to materially reduce healthcare costs and keep members satisfied with good benefits.

“Today we are doing medical bill review and out of that network claim review for over 500 employers and we are running reference-based pricing programs for slightly over 220 employers,” Glascott said. They save an average of 6% to 7% annually in hospital plan charges.

“We have something we call clinical only medical reviews that review overcharge mistakes—what we call fat finger—a charge that was $710 entered as $71,000,” he said.

And with their out of network bill review, they not only look for fat fingers but also reprice using reference-based pricing data because out of network claim reviews aren’t governed by a PPO agreement. AMPS was founded by a former COO of a hospital who was fed up with the egregious overcharging that rigged the system against self-funded employers.

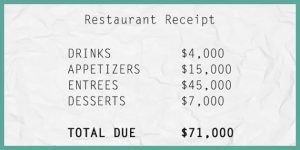

Reading a hospital bill in America is analogous to going to a restaurant and getting a bill for “entrees.” There could be 50 steaks on the bill, but when you’ve only got the one line item to look at, how would you know?

“The crux of the problem in healthcare is that the facility charges, the hospital bills, are paid off of what is called a UB, a uniform bill,” Glascott explained. It’s about 12 lines that have a charge of anywhere from $50,000 to $300,000.

“What we do in those larger claims is get itemized bills and look at the bill. That’s really not done at all in healthcare,” Glascott said.

Say No to BUCAs

Reference-based pricing is making a big push right now to shake off the biggest insurance carriers—the BUCAs, in industry lingo (Blue Cross, United, Cygnet, Aetna, and similarly large companies) “They have a stranglehold on the market on those employers with 4,000 or more lives,” Glascott said.

As for the smaller employers of anywhere from a hundred to a few thousand, a lot are moving to an independent third party administrator like Allegeant to escape that BUCAs net.

AMPS typically works with the smaller, independent TPAs (Third Party Administrators) that aren’t governed by the BUCAs.

Being a game-changer isn’t easy, but it’s totally the way to go.

“Nobody ever gets fired for recommending any of the BUCAs because they’re the big, safe, comfortable way to go,” Glascott said. “But you do pay a price for that.

On a macro level, every hospital that works with Medicare—and that’s anywhere from 30 to 60% of patients—has to file a cost-to charge ratio with the federal government. Which includes their costs for virtually all their procedures. Which is public information.

“What we’re seeing is the gross billed charges are rising anywhere from three to up to seven times the cost,” Glascott said. “It’s stunning.”

The charge increases while the costs are flat.

“We’re seeing gross billed charges of 500 to 700% of Medicare,” he said.

“The PPO BUCA discount game is an illusion because if you’re getting 50 percent off of 600 percent of Medicare, you’re still paying 300 percent of Medicare.”

If you’re a self-funded employer, you might be paying 250 to 325% of what Medicare is paying for the same procedures. Just outrageous.

But with reference-based pricing, you get out of that hamster wheel. You have your own plan and your own “network” that is managed by AMPS with your independent TPA. You pay based on references. “This year for our clients we’re reimbursing an average of about 156% of Medicare,” Glascott said.

“So the average company that we are working with will see a range of $1,500 to $2,500 per employee on the plan in savings annually by moving to reference-based pricing.”

A 1,000 employee group would save around three million and a 150 life group would save about half a million. “It’s very compelling to companies to save that kind of money,” Glascott added.

What Reference-Based Pricing Can Really Do

Here’s how it works.

Reference-based pricing is a defined contribution solution. This means that an employer has decided within their ERISA rights what their health plan is willing to pay as fair compensation for services rendered.

In a nutshell? With reference-based pricing, AMPS figures out how much a normal knee replacement costs.

And the employer says to employees that the plan will pay this and the deductible and co-pays will be that. Anything more is the employee’s responsibility.

“It injects consumerism into it and everybody focuses on the extreme examples like surgeries. But a huge amount of savings can be reaped from the services that are in hospitals now, like MRIs.”

Most of the time, you can just get an MRI at a freestanding clinic that AMPS or the TPA has a contract with. Saving everybody thousands.

“So we use steerage to drive people to get their blood work done outside the hospital,” Glascott said. “Reference-based pricing forces consumerism.”

It’s like if you’re taking a trip. If you want to stay at the Ritz, you can. But you’ll probably jump on Expedia to find a cheaper hotel.

Surprise Billing Scares

Balance billing is something that people always bring up with reference-based pricing because it can feel like your worst nightmare. “The bogeyman hiding in your closet,” Glascott said.

“It’s really a non-issue,” he said. AMPS has so much experience with this that it almost never becomes a thing. (They’ve never been sued for reference-based pricing, by the way.)

They’ve got a handle on helping employers and employees know what to do with additional bills. Most of the time, the hospitals don’t even try to challenge it.

Glascott’s example: 9 mg of acetaminophen three times a day for three days was billed at $81 per dose. That’s literally Tylenol.

They repriced it at 22 cents.

Or procedures that were put on the bill but never performed! Happens all the time.

“We like to say a balance bill is just a piece of paper. Something a computer generates and automatically mails,” he said.

When it can boil down to savings of thousands per employee, the decision to switch to reference-based pricing looks like a no-brainer.

“It’s the same care that you’re getting at the same hospitals—you’re just not overpaying,” Glascott said.

Email John Glascott directly at jglascott@advancedmedicalpricing.com or via the contact page. Be on the lookout for the reference-based pricing brochure that introduces these ideas.